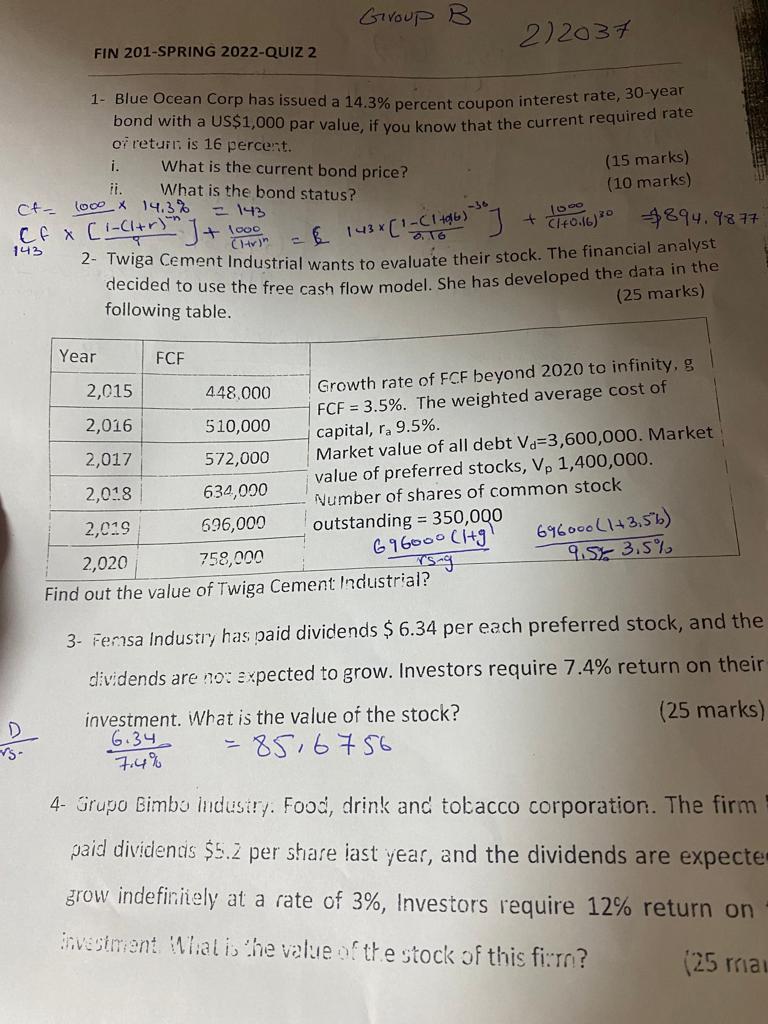

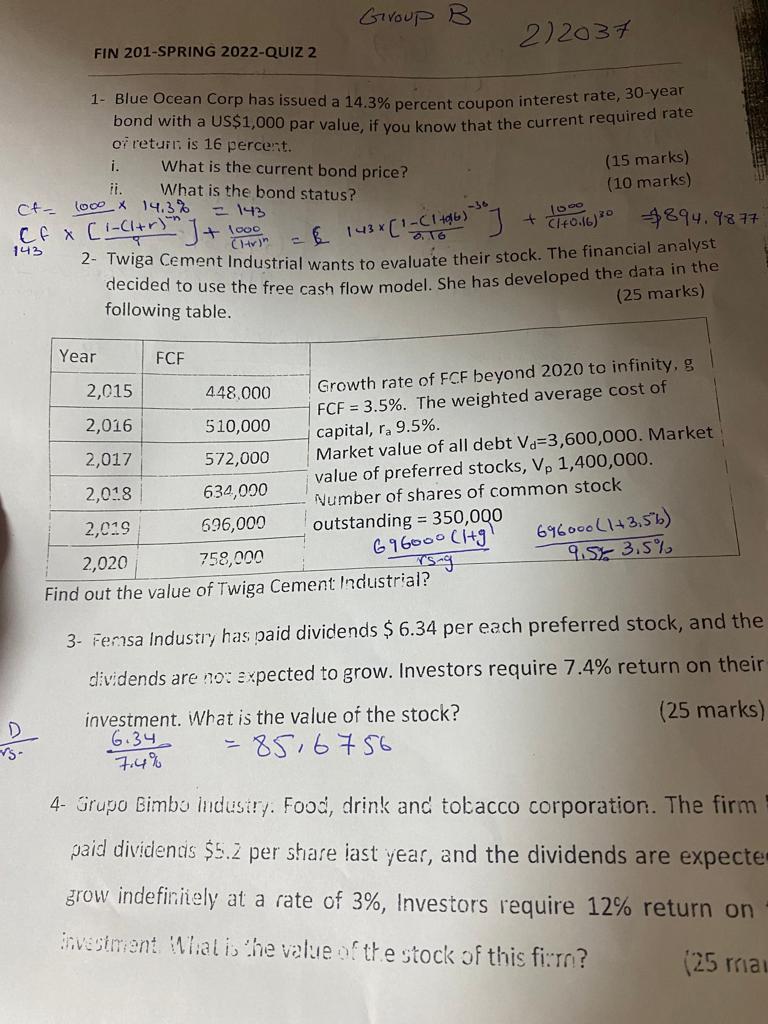

Group B 212037 FIN 201-SPRING 2022-QUIZ 2 1- Blue Ocean Corp has issued a 14.3% percent coupon interest rate, 30-year bond with a US$1,000 par value, if you know that the current required rate of return is 16 percent. i. What is the current bond price? (15 marks) ii. (10 marks) Ct 1000 x 14.3% What is the bond status? = 143 + 1000 1000 Cf x [1-(+) J+ & 143 x [1-C1 (1-(1+6)=30] 143 (Hr)" + C/40.16) 20 $894.9877 2- Twiga Cement Industrial wants to evaluate their stock. The financial analyst decided to use the free cash flow model. She has developed the data in the following table. (25 marks) Year FCF 2,015 448,000 Growth rate of FCF beyond 2020 to infinity, g FCF = 3.5%. The weighted average cost of capital, ra 9.5%. 2,016 510,000 2,017 572,000 Market value of all debt Va=3,600,000. Market value of preferred stocks, Vp 1,400,000. Number of shares of common stock 2,018 634,000 2,019 696,000 outstanding = 350,000 2,020 758,000 696000(1+3,5b) 9.5% 3.5% 696000 (+9) rs-g Find out the value of Twiga Cement Industrial? 3- Femsa Industry has paid dividends $ 6.34 per each preferred stock, and the dividends are not expected to grow. Investors require 7.4% return on their D investment. What is the value of the stock? (25 marks) =5- 6.34 7.4% = 85,6756 4- Grupo Bimbo Industry. Food, drink and tobacco corporation. The firm paid dividends $5.2 per share last year, and the dividends are expecte grow indefinitely at a rate of 3%, Investors require 12% return on Investment. What is the value of the stock of this firm? (25 mal Group B 212037 FIN 201-SPRING 2022-QUIZ 2 1- Blue Ocean Corp has issued a 14.3% percent coupon interest rate, 30-year bond with a US$1,000 par value, if you know that the current required rate of return is 16 percent. i. What is the current bond price? (15 marks) ii. (10 marks) Ct 1000 x 14.3% What is the bond status? = 143 + 1000 1000 Cf x [1-(+) J+ & 143 x [1-C1 (1-(1+6)=30] 143 (Hr)" + C/40.16) 20 $894.9877 2- Twiga Cement Industrial wants to evaluate their stock. The financial analyst decided to use the free cash flow model. She has developed the data in the following table. (25 marks) Year FCF 2,015 448,000 Growth rate of FCF beyond 2020 to infinity, g FCF = 3.5%. The weighted average cost of capital, ra 9.5%. 2,016 510,000 2,017 572,000 Market value of all debt Va=3,600,000. Market value of preferred stocks, Vp 1,400,000. Number of shares of common stock 2,018 634,000 2,019 696,000 outstanding = 350,000 2,020 758,000 696000(1+3,5b) 9.5% 3.5% 696000 (+9) rs-g Find out the value of Twiga Cement Industrial? 3- Femsa Industry has paid dividends $ 6.34 per each preferred stock, and the dividends are not expected to grow. Investors require 7.4% return on their D investment. What is the value of the stock? (25 marks) =5- 6.34 7.4% = 85,6756 4- Grupo Bimbo Industry. Food, drink and tobacco corporation. The firm paid dividends $5.2 per share last year, and the dividends are expecte grow indefinitely at a rate of 3%, Investors require 12% return on Investment. What is the value of the stock of this firm? (25 mal