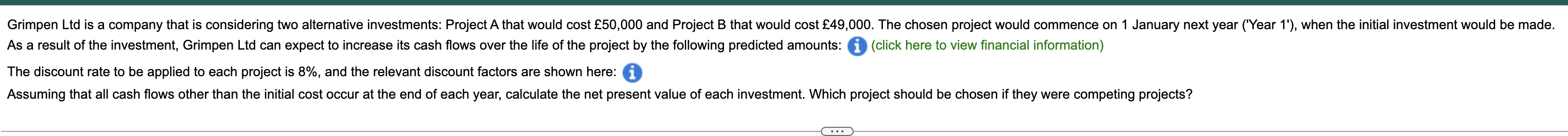

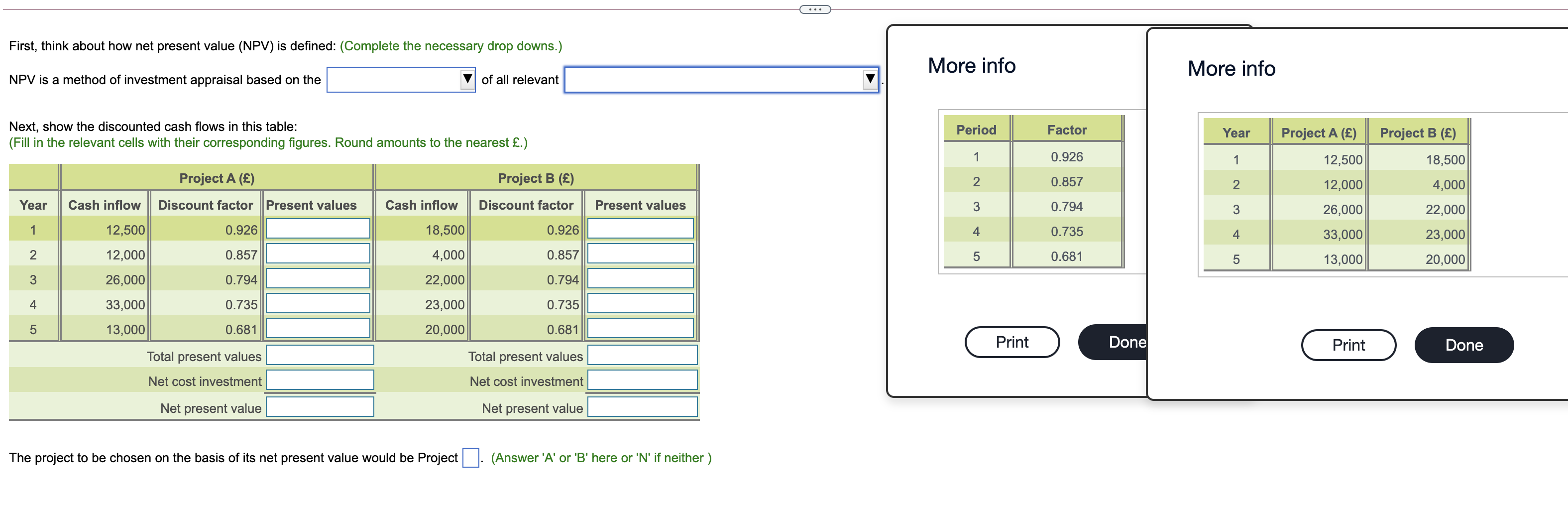

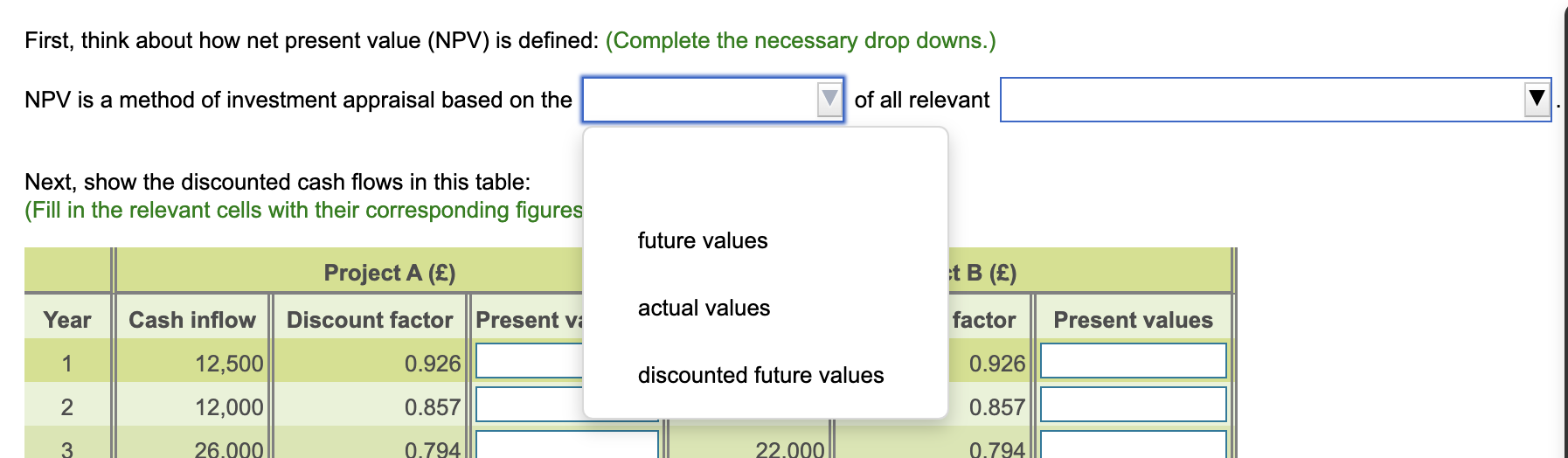

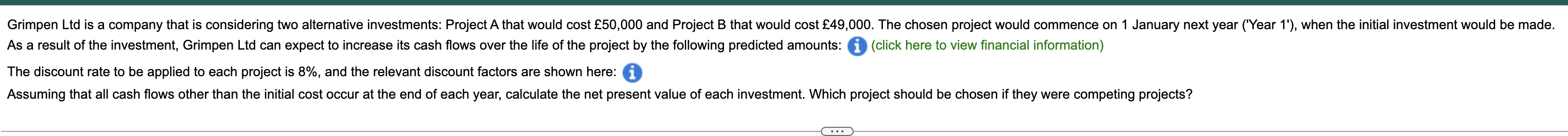

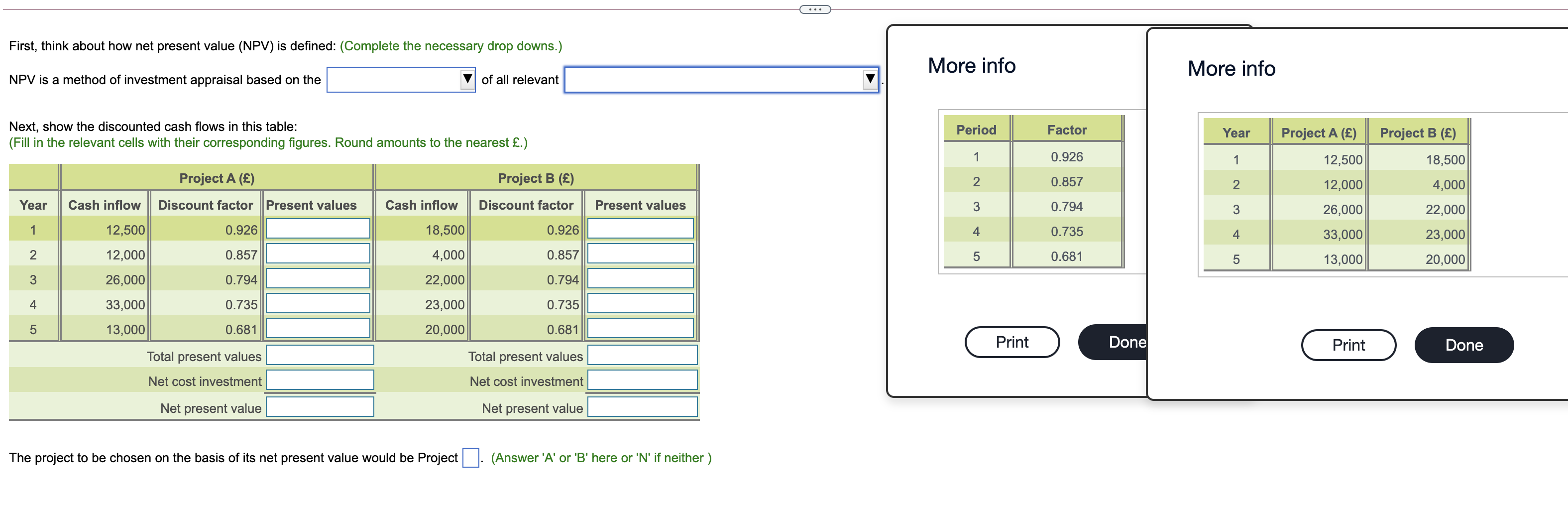

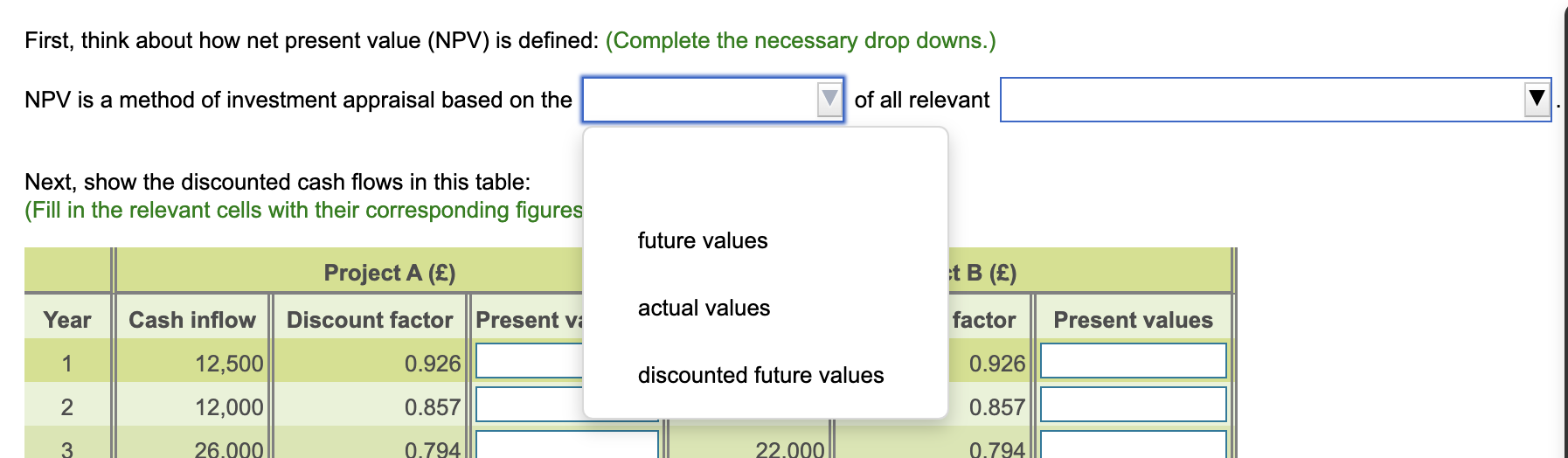

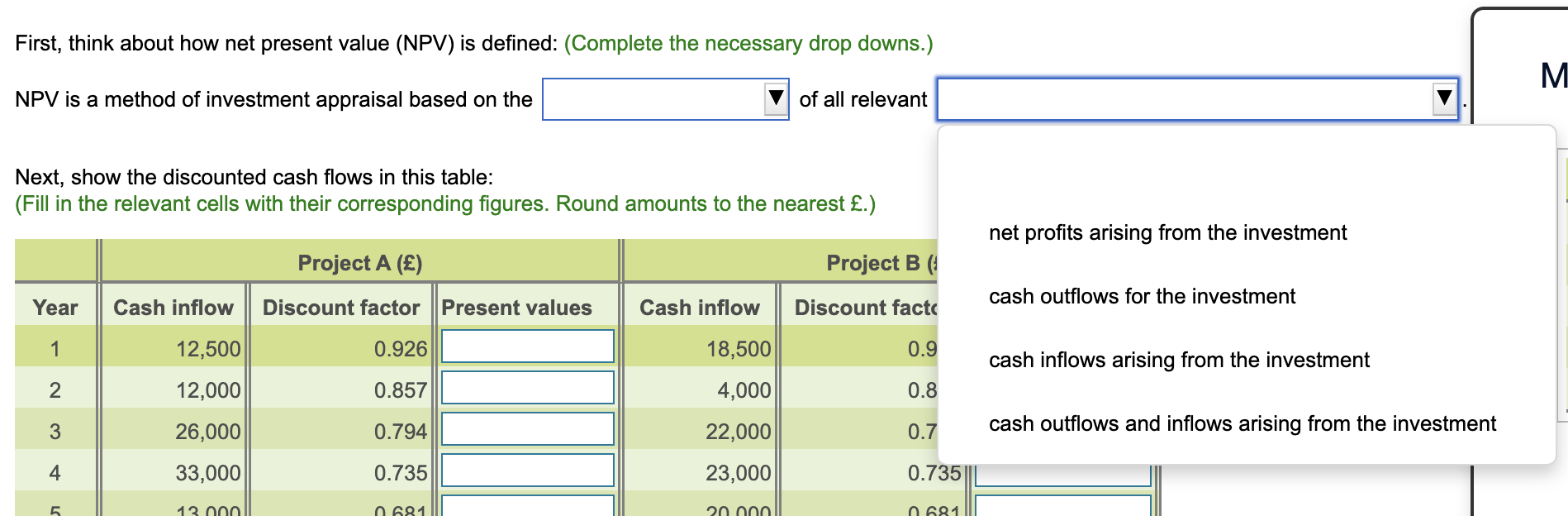

Grimpen Ltd is a company that is considering two alternative investments: Project A that would cost 50,000 and Project B that would cost 49,000. The chosen project would commence on 1 January next year ('Year 1'), when the initial investment would be made. As a result of the investment, Grimpen Ltd can expect to increase its cash flows over the life of the project by the following predicted amounts: (click here to view financial information) The discount rate to be applied to each project is 8%, and the relevant discount factors are shown here: i Assuming that all cash flows other than the initial cost occur at the end of each year, calculate the net present value of each investment. Which project should be chosen if they were competing projects? First, think about how net present value (NPV) is defined: (Complete the necessary drop downs.) More info More info NPV is a method of investment appraisal based on the of all relevant Next, show the discounted cash flows in this table: (Fill in the relevant cells with their corresponding figures. Round amounts to the nearest .) Period Factor Year Project A () 12,500 1 0.926 1 Project B () 18,500 4,000 Project A () Project B () 2. 0.857 2 12,000 Year Cash inflow Discount factor Present values Cash inflow Discount factor Present values 3 0.794 3 26,000 22,000 1 12,500 0.926 18,500 0.926 4 0.735 4 33,000 23,000 2 12,000 0.857 4,000 0.857 5 0.681 5 13,000 20,000 3 0.794 0.794 26,000 33,000 22,000 23,000 4 0.735 0.735 5 13,000 0.681 20,000 0.681 Print Done Print Done Total present values Total present values Net cost investment Net cost investment Net present value Net present value The project to be chosen on the basis of its net present value would be Project (Answer 'A' or 'B' here or 'N' if neither ) First, think about how net present value (NPV) is defined: (Complete the necessary drop downs.) NPV is a method of investment appraisal based on the of all relevant Next, show the discounted cash flows in this table: (Fill in the relevant cells with their corresponding figures future values Project A () it B () actual values Year Cash inflow Discount factor | Present vi factor Present values 1 12,500 0.926 0.926 discounted future values 2 12,000 0.857 0.857 3 26.000 0.794 22.000 0.794 First, think about how net present value (NPV) is defined: (Complete the necessary drop downs.) M NPV is a method of investment appraisal based on the of all relevant Next, show the discounted cash flows in this table: (Fill in the relevant cells with their corresponding figures. Round amounts to the nearest .) net profits arising from the investment Project A () Project B E cash outflows for the investment Year Cash inflow Discount factor Present values Cash inflow Discount fact 1 12,500 0.926 18,500 0.9 cash inflows arising from the investment 12,000 0.857 4,000 0.8 N 3 26,000 0.794 22,000 0.7 cash outflows and inflows arising from the investment 4 33,000 0.735 23,000 0.735 5. 13.000 91 20 non 81