Answered step by step

Verified Expert Solution

Question

1 Approved Answer

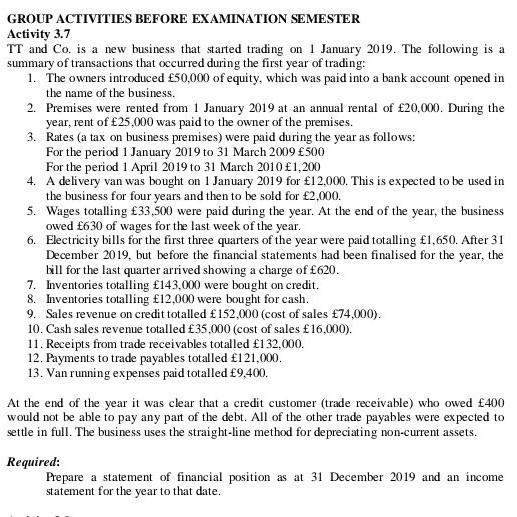

GROUP ACTIVITIES BEFORE EXAMINATION SEMESTER Activity 3.7 TT and Co. is a new business that started trading on 1 January 2019. The following is a

GROUP ACTIVITIES BEFORE EXAMINATION SEMESTER Activity 3.7 TT and Co. is a new business that started trading on 1 January 2019. The following is a summary of transactions that occurred during the first year of trading: 1. The owners introduced 50,000 of equity, which was paid into a bank account opened in the name of the business. 2. Premises were rented from 1 January 2019 at an annual rental of 20,000. During the year, rent of 25,000 was paid to the owner of the premises. 3. Rates (a tax on business premises) were paid during the year as follows: For the period 1 January 2019 to 31 March 2009 500 For the period 1 April 2019 to 31 March 2010 1,200 4. A delivery van was bought on 1 January 2019 for 12.000. This is expected to be used in the business for four years and then to be sold for 2.000. 5. Wages totalling 33,500 were paid during the year. At the end of the year, the business owed 630 of wages for the last week of the year. 6. Electricity bills for the first three quarters of the year were paid totalling 1,650. After 31 December 2019, but before the financial statements had been finalised for the year, the bill for the last quarter arrived showing a charge of 620. 7. Inventories totalling 143.000 were bought on credit. 8. Inventories totalling 12.000 were bought for cash. 9. Sales revenue on credit totalled 152,000 (cost of sales 74,000). 10. Cash sales revenue totalled 35,000 (cost of sales 16,000). 11. Receipts from trade receivables totalled 132,000. 12. Payments to trade payables totalled 121.000. 13. Van running expenses paid totalled 9,400. At the end of the year it was clear that a credit customer (trade receivable) who owed 400 would not be able to pay any part of the debt. All of the other trade payables were expected to settle in full. The business uses the straight-line method for depreciating non-current assets. Required: Prepare a statement of financial position as at 31 December 2019 and an income statement for the year to that date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started