Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Group Activity: 10 items x 3 points INSTRUCTIONS: 1. Find a partner. 2. For the first 10 minutes, Partner A will work on Problem

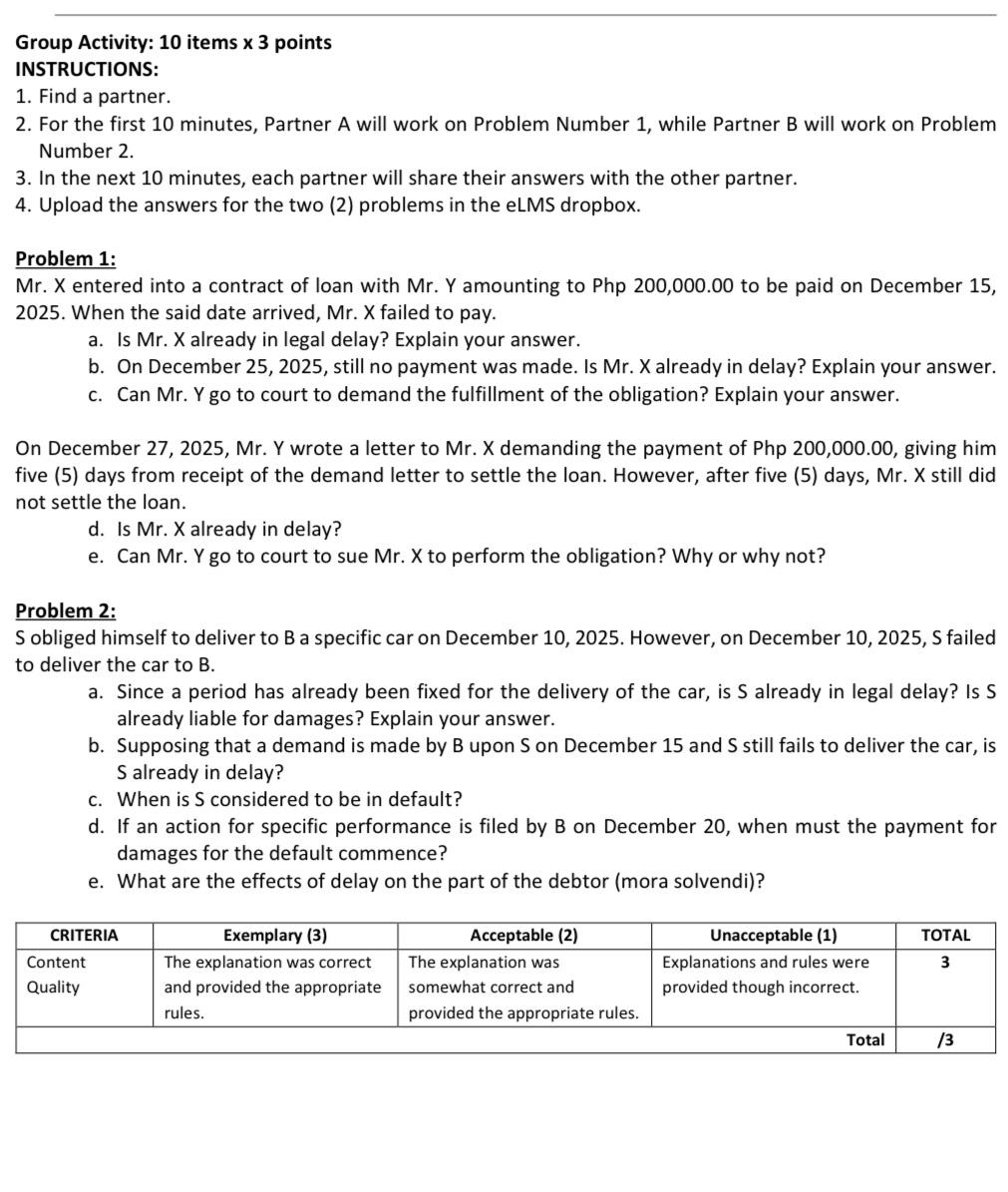

Group Activity: 10 items x 3 points INSTRUCTIONS: 1. Find a partner. 2. For the first 10 minutes, Partner A will work on Problem Number 1, while Partner B will work on Problem Number 2. 3. In the next 10 minutes, each partner will share their answers with the other partner. 4. Upload the answers for the two (2) problems in the eLMS dropbox. Problem 1: Mr. X entered into a contract of loan with Mr. Y amounting to Php 200,000.00 to be paid on December 15, 2025. When the said date arrived, Mr. X failed to pay. a. Is Mr. X already in legal delay? Explain your answer. b. On December 25, 2025, still no payment was made. Is Mr. X already in delay? Explain your answer. c. Can Mr. Y go to court to demand the fulfillment of the obligation? Explain your answer. On December 27, 2025, Mr. Y wrote a letter to Mr. X demanding the payment of Php 200,000.00, giving him five (5) days from receipt of the demand letter to settle the loan. However, after five (5) days, Mr. X still did not settle the loan. d. Is Mr. X already in delay? e. Can Mr. Y go to court to sue Mr. X to perform the obligation? Why or why not? Problem 2: S obliged himself to deliver to B a specific car on December 10, 2025. However, on December 10, 2025, S failed to deliver the car to B. a. Since a period has already been fixed for the delivery of the car, is S already in legal delay? Is S already liable for damages? Explain your answer. b. Supposing that a demand is made by B upon S on December 15 and S still fails to deliver the car, is S already in delay? c. When is S considered to be in default? d. If an action for specific performance is filed by B on December 20, when must the payment for damages for the default commence? e. What are the effects of delay on the part of the debtor (mora solvendi)? CRITERIA Content Quality Exemplary (3) The explanation was correct and provided the appropriate rules. Acceptable (2) The explanation was somewhat correct and provided the appropriate rules. Unacceptable (1) Explanations and rules were provided though incorrect. TOTAL 3 Total /3

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Since this is a group activity Ill provide sample answers for each problem Please note that these answers are for illustrative purposes only and may n...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started