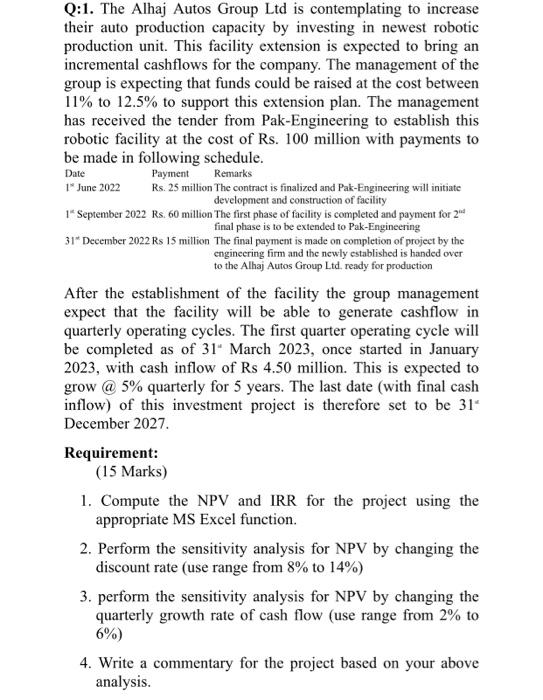

group is expecting that funds could be raised at the cost between 11% to 12.5% to support this extension plan. The management has received the tender from Pak-Engineering to establish this robotic facility at the cost of Rs. 100 million with payments to be made in following schedule. After the establishment of the facility the group management expect that the facility will be able to generate cashflow in quarterly operating cycles. The first quarter operating cycle will be completed as of 31 March 2023 , once started in January 2023, with cash inflow of Rs 4.50 million. This is expected to grow@5\% quarterly for 5 years. The last date (with final cash inflow) of this investment project is therefore set to be 31 December 2027. Requirement: (15 Marks) 1. Compute the NPV and IRR for the project using the appropriate MS Excel function. 2. Perform the sensitivity analysis for NPV by changing the discount rate (use range from 8% to 14% ) 3. perform the sensitivity analysis for NPV by changing the quarterly growth rate of cash flow (use range from 2% to 6% group is expecting that funds could be raised at the cost between 11% to 12.5% to support this extension plan. The management has received the tender from Pak-Engineering to establish this robotic facility at the cost of Rs. 100 million with payments to be made in following schedule. After the establishment of the facility the group management expect that the facility will be able to generate cashflow in quarterly operating cycles. The first quarter operating cycle will be completed as of 31 March 2023 , once started in January 2023, with cash inflow of Rs 4.50 million. This is expected to grow@5\% quarterly for 5 years. The last date (with final cash inflow) of this investment project is therefore set to be 31 December 2027. Requirement: (15 Marks) 1. Compute the NPV and IRR for the project using the appropriate MS Excel function. 2. Perform the sensitivity analysis for NPV by changing the discount rate (use range from 8% to 14% ) 3. perform the sensitivity analysis for NPV by changing the quarterly growth rate of cash flow (use range from 2% to 6%