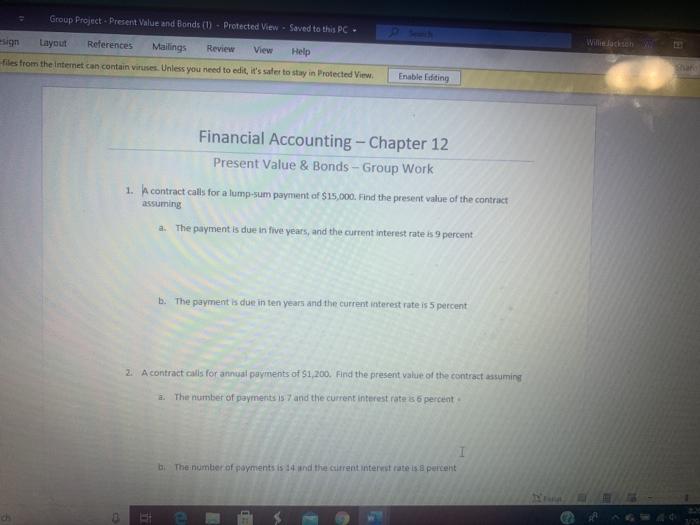

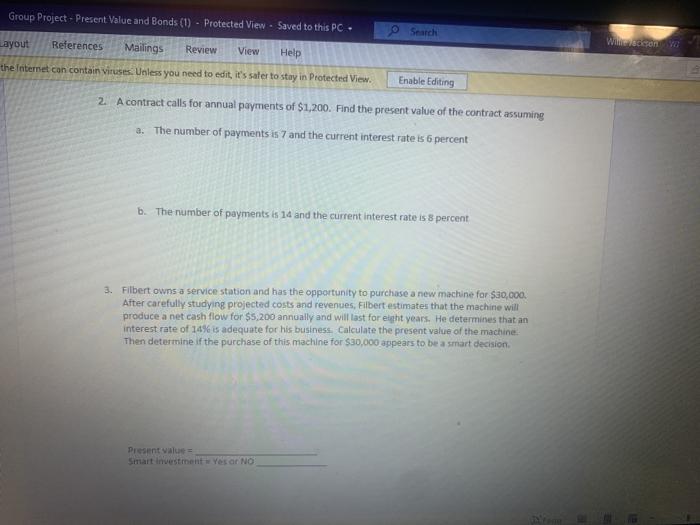

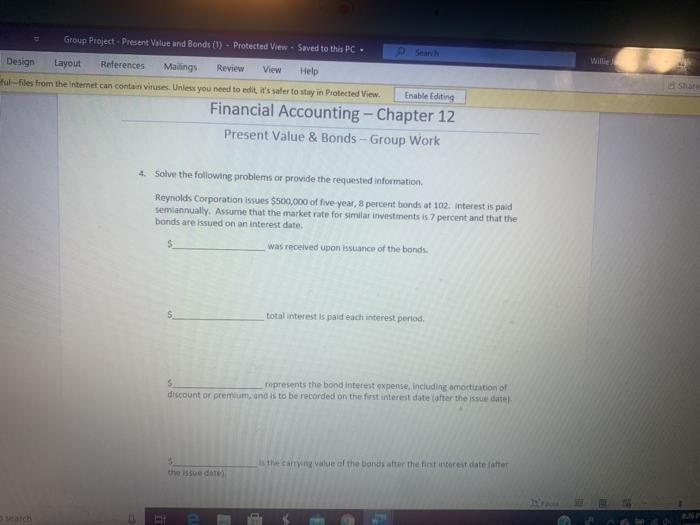

Group Project Present Value and Bonds (1) - Protected View - Saved to this PC- Willochton sign Layout References Mailings Review View Help files from the Internet can contain viruses. Unless you need to edit, it's safe to stay in Protected View Enable Editing Financial Accounting - Chapter 12 Present Value & Bonds - Group Work 1. A contract calls for a lump sum payment of $15,000. Find the present value of the contract assuming a. The payment is due in five years, and the current interest rate is 9 percent b. The payment is due in ten years and the current interest rate is 5 percent 2. A contract calls for annual payments of $1,200. Find the present value of the contract assuming a. The number of payments is 7 and the current interest rates 6 percent The number of payments is 14 and the current interest rate is a percent Group Project - Present Value and Bonds (1) - Protected View - Saved to this PC- e Search Layout References Wiscono Mailings Review View Help the Internet con contain viruses. Unless you need to edit it's safer to stay in Protected View Enable Editing 2. A contract calls for annual payments of $1,200. Find the present value of the contract assuming a. The number of payments is 7 and the current interest rate is 6 percent b. The number of payments is 14 and the current interest rate is 8 percent 3. Filbert owns a service station and has the opportunity to purchase a new machine for $30,000 After carefully studying projected costs and revenues, Filbert estimates that the machine will produce a net cash flow for $5,200 annually and will last for eight years. He determines that an interest rate of 14% is adequate for his business Calculate the present value of the machine Then determine if the purchase of this machine for $30,000 appears to be a smart decision Present Value = Smart Investment Yesar NO WWE Group Project - Present Value and Bonds (I) - Protected View - Saved to this PC- Design Layout References Mailings Review View Help - files from the Internet can contain viruses. Unless you need to edit it's safe to stay in Protected View Enable Editing Financial Accounting - Chapter 12 Present Value & Bonds - Group Work 4. Solve the following problems or provide the requested information Reynolds Corporation issues $500,000 of five year, 8 percent bonds at 102. Interest is paid semiannually. Assume that the market rate for similar investments is 7 percent and that the bands are issued on an interest date. S was received upon issuance of the bonds total interest is paid each interest period. S represents the bond Interest expense, including amortuation of discount or premium, and is to be recorded on the first interest date after the issue date the cany value of the land after the first interest date fatter the issue date