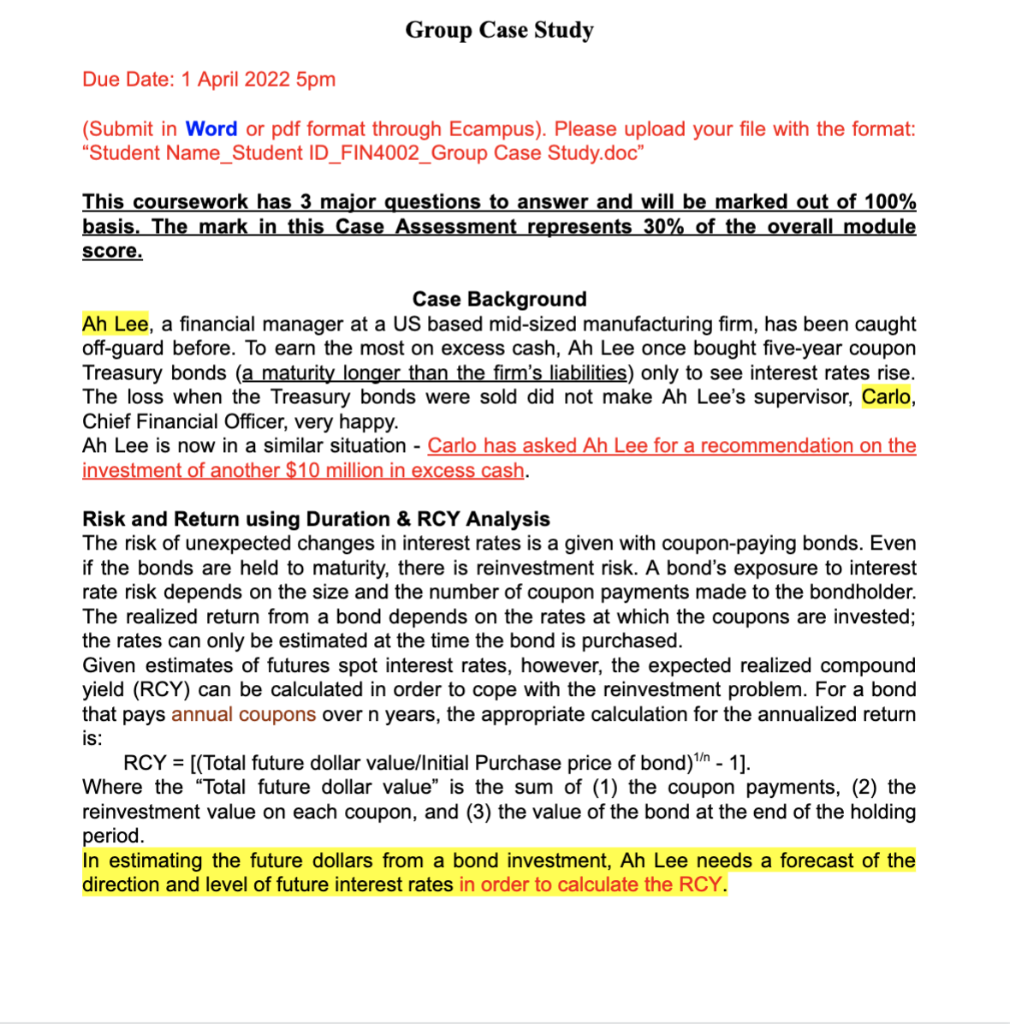

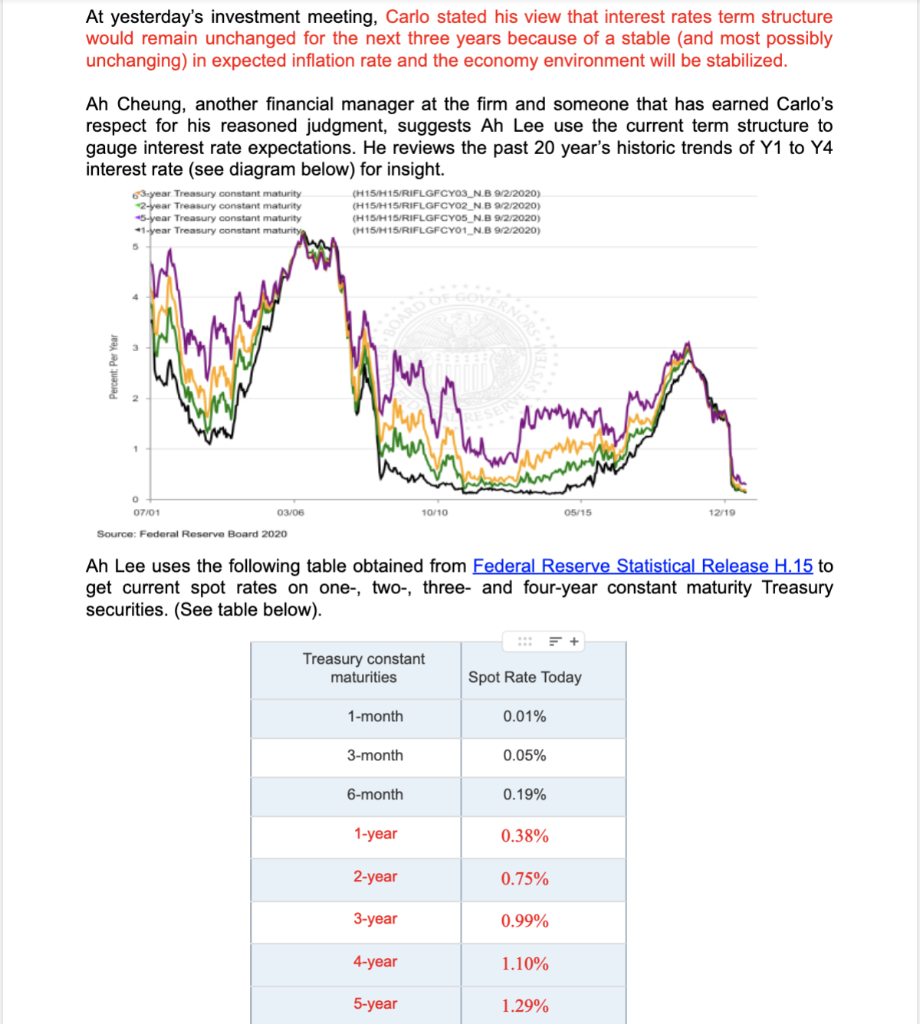

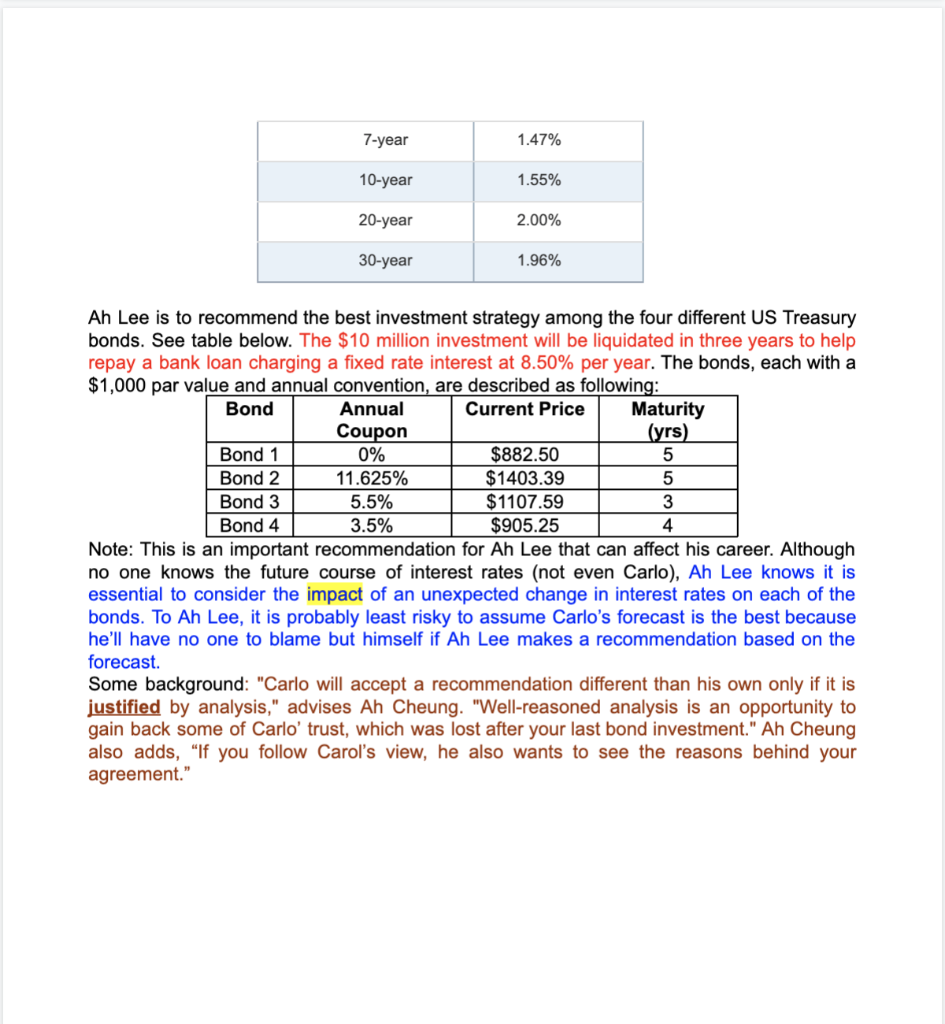

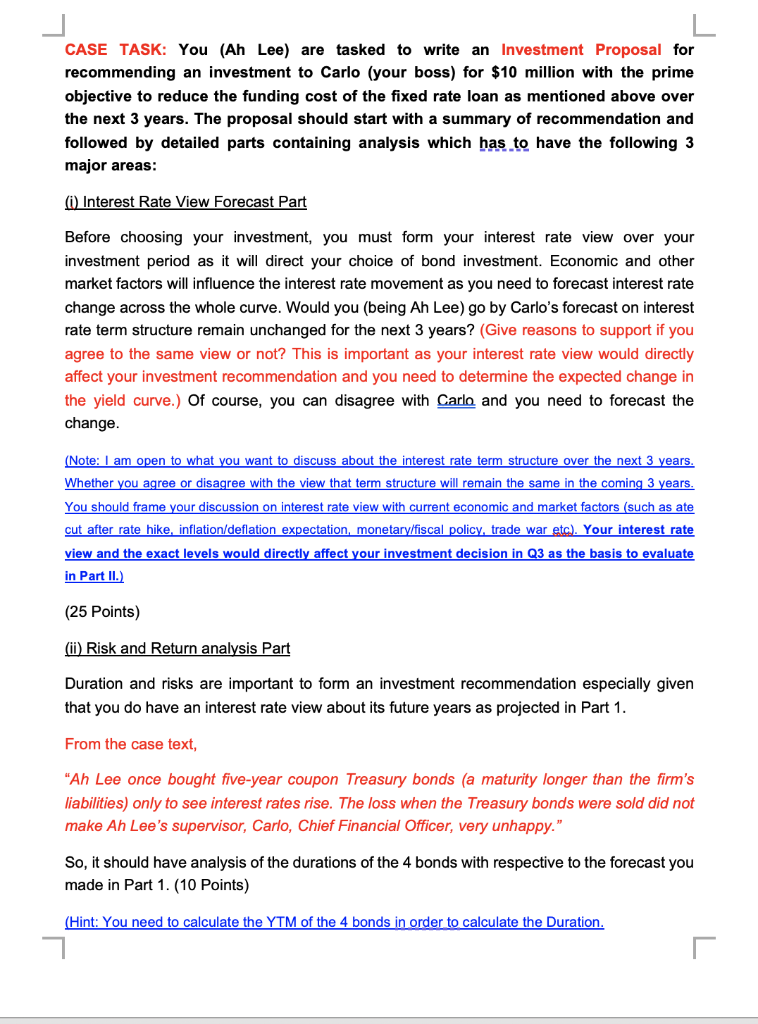

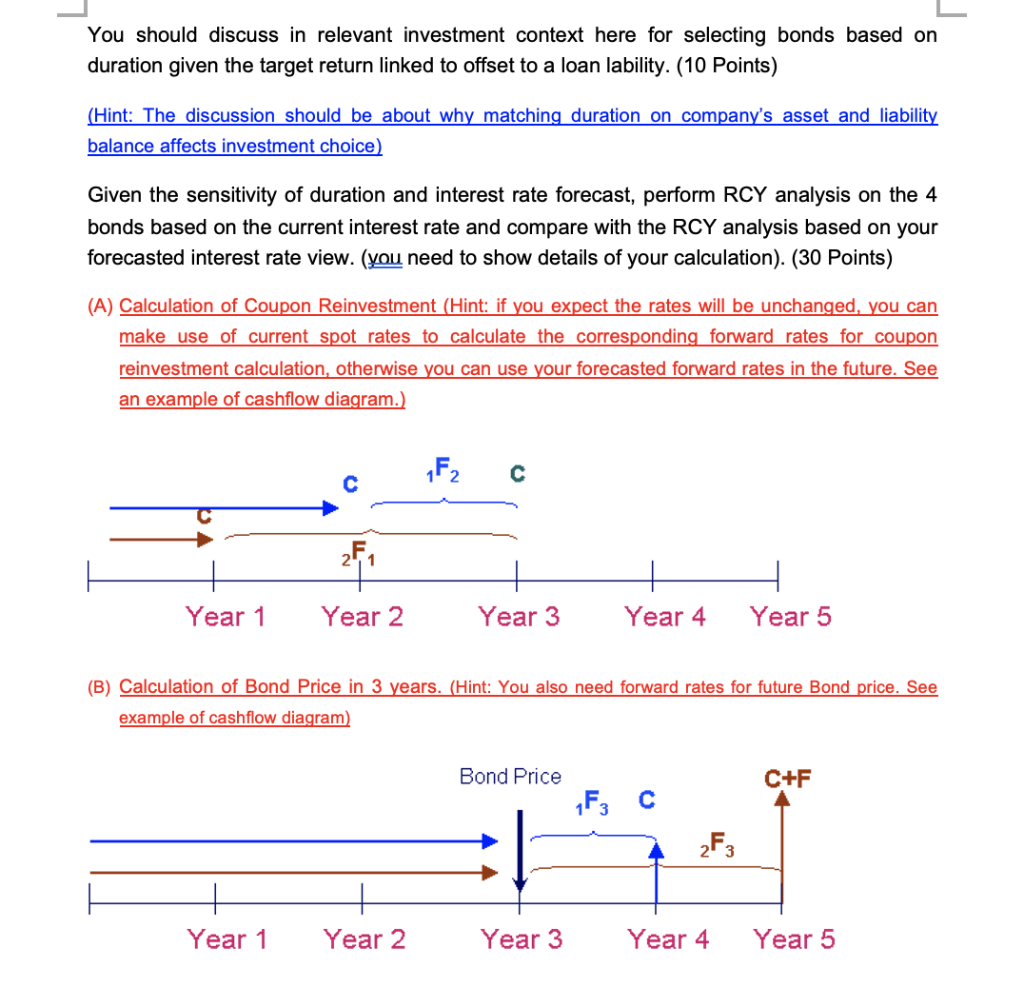

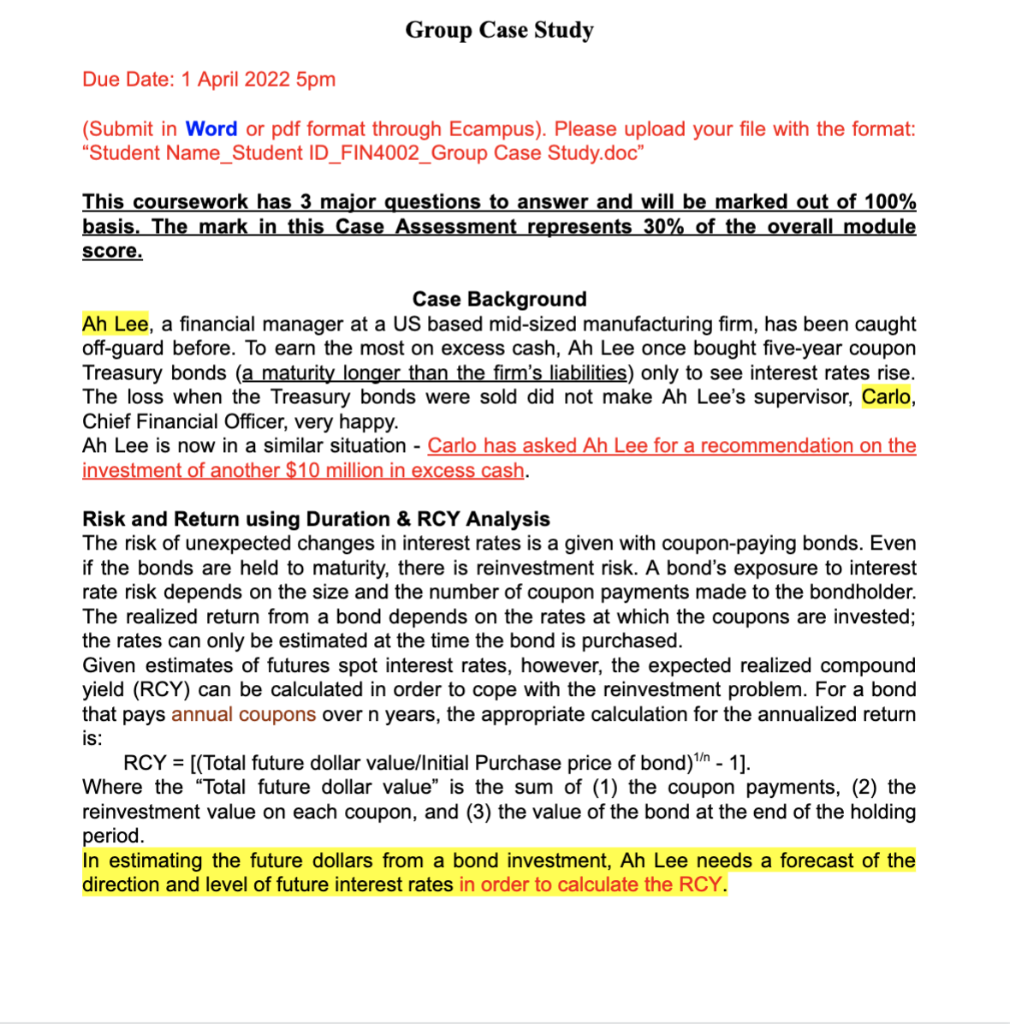

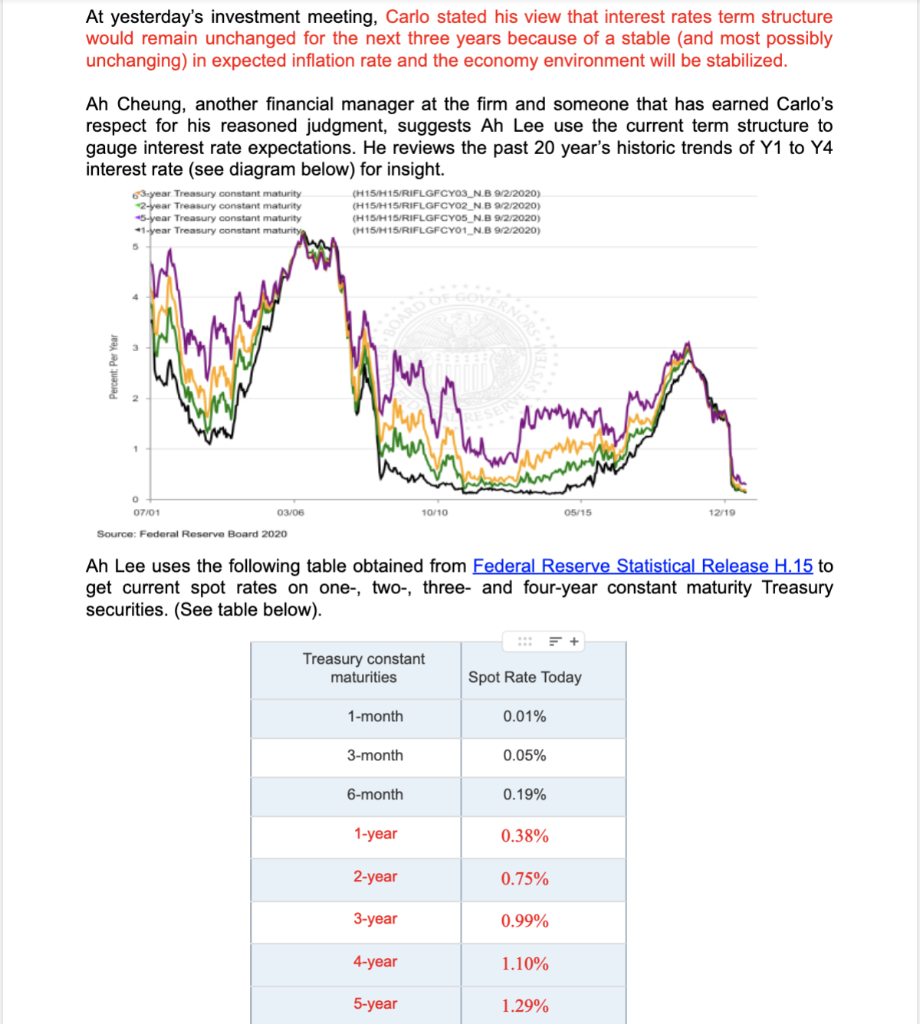

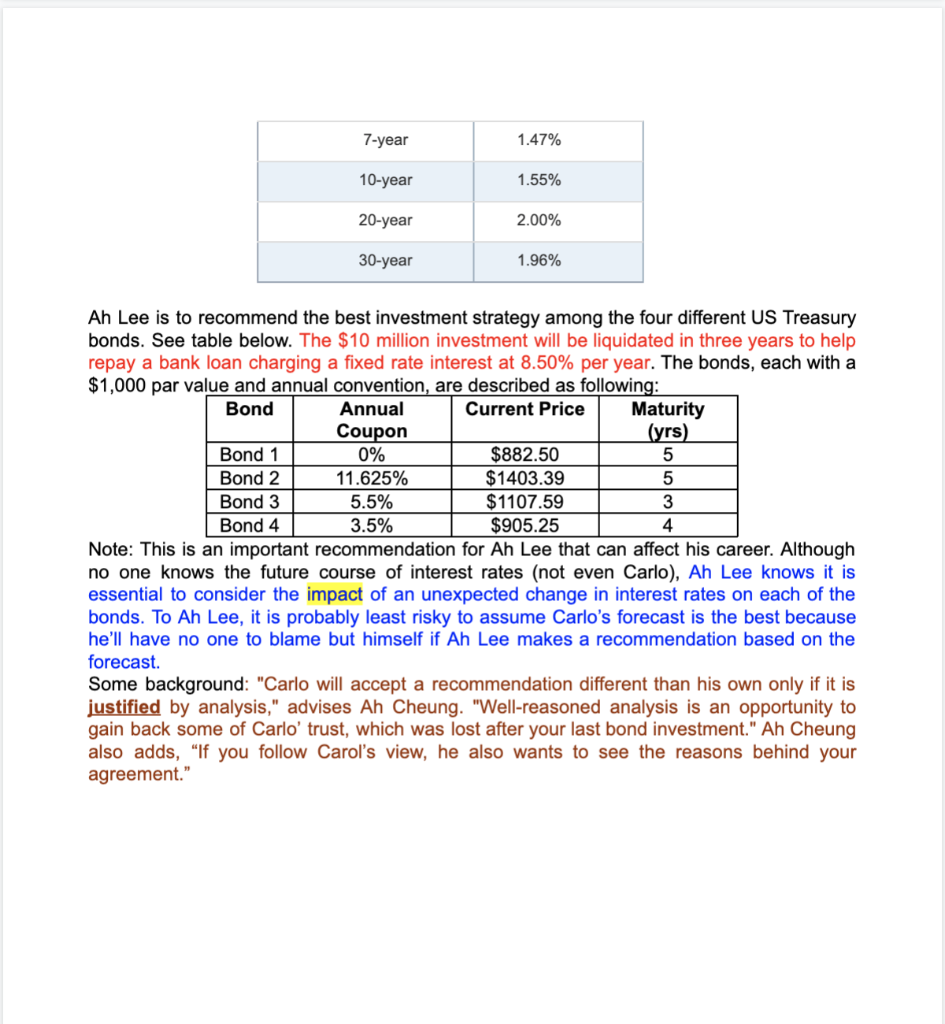

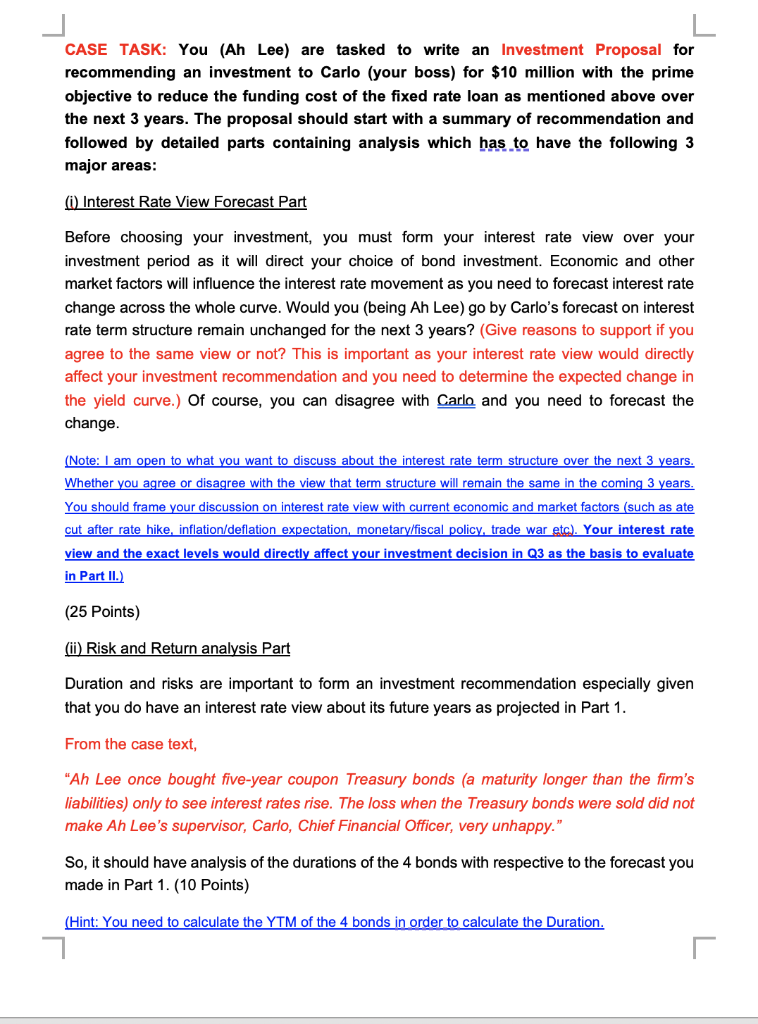

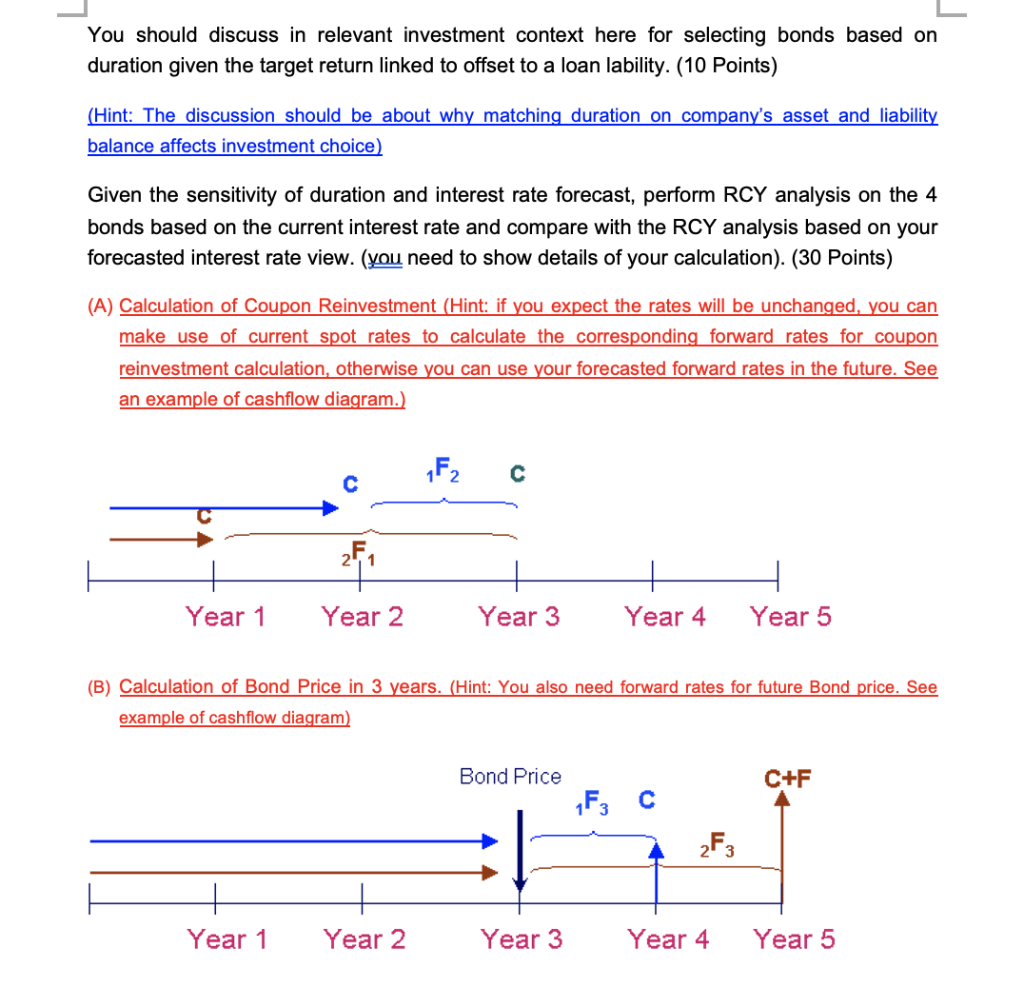

Group Case Study Due Date: 1 April 2022 5pm (Submit in Word or pdf format through Ecampus). Please upload your file with the format: Student Name_Student ID_FIN4002_Group Case Study.doc" This coursework has 3 major questions to answer and will be marked out of 100% basis. The mark in this case Assessment represents 30% of the overall module score. Case Background Ah Lee, a financial manager at a US based mid-sized manufacturing firm, has been caught off-guard before. To earn the most on excess cash, Ah Lee once bought five-year coupon Treasury bonds (a maturity longer than the firm's liabilities) only to see interest rates rise. The loss when the Treasury bonds were sold did not make Ah Lee's supervisor, Carlo, Chief Financial Officer, very happy. Ah Lee is now in a similar situation - Carlo has asked Ah Lee for a recommendation on the investment of another $10 million in excess cash. Risk and Return using Duration & RCY Analysis The risk of unexpected changes in interest rates is a given with coupon-paying bonds. Even if the bonds are held to maturity, there is reinvestment risk. A bond's exposure to interest rate risk depends on the size and the number of coupon payments made to the bondholder. The realized return from a bond depends on the rates at which the coupons are invested; the rates can only be estimated at the time the bond is purchased. Given estimates of futures spot interest rates, however, the expected realized compound yield (RCY) can be calculated in order to cope with the reinvestment problem. For a bond that pays annual coupons over n years, the appropriate calculation for the annualized return is: RCY = [(Total future dollar value/Initial Purchase price of bond)"'n - 1). Where the "Total future dollar value is the sum of (1) the coupon payments, (2) the reinvestment value on each coupon, and (3) the value of the bond at the end of the holding period. In estimating the future dollars from a bond investment, Ah Lee needs a forecast of the direction and level of future interest rates in order to calculate the RCY. = - At yesterday's investment meeting, Carlo stated his view that interest rates term structure would remain unchanged for the next three years because of a stable (and most possibly unchanging) in expected inflation rate and the economy environment will be stabilized. Ah Cheung, another financial manager at the firm and someone that has earned Carlo's respect for his reasoned judgment, suggests Ah Lee use the current term structure to gauge interest rate expectations. He reviews the past 20 year's historic trends of Y1 to Y4 interest rate (see diagram below) for insight. 63-year Treasury constant maturity (H15/115/RIFLGFCY03_N.B 9/2/2020) 2-year Treasury constant maturity 5-year Treasury constant maturity 1-year Treasury constant maturity (H15/H15/RIFLGFCYO2 NB 9/2/2020) (H15/H1SVRIFLGFCYOS_N.B 9/2/2020) (H15/15/RIFLGFCY01_N.B 9/2/2020) 0 07/01 03/06 10/10 05/15 12/19 Source: Federal Reserve Board 2020 Ah Lee uses the following table obtained from Federal Reserve Statistical Release H.15 to get current spot rates on one-, two-, three- and four-year constant maturity Treasury securities. (See table below). + Treasury constant maturities Spot Rate Today 1-month 0.01% 3-month 0.05% 6-month 0.19% 1-year 0.38% 2-year 0.75% 3-year 0.99% 4-year 1.10% 5-year 1.29% 7-year 1.47% 10-year 1.55% 20-year 2.00% 30-year 1.96% Ah Lee is to recommend the best investment strategy among the four different US Treasury bonds. See table below. The $10 million investment will be liquidated in three years to help repay a bank loan charging a fixed rate interest at 8.50% per year. The bonds, each with a $1,000 par value and annual convention, are described as following: Bond Annual Current Price Maturity Coupon (yrs) Bond 1 0% $882.50 5 Bond 2 11.625% $1403.39 5 Bond 3 5.5% $1107.59 3 Bond 4 3.5% $905.25 4 Note: This is an important recommendation for Ah Lee that can affect his career. Although no one knows the future course of interest rates (not even Carlo), Ah Lee knows it is essential to consider the impact of an unexpected change in interest rates on each of the bonds. To Ah Lee, it is probably least risky to assume Carlo's forecast is the best because he'll have no one to blame but himself if Ah Lee makes a recommendation based on the forecast Some background: "Carlo will accept a recommendation different than his own only if it is justified by analysis," advises Ah Cheung. "Well-reasoned analysis is an opportunity to gain back some of Carlo' trust, which was lost after your last bond investment." Ah Cheung also adds, If you follow Carol's view, he also wants to see the reasons behind your agreement." CASE TASK: You (Ah Lee) are tasked to write an Investment Proposal for recommending an investment to Carlo (your boss) for $10 million with the prime objective to reduce the funding cost of the fixed rate loan as mentioned above over the next 3 years. The proposal should start with a summary of recommendation and followed by detailed parts containing analysis which has to have the following 3 major areas: (i) Interest Rate View Forecast Part Before choosing your investment, you must form your interest rate view over your investment period as it will direct your choice of bond investment. Economic and other market factors will influence the interest rate movement as you need to forecast interest rate change across the whole curve. Would you (being Ah Lee) go by Carlo's forecast on interest rate term structure remain unchanged for the next 3 years? (Give reasons to support if you agree to the same view or not? This is important as your interest rate view would directly affect your investment recommendation and you need to determine the expected change in the yield curve.) Of course, you can disagree with Carlo and you need to forecast the change. (Note: I am open to what you want to discuss about the interest rate term structure over the next 3 years. Whether you agree or disagree with the view that term structure will remain the same in the coming 3 years. You should frame your discussion on interest rate view with current economic and market factors (such as ate cut after rate hike, inflation/deflation expectation, monetary/fiscal policy, trade war etc.). Your interest rate view and the exact levels would directly affect your investment decision in Q3 as the basis to evaluate in Part II.) (25 Points) (ii) Risk and Return analysis Part Duration and risks are important to form an investment recommendation especially given that you do have an interest rate view about its future years as projected in Part 1. From the case text, "Ah Lee once bought five-year coupon Treasury bonds (a maturity longer than the firm's liabilities) only to see interest rates rise. The loss when the Treasury bonds were sold did not make Ah Lee's supervisor, Carlo, Chief Financial Officer, very unhappy." So, it should have analysis of the durations of the 4 bonds with respective to the forecast you made in Part 1. (10 Points) (Hint: You need to calculate the YTM of the 4 bonds in order to calculate the Duration. You should discuss in relevant investment context here for selecting bonds based on duration given the target return linked to offset to a loan lability. (10 Points) (Hint: The discussion should be about why matching duration on company's asset and liability balance affects investment choice) Given the sensitivity of duration and interest rate forecast, perform RCY analysis on the 4 bonds based on the current interest rate and compare with the RCY analysis based on your forecasted interest rate view. (you need to show details of your calculation). (30 Points) (A) Calculation of Coupon Reinvestment (Hint: if you expect the rates will be unchanged, you can make use of current spot rates to calculate the corresponding forward rates for coupon reinvestment calculation, otherwise you can use your forecasted forward rates in the future. See an example of cashflow diagram.) 1F2 2F1 Year 1 Year 2 Year 3 Year 4 Year 5 (B) Calculation of Bond Price in 3 years. (Hint: You also need forward rates for future Bond price. See example of cashflow diagram) Bond Price C+F 1F3 2F3 Year 1 Year 2 Year 3 Year 4 Year 5 Group Case Study Due Date: 1 April 2022 5pm (Submit in Word or pdf format through Ecampus). Please upload your file with the format: Student Name_Student ID_FIN4002_Group Case Study.doc" This coursework has 3 major questions to answer and will be marked out of 100% basis. The mark in this case Assessment represents 30% of the overall module score. Case Background Ah Lee, a financial manager at a US based mid-sized manufacturing firm, has been caught off-guard before. To earn the most on excess cash, Ah Lee once bought five-year coupon Treasury bonds (a maturity longer than the firm's liabilities) only to see interest rates rise. The loss when the Treasury bonds were sold did not make Ah Lee's supervisor, Carlo, Chief Financial Officer, very happy. Ah Lee is now in a similar situation - Carlo has asked Ah Lee for a recommendation on the investment of another $10 million in excess cash. Risk and Return using Duration & RCY Analysis The risk of unexpected changes in interest rates is a given with coupon-paying bonds. Even if the bonds are held to maturity, there is reinvestment risk. A bond's exposure to interest rate risk depends on the size and the number of coupon payments made to the bondholder. The realized return from a bond depends on the rates at which the coupons are invested; the rates can only be estimated at the time the bond is purchased. Given estimates of futures spot interest rates, however, the expected realized compound yield (RCY) can be calculated in order to cope with the reinvestment problem. For a bond that pays annual coupons over n years, the appropriate calculation for the annualized return is: RCY = [(Total future dollar value/Initial Purchase price of bond)"'n - 1). Where the "Total future dollar value is the sum of (1) the coupon payments, (2) the reinvestment value on each coupon, and (3) the value of the bond at the end of the holding period. In estimating the future dollars from a bond investment, Ah Lee needs a forecast of the direction and level of future interest rates in order to calculate the RCY. = - At yesterday's investment meeting, Carlo stated his view that interest rates term structure would remain unchanged for the next three years because of a stable (and most possibly unchanging) in expected inflation rate and the economy environment will be stabilized. Ah Cheung, another financial manager at the firm and someone that has earned Carlo's respect for his reasoned judgment, suggests Ah Lee use the current term structure to gauge interest rate expectations. He reviews the past 20 year's historic trends of Y1 to Y4 interest rate (see diagram below) for insight. 63-year Treasury constant maturity (H15/115/RIFLGFCY03_N.B 9/2/2020) 2-year Treasury constant maturity 5-year Treasury constant maturity 1-year Treasury constant maturity (H15/H15/RIFLGFCYO2 NB 9/2/2020) (H15/H1SVRIFLGFCYOS_N.B 9/2/2020) (H15/15/RIFLGFCY01_N.B 9/2/2020) 0 07/01 03/06 10/10 05/15 12/19 Source: Federal Reserve Board 2020 Ah Lee uses the following table obtained from Federal Reserve Statistical Release H.15 to get current spot rates on one-, two-, three- and four-year constant maturity Treasury securities. (See table below). + Treasury constant maturities Spot Rate Today 1-month 0.01% 3-month 0.05% 6-month 0.19% 1-year 0.38% 2-year 0.75% 3-year 0.99% 4-year 1.10% 5-year 1.29% 7-year 1.47% 10-year 1.55% 20-year 2.00% 30-year 1.96% Ah Lee is to recommend the best investment strategy among the four different US Treasury bonds. See table below. The $10 million investment will be liquidated in three years to help repay a bank loan charging a fixed rate interest at 8.50% per year. The bonds, each with a $1,000 par value and annual convention, are described as following: Bond Annual Current Price Maturity Coupon (yrs) Bond 1 0% $882.50 5 Bond 2 11.625% $1403.39 5 Bond 3 5.5% $1107.59 3 Bond 4 3.5% $905.25 4 Note: This is an important recommendation for Ah Lee that can affect his career. Although no one knows the future course of interest rates (not even Carlo), Ah Lee knows it is essential to consider the impact of an unexpected change in interest rates on each of the bonds. To Ah Lee, it is probably least risky to assume Carlo's forecast is the best because he'll have no one to blame but himself if Ah Lee makes a recommendation based on the forecast Some background: "Carlo will accept a recommendation different than his own only if it is justified by analysis," advises Ah Cheung. "Well-reasoned analysis is an opportunity to gain back some of Carlo' trust, which was lost after your last bond investment." Ah Cheung also adds, If you follow Carol's view, he also wants to see the reasons behind your agreement." CASE TASK: You (Ah Lee) are tasked to write an Investment Proposal for recommending an investment to Carlo (your boss) for $10 million with the prime objective to reduce the funding cost of the fixed rate loan as mentioned above over the next 3 years. The proposal should start with a summary of recommendation and followed by detailed parts containing analysis which has to have the following 3 major areas: (i) Interest Rate View Forecast Part Before choosing your investment, you must form your interest rate view over your investment period as it will direct your choice of bond investment. Economic and other market factors will influence the interest rate movement as you need to forecast interest rate change across the whole curve. Would you (being Ah Lee) go by Carlo's forecast on interest rate term structure remain unchanged for the next 3 years? (Give reasons to support if you agree to the same view or not? This is important as your interest rate view would directly affect your investment recommendation and you need to determine the expected change in the yield curve.) Of course, you can disagree with Carlo and you need to forecast the change. (Note: I am open to what you want to discuss about the interest rate term structure over the next 3 years. Whether you agree or disagree with the view that term structure will remain the same in the coming 3 years. You should frame your discussion on interest rate view with current economic and market factors (such as ate cut after rate hike, inflation/deflation expectation, monetary/fiscal policy, trade war etc.). Your interest rate view and the exact levels would directly affect your investment decision in Q3 as the basis to evaluate in Part II.) (25 Points) (ii) Risk and Return analysis Part Duration and risks are important to form an investment recommendation especially given that you do have an interest rate view about its future years as projected in Part 1. From the case text, "Ah Lee once bought five-year coupon Treasury bonds (a maturity longer than the firm's liabilities) only to see interest rates rise. The loss when the Treasury bonds were sold did not make Ah Lee's supervisor, Carlo, Chief Financial Officer, very unhappy." So, it should have analysis of the durations of the 4 bonds with respective to the forecast you made in Part 1. (10 Points) (Hint: You need to calculate the YTM of the 4 bonds in order to calculate the Duration. You should discuss in relevant investment context here for selecting bonds based on duration given the target return linked to offset to a loan lability. (10 Points) (Hint: The discussion should be about why matching duration on company's asset and liability balance affects investment choice) Given the sensitivity of duration and interest rate forecast, perform RCY analysis on the 4 bonds based on the current interest rate and compare with the RCY analysis based on your forecasted interest rate view. (you need to show details of your calculation). (30 Points) (A) Calculation of Coupon Reinvestment (Hint: if you expect the rates will be unchanged, you can make use of current spot rates to calculate the corresponding forward rates for coupon reinvestment calculation, otherwise you can use your forecasted forward rates in the future. See an example of cashflow diagram.) 1F2 2F1 Year 1 Year 2 Year 3 Year 4 Year 5 (B) Calculation of Bond Price in 3 years. (Hint: You also need forward rates for future Bond price. See example of cashflow diagram) Bond Price C+F 1F3 2F3 Year 1 Year 2 Year 3 Year 4 Year 5