Answered step by step

Verified Expert Solution

Question

1 Approved Answer

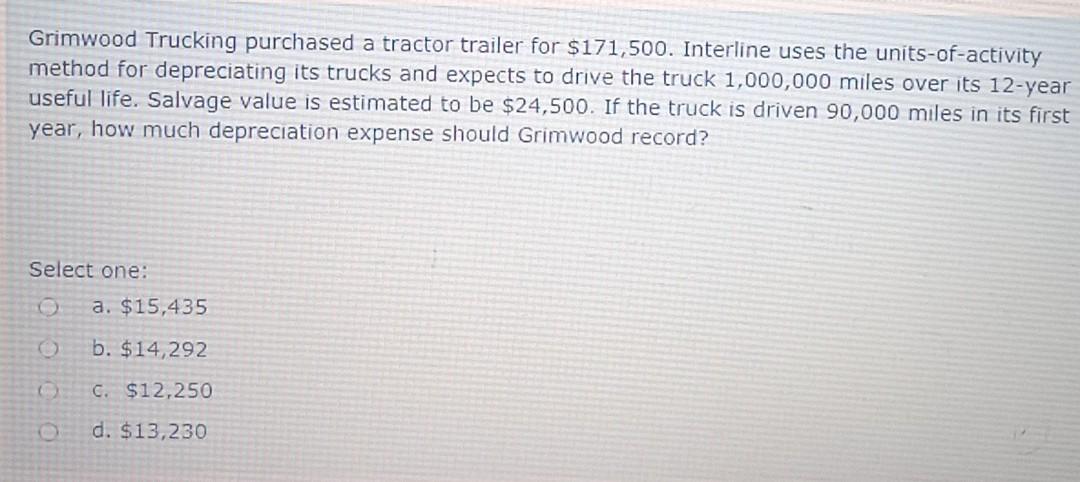

Grimwood Trucking purchased a tractor trailer for $171,500. Interline uses the units-of-activity method for depreciating its trucks and expects to drive the truck 1,000,000 miles

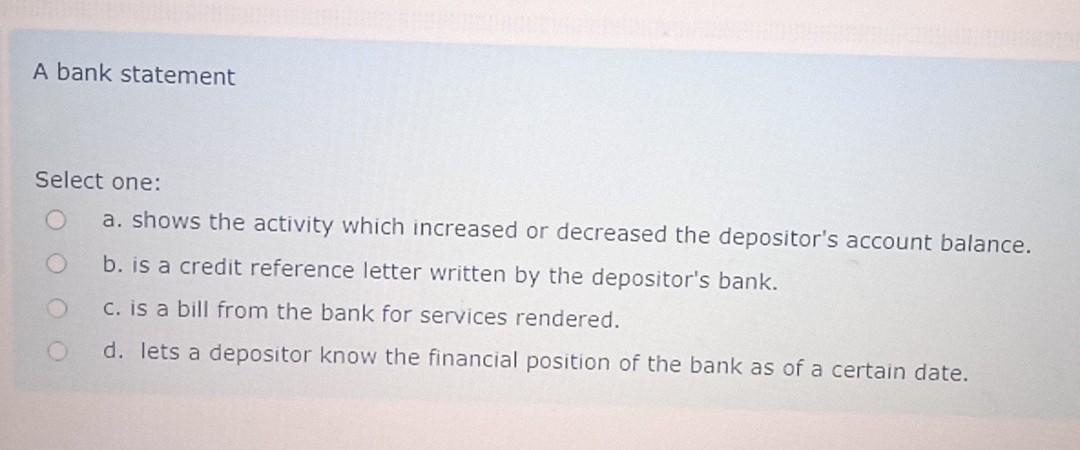

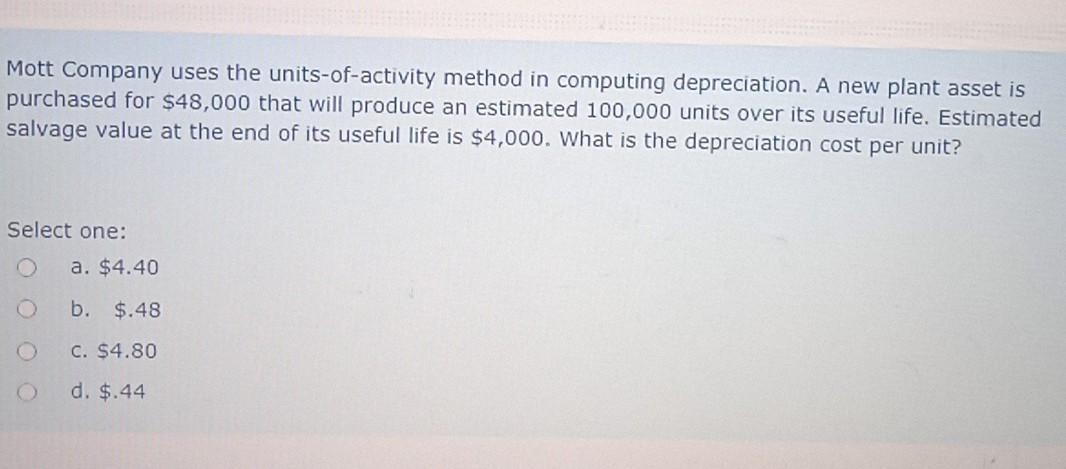

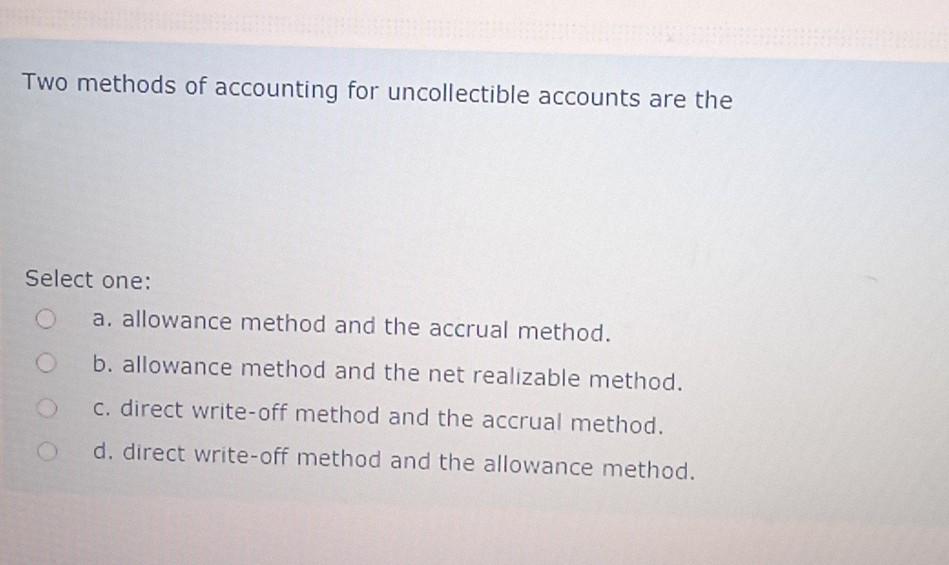

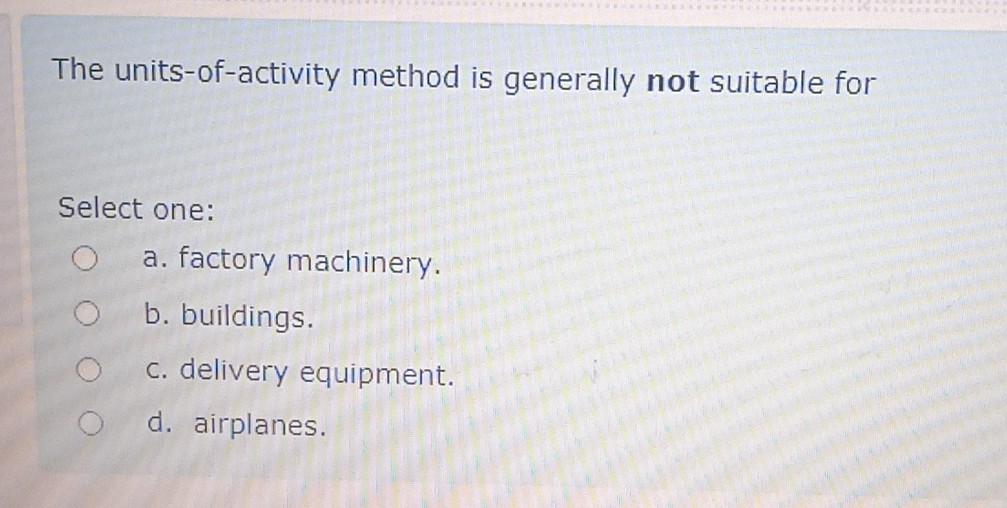

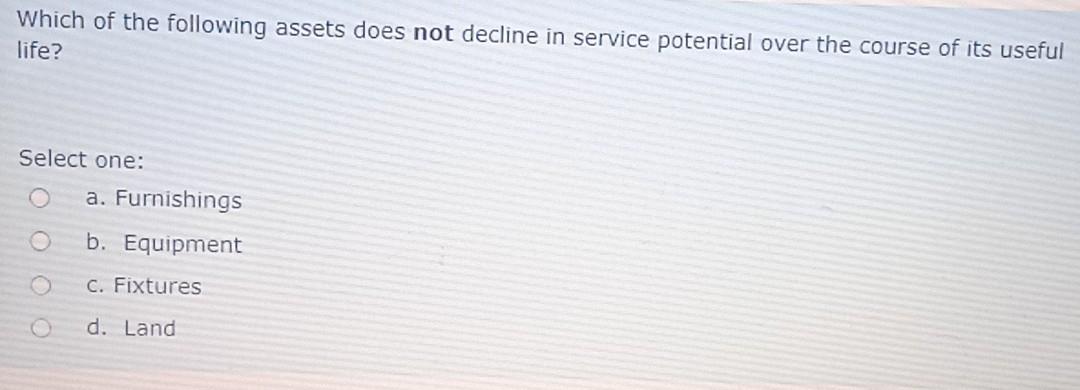

Grimwood Trucking purchased a tractor trailer for $171,500. Interline uses the units-of-activity method for depreciating its trucks and expects to drive the truck 1,000,000 miles over its 12-year useful life. Salvage value is estimated to be $24,500. If the truck is driven 90,000 miles in its first year, how much depreciation expense should Grimwood record? Select one: a. $15,435 0 b. $14,292 C. $12,250 d. $13,230 A bank statement Select one: a. shows the activity which increased or decreased the depositor's account balance. b. is a credit reference letter written by the depositor's bank. c. is a bill from the bank for services rendered. d. lets a depositor know the financial position of the bank as of a certain date. Mott Company uses the units-of-activity method in computing depreciation. A new plant asset is purchased for $48,000 that will produce an estimated 100,000 units over its useful life. Estimated salvage value at the end of its useful life is $4,000. What is the depreciation cost per unit? Select one: 0 a. $4.40 b. $.48 C. $4.80 d. $.44 Two methods of accounting for uncollectible accounts are the Select one: a. allowance method and the accrual method. b. allowance method and the net realizable method. c. direct write-off method and the accrual method. d. direct write-off method and the allowance method. Interest is usually associated with Select one: A. accounts receivable. B. doubtful accounts. C. notes receivable. D. bad debts. A company purchased land for $90,000 cash. Real estate brokers' commission was $5,000 and $7,000 was spent for demolishing an old building on the land before construction of a new building could start. Under the historical cost principle, the cost of land would be recorded at Select one: a. $70,000. b. $102,000. C. $107,000. d. $90,000. A company purchased office equipment for $40,000 and estimated a salvage value of $8,000 at the end of its 5-year useful life. The constant percentage to be applied against book value each year if the double-declining-balance method is used is Select one: a. 20% b. 40%. C. 25% d. 5%. A deposit made by a company will appear on the bank statement as a Select one: a. debit memorandum. b. credit memorandum. C. debit. d. credit. The units-of-activity method is generally not suitable for Select one: a. factory machinery. b. buildings. C. delivery equipment. d. airplanes. Which of the following assets does not decline in service potential over the course of its useful life? Select one: a. Furnishings b. Equipment C. Fixtures d. Land

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started