Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GROUP PROJECT: ALWASL PLUMBING COMPANY AlWasl Plumbing Company (WPC) has approached Etihad Bank (EB) with a request for AED2,000,000 in credit facilities to finance its

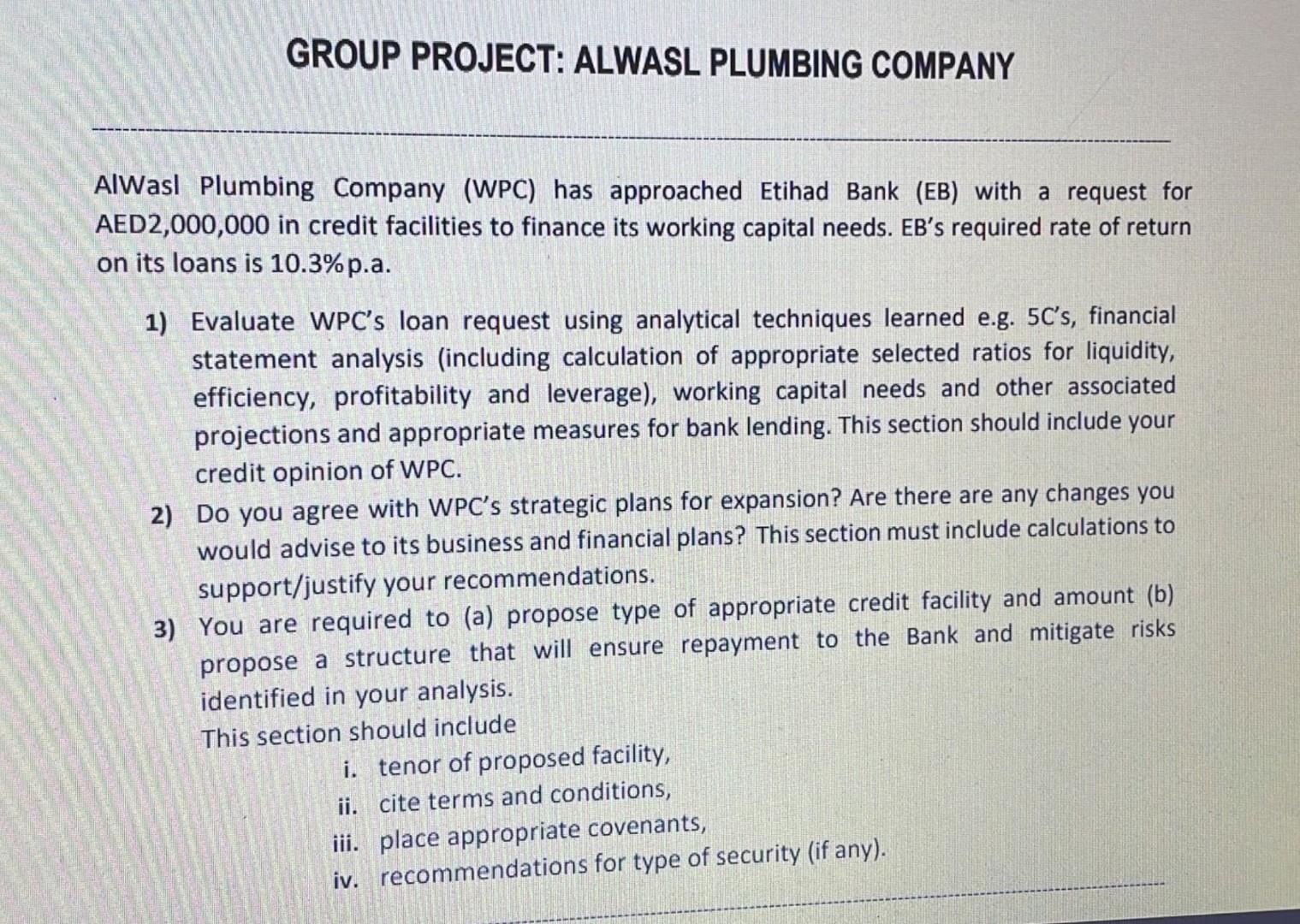

GROUP PROJECT: ALWASL PLUMBING COMPANY AlWasl Plumbing Company (WPC) has approached Etihad Bank (EB) with a request for AED2,000,000 in credit facilities to finance its working capital needs. EB's required rate of return on its loans is 10.3%p.a. 1) Evaluate WPC's loan request using analytical techniques learned e.g. 5C's, financial statement analysis (including calculation of appropriate selected ratios for liquidity, efficiency, profitability and leverage), working capital needs and other associated projections and appropriate measures for bank lending. This section should include your credit opinion of WPC. 2) Do you agree with WPC's strategic plans for expansion? Are there are any changes you would advise to its business and financial plans? This section must include calculations to support/justify your recommendations. 3) You are required to (a) propose type of appropriate credit facility and amount (b) propose a structure that will ensure repayment to the Bank and mitigate risks identified in your analysis. This section should include i. tenor of proposed facility, ii. cite terms and conditions, iii. place appropriate covenants, iv. recommendations for type of security (if any). GROUP PROJECT: ALWASL PLUMBING COMPANY AlWasl Plumbing Company (WPC) has approached Etihad Bank (EB) with a request for AED2,000,000 in credit facilities to finance its working capital needs. EB's required rate of return on its loans is 10.3%p.a. 1) Evaluate WPC's loan request using analytical techniques learned e.g. 5C's, financial statement analysis (including calculation of appropriate selected ratios for liquidity, efficiency, profitability and leverage), working capital needs and other associated projections and appropriate measures for bank lending. This section should include your credit opinion of WPC. 2) Do you agree with WPC's strategic plans for expansion? Are there are any changes you would advise to its business and financial plans? This section must include calculations to support/justify your recommendations. 3) You are required to (a) propose type of appropriate credit facility and amount (b) propose a structure that will ensure repayment to the Bank and mitigate risks identified in your analysis. This section should include i. tenor of proposed facility, ii. cite terms and conditions, iii. place appropriate covenants, iv. recommendations for type of security (if any)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started