Answered step by step

Verified Expert Solution

Question

1 Approved Answer

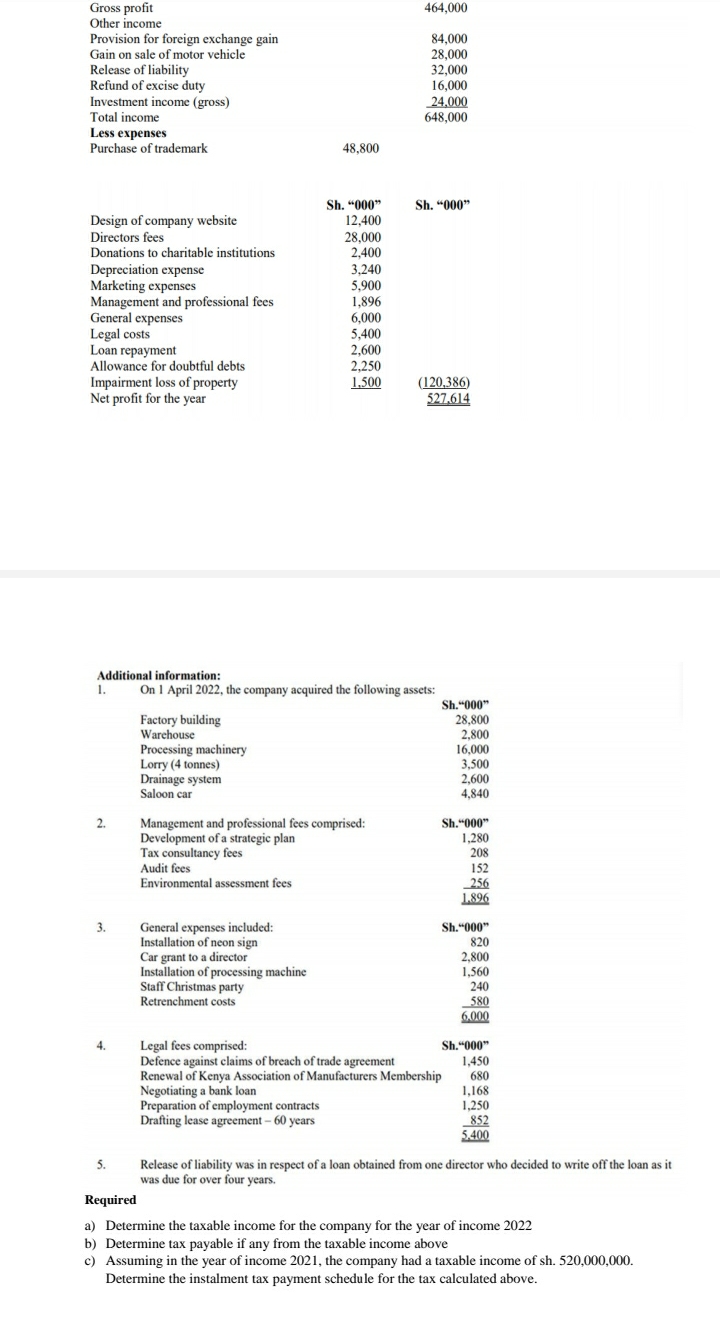

Gross profit 464,000 Other income Provision for foreign exchange gain 84,000 Gain on sale of motor vehicle 28,000 Release of liability 32,000 Refund of

Gross profit 464,000 Other income Provision for foreign exchange gain 84,000 Gain on sale of motor vehicle 28,000 Release of liability 32,000 Refund of excise duty 16,000 Investment income (gross) Total income Less expenses Purchase of trademark 24,000 648,000 48,800 Sh. "000" Sh. "000" Design of company website 12,400 Directors fees 28,000 Donations to charitable institutions 2,400 Depreciation expense 3,240 Marketing expenses 5,900 Management and professional fees 1,896 General expenses 6,000 Legal costs 5,400 Loan repayment 2,600 Allowance for doubtful debts 2,250 Impairment loss of property 1,500 Net profit for the year (120,386) 527,614 Additional information: 1. On 1 April 2022, the company acquired the following assets: Sh."000" Factory building 28,800 Warehouse 2,800 Processing machinery 16,000 Lorry (4 tonnes) 3,500 Drainage system 2,600 Saloon car 4,840 2. Management and professional fees comprised: Sh."000" Development of a strategic plan 1,280 Tax consultancy fees 208 Audit fees 152 Environmental assessment fees 256 1.896 3. General expenses included: Installation of neon sign Car grant to a director Installation of processing machine Staff Christmas party Retrenchment costs Sh."000" 820 2,800 1,560 240 580 6.000 4. Legal fees comprised: Defence against claims of breach of trade agreement Negotiating a bank loan Preparation of employment contracts Drafting lease agreement - 60 years Sh."000" 1,450 Renewal of Kenya Association of Manufacturers Membership 680 1,168 1,250 852 5.400 5. Required Release of liability was in respect of a loan obtained from one director who decided to write off the loan as it was due for over four years. a) Determine the taxable income for the company for the year of income 2022 b) Determine tax payable if any from the taxable income above c) Assuming in the year of income 2021, the company had a taxable income of sh. 520,000,000. Determine the instalment tax payment schedule for the tax calculated above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a To determine the taxable income for the company for the year of income 2022 we need to calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started