Answered step by step

Verified Expert Solution

Question

1 Approved Answer

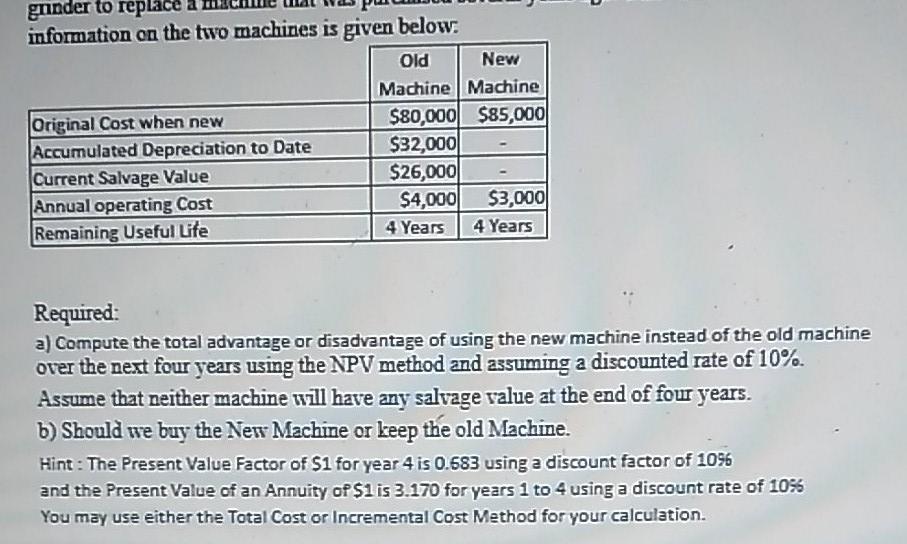

grinder to replace information on the two machines is given below. Old New Machine Machine Original Cost when new $80,000 $85,000 | Accumulated Depreciation to

grinder to replace information on the two machines is given below. Old New Machine Machine Original Cost when new $80,000 $85,000 | Accumulated Depreciation to Date $32,000 Current Salvage Value $26,000 Annual operating Cost $4,000 $3,000 Remaining Useful Life 4 Years 4 Years Required: a) Compute the total advantage or disadvantage of using the new machine instead of the old machine over the next four years using the NPV method and assuming a discounted rate of 10%. Assume that neither machine will have any salvage value at the end of four years. b) Should we buy the New Machine or keep the old Machine. Hint : The Present Value Factor of $1 for year 4 is 0.583 using a discount factor of 1096 and the Present Value of an Annuity of $1 is 3.170 for years 1 to 4 using a discount rate of 10% You may use either the Total Cost or Incremental Cost Method for your calculation. grinder to replace information on the two machines is given below. Old New Machine Machine Original Cost when new $80,000 $85,000 | Accumulated Depreciation to Date $32,000 Current Salvage Value $26,000 Annual operating Cost $4,000 $3,000 Remaining Useful Life 4 Years 4 Years Required: a) Compute the total advantage or disadvantage of using the new machine instead of the old machine over the next four years using the NPV method and assuming a discounted rate of 10%. Assume that neither machine will have any salvage value at the end of four years. b) Should we buy the New Machine or keep the old Machine. Hint : The Present Value Factor of $1 for year 4 is 0.583 using a discount factor of 1096 and the Present Value of an Annuity of $1 is 3.170 for years 1 to 4 using a discount rate of 10% You may use either the Total Cost or Incremental Cost Method for your calculation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started