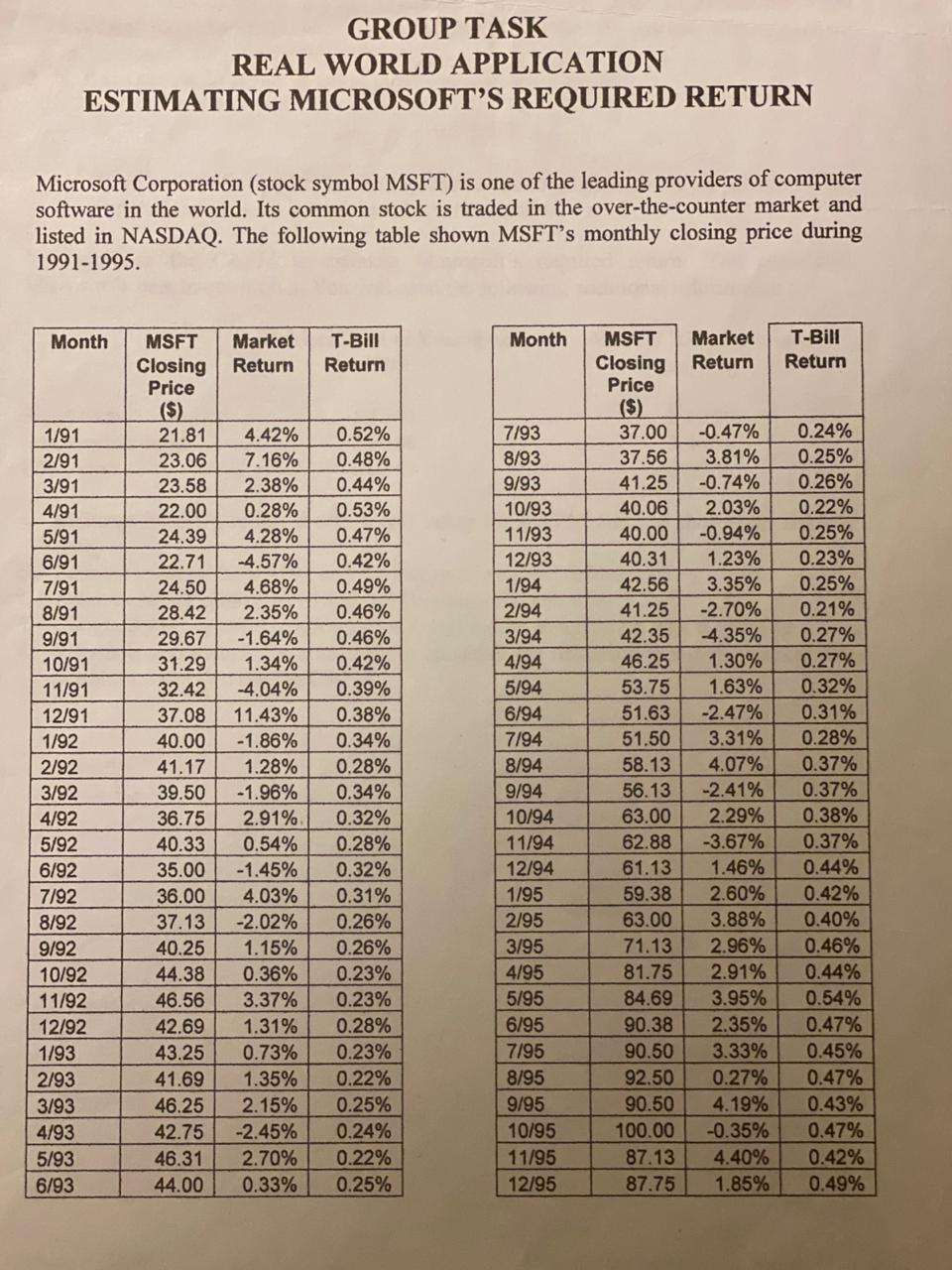

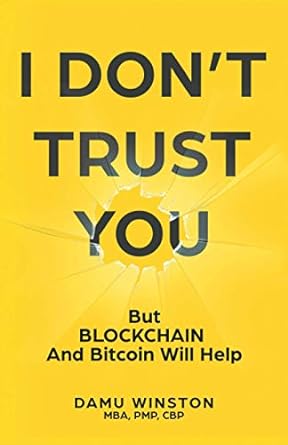

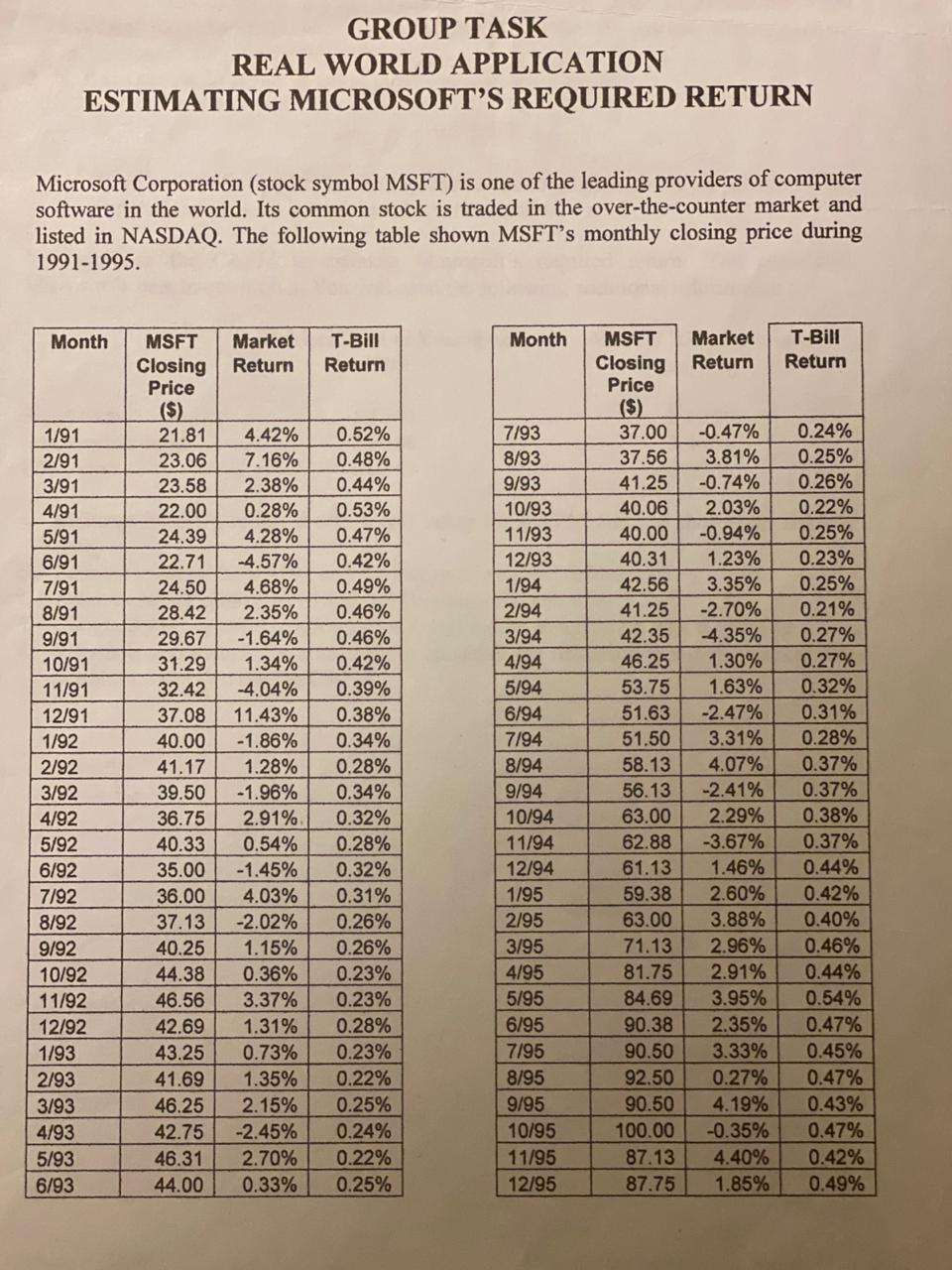

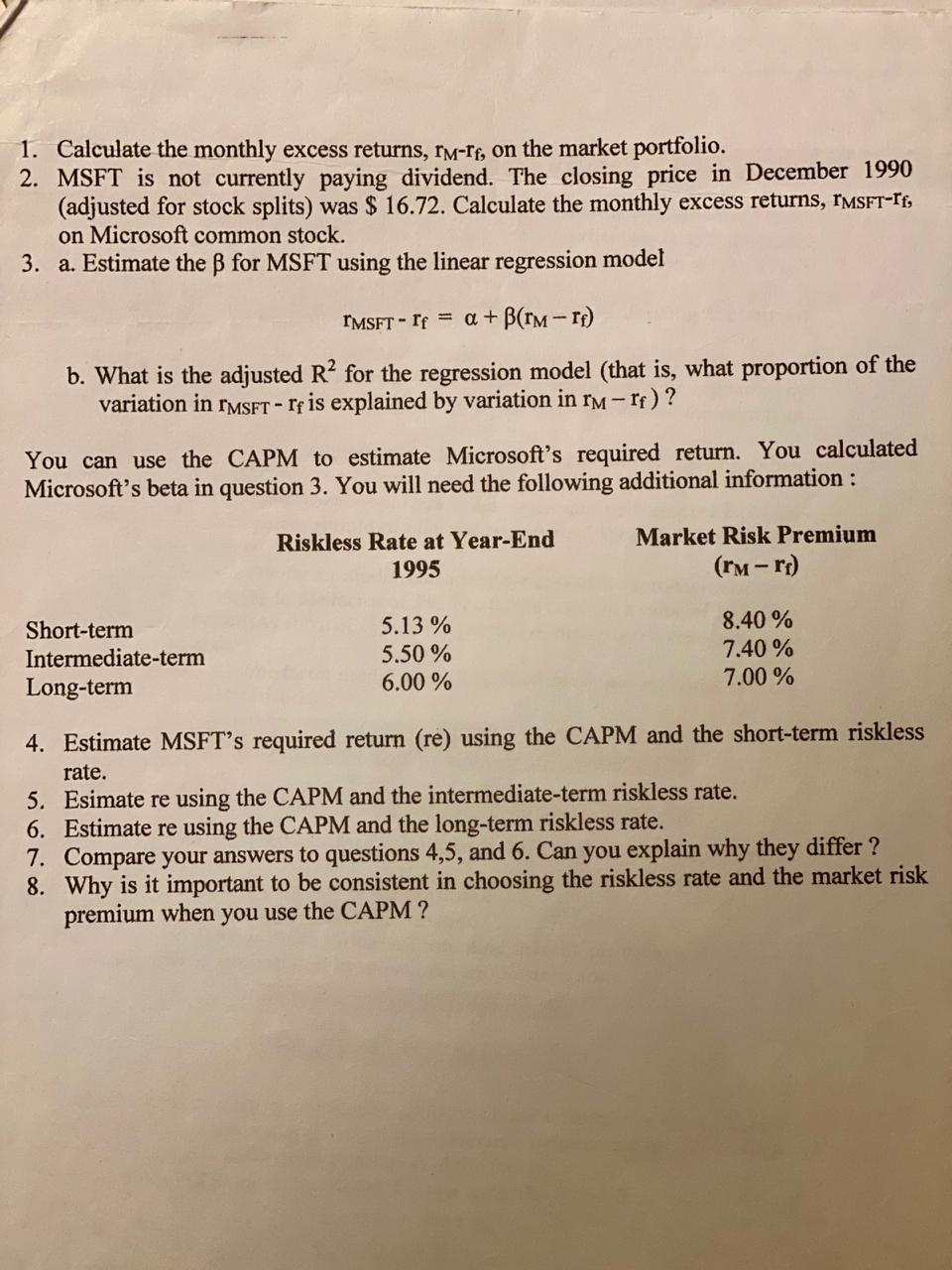

GROUP TASK REAL WORLD APPLICATION ESTIMATING MICROSOFTS REQUIRED RETURN Microsoft Corporation (stock symbol MSFT) is one of the leading providers of computer software in the world. Its common stock is traded in the over-the-counter market and listed in NASDAQ. The following table shown MSFT's monthly closing price during 1991-1995. Month Month Market Return T-Bill Return Market Return T-Bill Return 1/91 2/91 3/91 4/91 5/91 6/91 7/91 8/91 9/91 10/91 11/91 12/91 1/92 2/92 3/92 4/92 5/92 6/92 7/92 8/92 9/92 10/92 11/92 12/92 1/93 2/93 3/93 4/93 5/93 6/93 MSFT Closing Price ($) 21.81 23.06 23.58 22.00 24.39 22.71 24.50 28.42 29.67 31.29 32.42 37.08 40.00 41.17 39.50 36.75 40.33 35.00 36.00 37.13 40.25 44.38 46.56 42.69 43.25 41.69 46.25 42.75 46.31 44.00 4.42% 7.16% 2.38% 0.28% 4.28% -4.57% 4.68% 2.35% -1.64% 1.34% -4.04% 11.43% -1.86% 1.28% -1.96% 2.91% 0.54% -1.45% 4.03% -2.02% 1.15% 0.36% 3.37% 1.31% 0.73% 1.35% 2.15% -2.45% 2.70% 0.33% 0.52% 48% 0.44% 0.53% 0.47% 0.42% 0.49% 0.46% 0.46% 0.42% 0.39% 0.38% 0.34% 0.28% 0.34% 0.32% 0.28% 0.32% 0.31% 0.26% 0.26% 0.23% 0.23% 0.28% 0.23% 0.22% 0.25% 0.24% 0.22% 0.25% 7/93 8/93 9/93 10/93 11/93 12/93 1/94 2/94 3/94 4/94 5/94 6/94 7/94 8/94 9/94 10/94 11/94 12/94 1/95 2/95 3/95 4/95 5/95 6/95 7/95 8/95 9/95 10/95 11/95 12/95 MSFT Closing Price ($) 37.00 37.56 41.25 40.06 40.00 40.31 42.56 41.25 42.35 46.25 53.75 51.63 51.50 58.13 56.13 63.00 62.88 13 59.38 63.00 71.13 81.75 84.69 90.38 90.50 92.50 90.50 100.00 87.13 87.75 -0.47% 3.81% -0.74% 2.03% -0.94% 1.23% 3.35% -2.70% 4.35% 1.30% 1.63% -2.47% 3.31% 4.07% -2.41% 2.29% -3.67% 1.46% 2.60% 3.88% 2.96% 2.91% 3.95% 2.35% 3.33% 0.27% 4.19% -0.35% 4.40% 1.85% 0.24% 0.25% 0.26% 0.22% 0.25% 0.23% 0.25% 0.21% 0.27% 0.27% 0.32% 0.31% 0.28% 0.37% 0.37% 0.38% 0.37% 0.44% 0.42% 0.40% 0.46% 0.44% 0.54% 0.47% 0.45% 0.47% 0.43% 0.47% 0.42% 0.49% 1. Calculate the monthly excess returns, Im-ff, on the market portfolio. 2. MSFT is not currently paying dividend. The closing price in December 1990 (adjusted for stock splits) was $ 16.72. Calculate the monthly excess returns, TMSFT-If, on Microsoft common stock. 3. a. Estimate the B for MSFT using the linear regression model IMSFT - If = a + (rm- 1f) b. What is the adjusted R? for the regression model (that is, what proportion of the variation in IMSFT-rf is explained by variation in rm -rf)? You can use CAPM to estimate Microsoft's required return. You calculated Microsoft's beta in question 3. You will need the following additional information : Riskless Rate at Year-End 1995 Market Risk Premium (rm-rr) Short-term Intermediate-term Long-term 5.13 % 5.50% 6.00 % 8.40% 7.40% 7.00 % 4. Estimate MSFT's required return (re) using the CAPM and the short-term riskless rate. 5. Esimate re using the CAPM and the intermediate-term riskless rate. 6. Estimate re using the CAPM and the long-term riskless rate. 7. Compare your answers to questions 4,5, and 6. Can you explain why they differ? 8. Why is it important to be consistent in choosing the riskless rate and the market risk premium when you use the CAPM? GROUP TASK REAL WORLD APPLICATION ESTIMATING MICROSOFTS REQUIRED RETURN Microsoft Corporation (stock symbol MSFT) is one of the leading providers of computer software in the world. Its common stock is traded in the over-the-counter market and listed in NASDAQ. The following table shown MSFT's monthly closing price during 1991-1995. Month Month Market Return T-Bill Return Market Return T-Bill Return 1/91 2/91 3/91 4/91 5/91 6/91 7/91 8/91 9/91 10/91 11/91 12/91 1/92 2/92 3/92 4/92 5/92 6/92 7/92 8/92 9/92 10/92 11/92 12/92 1/93 2/93 3/93 4/93 5/93 6/93 MSFT Closing Price ($) 21.81 23.06 23.58 22.00 24.39 22.71 24.50 28.42 29.67 31.29 32.42 37.08 40.00 41.17 39.50 36.75 40.33 35.00 36.00 37.13 40.25 44.38 46.56 42.69 43.25 41.69 46.25 42.75 46.31 44.00 4.42% 7.16% 2.38% 0.28% 4.28% -4.57% 4.68% 2.35% -1.64% 1.34% -4.04% 11.43% -1.86% 1.28% -1.96% 2.91% 0.54% -1.45% 4.03% -2.02% 1.15% 0.36% 3.37% 1.31% 0.73% 1.35% 2.15% -2.45% 2.70% 0.33% 0.52% 48% 0.44% 0.53% 0.47% 0.42% 0.49% 0.46% 0.46% 0.42% 0.39% 0.38% 0.34% 0.28% 0.34% 0.32% 0.28% 0.32% 0.31% 0.26% 0.26% 0.23% 0.23% 0.28% 0.23% 0.22% 0.25% 0.24% 0.22% 0.25% 7/93 8/93 9/93 10/93 11/93 12/93 1/94 2/94 3/94 4/94 5/94 6/94 7/94 8/94 9/94 10/94 11/94 12/94 1/95 2/95 3/95 4/95 5/95 6/95 7/95 8/95 9/95 10/95 11/95 12/95 MSFT Closing Price ($) 37.00 37.56 41.25 40.06 40.00 40.31 42.56 41.25 42.35 46.25 53.75 51.63 51.50 58.13 56.13 63.00 62.88 13 59.38 63.00 71.13 81.75 84.69 90.38 90.50 92.50 90.50 100.00 87.13 87.75 -0.47% 3.81% -0.74% 2.03% -0.94% 1.23% 3.35% -2.70% 4.35% 1.30% 1.63% -2.47% 3.31% 4.07% -2.41% 2.29% -3.67% 1.46% 2.60% 3.88% 2.96% 2.91% 3.95% 2.35% 3.33% 0.27% 4.19% -0.35% 4.40% 1.85% 0.24% 0.25% 0.26% 0.22% 0.25% 0.23% 0.25% 0.21% 0.27% 0.27% 0.32% 0.31% 0.28% 0.37% 0.37% 0.38% 0.37% 0.44% 0.42% 0.40% 0.46% 0.44% 0.54% 0.47% 0.45% 0.47% 0.43% 0.47% 0.42% 0.49% 1. Calculate the monthly excess returns, Im-ff, on the market portfolio. 2. MSFT is not currently paying dividend. The closing price in December 1990 (adjusted for stock splits) was $ 16.72. Calculate the monthly excess returns, TMSFT-If, on Microsoft common stock. 3. a. Estimate the B for MSFT using the linear regression model IMSFT - If = a + (rm- 1f) b. What is the adjusted R? for the regression model (that is, what proportion of the variation in IMSFT-rf is explained by variation in rm -rf)? You can use CAPM to estimate Microsoft's required return. You calculated Microsoft's beta in question 3. You will need the following additional information : Riskless Rate at Year-End 1995 Market Risk Premium (rm-rr) Short-term Intermediate-term Long-term 5.13 % 5.50% 6.00 % 8.40% 7.40% 7.00 % 4. Estimate MSFT's required return (re) using the CAPM and the short-term riskless rate. 5. Esimate re using the CAPM and the intermediate-term riskless rate. 6. Estimate re using the CAPM and the long-term riskless rate. 7. Compare your answers to questions 4,5, and 6. Can you explain why they differ? 8. Why is it important to be consistent in choosing the riskless rate and the market risk premium when you use the CAPM