Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GROUP TWO AND GROUP SIX 1. Describe and explain when you would be likely to use (i) options, (ii) forwards, (iii) futures, and (iv) swaps.

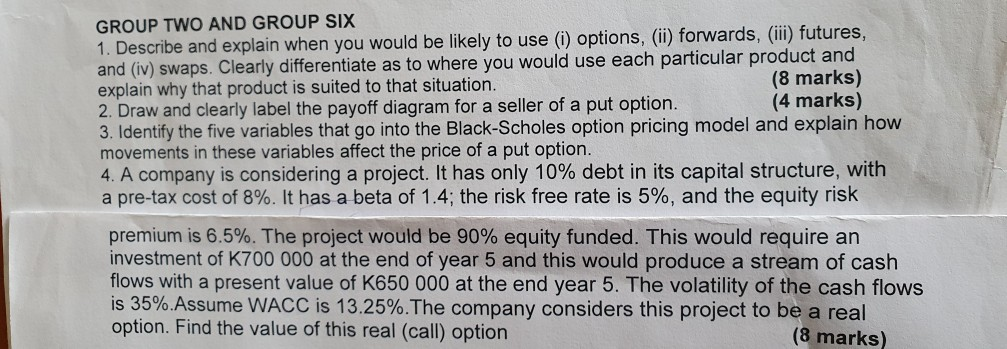

GROUP TWO AND GROUP SIX 1. Describe and explain when you would be likely to use (i) options, (ii) forwards, (iii) futures, and (iv) swaps. Clearly differentiate as to where you would use each particular product and explain why that product is suited to that situation. (8 marks) 2. Draw and clearly label the payoff diagram for a seller of a put option. (4 marks) 3. Identify the five variables that go into the Black-Scholes option pricing model and explain how movements in these variables affect the price of a put option. 4. A company is considering a project. It has only 10% debt in its capital structure, with a pre-tax cost of 8%. It has a beta of 1.4; the risk free rate is 5%, and the equity risk premium is 6.5%. The project would be 90% equity funded. This would require an investment of K700 000 at the end of year 5 and this would produce a stream of cash flows with a present value of K650 000 at the end year 5. The volatility of the cash flows is 35%. Assume WACC is 13.25%. The company considers this project to be a real option. Find the value of this real (call) option (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started