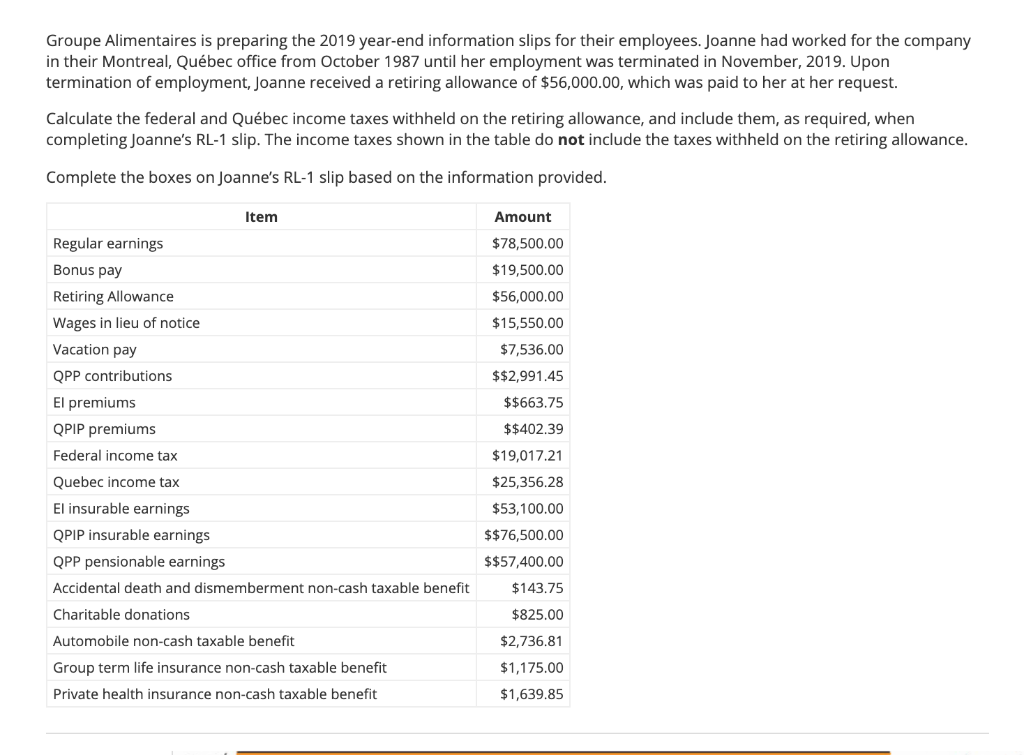

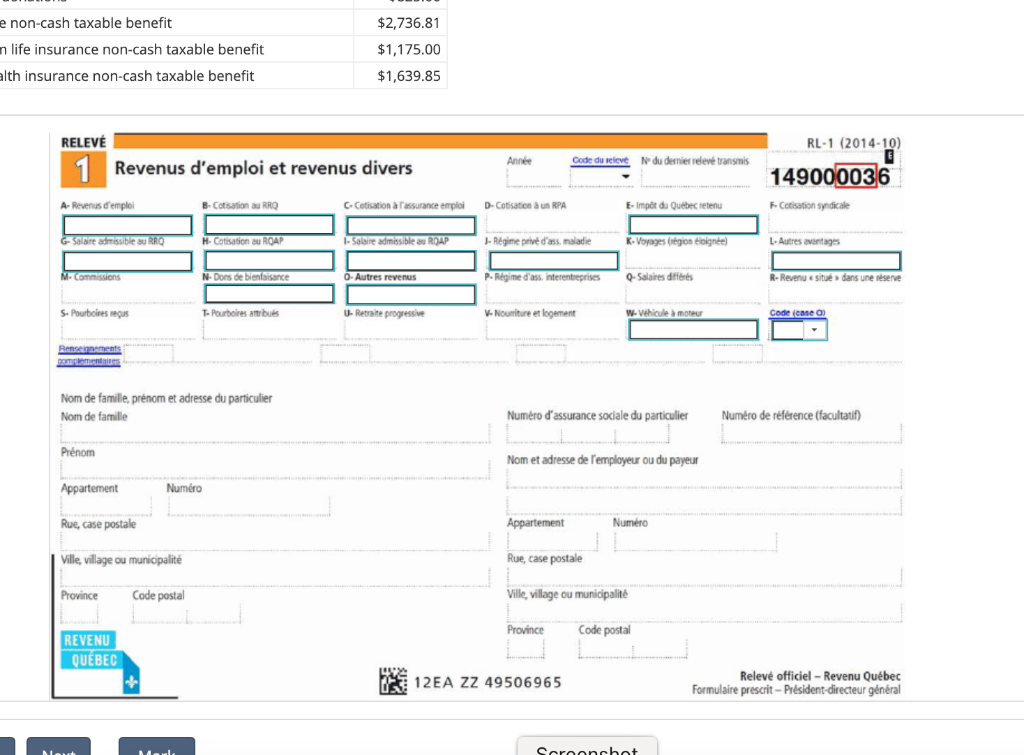

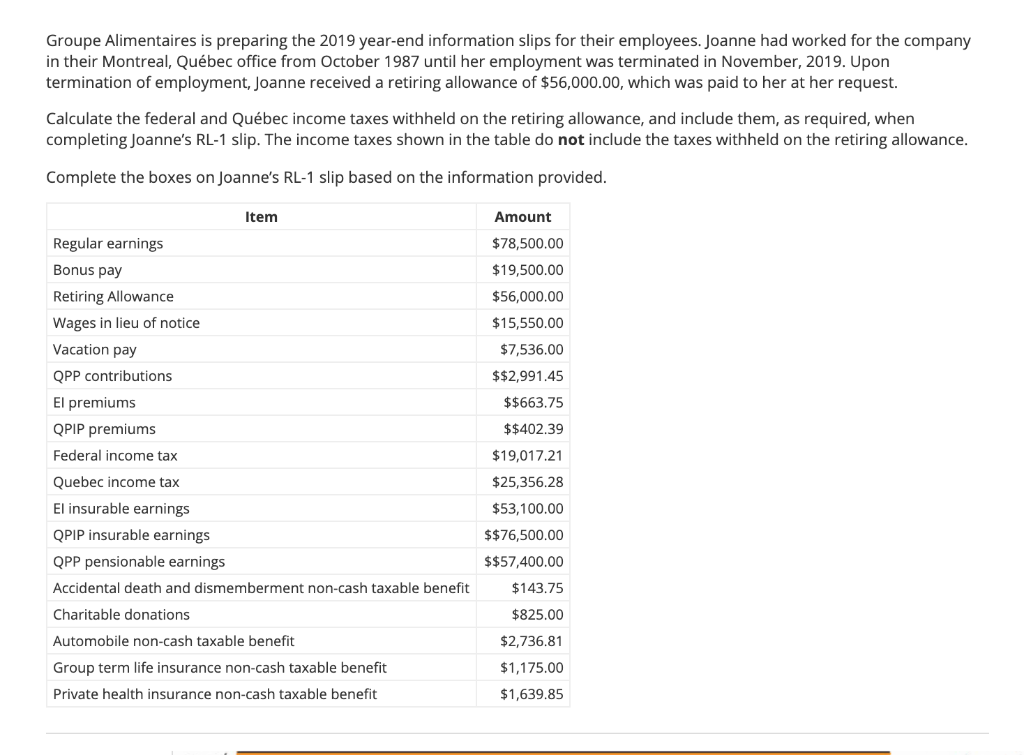

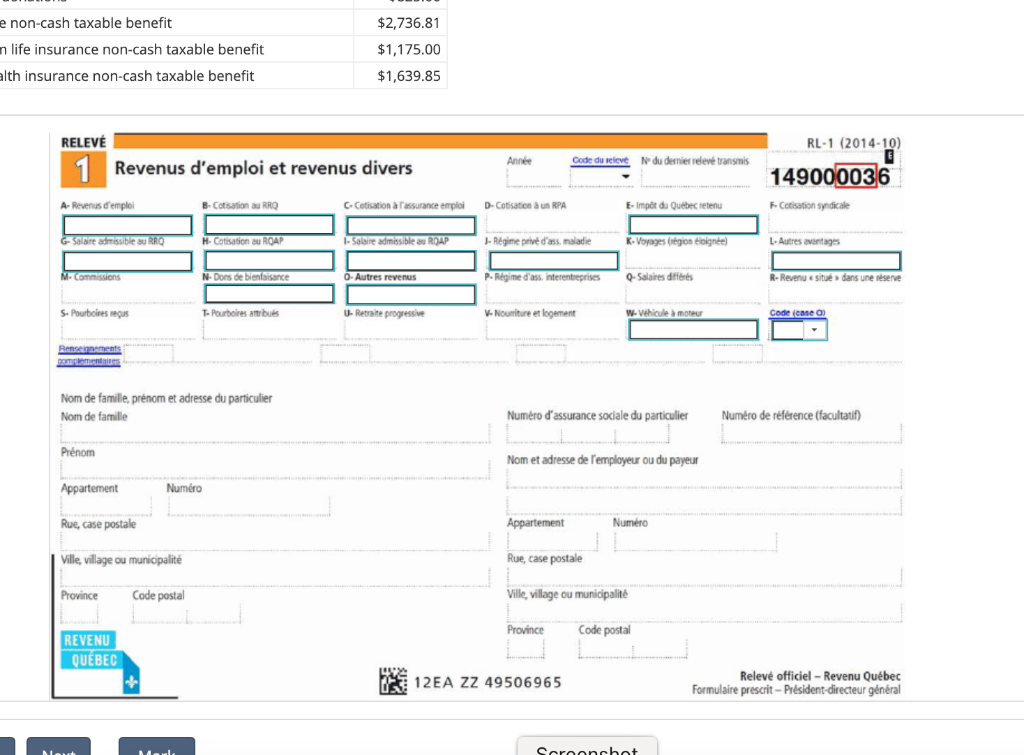

Groupe Alimentaires is preparing the 2019 year-end information slips for their employees. Joanne had worked for the company in their Montreal, Qubec office from October 1987 until her employment was terminated in November, 2019. Upon termination of employment, Joanne received a retiring allowance of $56,000.00, which was paid to her at her request. Calculate the federal and Qubec income taxes withheld on the retiring allowance, and include them, as required, when completing Joanne's RL-1 slip. The income taxes shown in the table do not include the taxes withheld on the retiring allowance. Complete the boxes on Joanne's RL-1 slip based on the information provided. Item Amount $78,500.00 $19,500.00 $56,000.00 $15,550.00 Regular earnings Bonus pay Retiring Allowance Wages in lieu of notice Vacation pay QPP contributions El premiums QPIP premiums $7,536.00 $$2,991.45 $$663.75 $$402.39 Federal income tax $19,017.21 $25,356.28 $53,100.00 $$76,500.00 Quebec income tax El insurable earnings QPIP insurable earnings QPP pensionable earnings Accidental death and dismemberment non-cash taxable benefit Charitable donations Automobile non-cash taxable benefit Group term life insurance non-cash taxable benefit Private health insurance non-cash taxable benefit $$57,400.00 $143.75 $825.00 $2,736.81 $1,175.00 $1,639.85 $2,736.81 e non-cash taxable benefit n life insurance non-cash taxable benefit alth insurance non-cash taxable benefit $1,175.00 $1,639.85 RELEV RL-1 (2014-10) Anne Code du relevt du dernier relev transmis 1 Revenus d'emploi et revenus divers 149000036 A-Revenus d'emploi B-Cotisation au RRO B-Cotisatie C-Cotisation l'assurance emploi D-Cotisation un RPA E-impor du Qubec retenu F-Cotisation syndicale G-Saare admissible URRO H. Cotisation au ROAP - Salaire admissible au ROAP 1- Rgime priv d'ass maladie K-Voyages (rgion toigne) L-Autres avantages M-Commissions N-Dors de bienfaisance 0 O-Autres revenus P- Rgime d'ass. interentreprises Q-Salaires diffres R- Revenue situ dans une rserve S. Pourboiresnes T- Pourboires attributes U. Retraite progressive - Nourriture et logement W-Vehicule moteur Code (case o Renseignements Nom de famille, prnom et adresse du particulier Nom de famille Numro d'assurance sociale du particulier Numro de reference (facultatif) Prnom Nom et adresse de l'employeur ou du payeur Appartement Numro Rue, case postale Appartement Numro Ville, village ou municipalit Rue, case postale Province Code postal Ville, village ou municipalit Province Code postal REVENU QUBEC 12EA ZZ 49506965 Relev officiel - Revenu Qubec Formulaire prescrit - President-directeur gnral Caroonchot Groupe Alimentaires is preparing the 2019 year-end information slips for their employees. Joanne had worked for the company in their Montreal, Qubec office from October 1987 until her employment was terminated in November, 2019. Upon termination of employment, Joanne received a retiring allowance of $56,000.00, which was paid to her at her request. Calculate the federal and Qubec income taxes withheld on the retiring allowance, and include them, as required, when completing Joanne's RL-1 slip. The income taxes shown in the table do not include the taxes withheld on the retiring allowance. Complete the boxes on Joanne's RL-1 slip based on the information provided. Item Amount $78,500.00 $19,500.00 $56,000.00 $15,550.00 Regular earnings Bonus pay Retiring Allowance Wages in lieu of notice Vacation pay QPP contributions El premiums QPIP premiums $7,536.00 $$2,991.45 $$663.75 $$402.39 Federal income tax $19,017.21 $25,356.28 $53,100.00 $$76,500.00 Quebec income tax El insurable earnings QPIP insurable earnings QPP pensionable earnings Accidental death and dismemberment non-cash taxable benefit Charitable donations Automobile non-cash taxable benefit Group term life insurance non-cash taxable benefit Private health insurance non-cash taxable benefit $$57,400.00 $143.75 $825.00 $2,736.81 $1,175.00 $1,639.85 $2,736.81 e non-cash taxable benefit n life insurance non-cash taxable benefit alth insurance non-cash taxable benefit $1,175.00 $1,639.85 RELEV RL-1 (2014-10) Anne Code du relevt du dernier relev transmis 1 Revenus d'emploi et revenus divers 149000036 A-Revenus d'emploi B-Cotisation au RRO B-Cotisatie C-Cotisation l'assurance emploi D-Cotisation un RPA E-impor du Qubec retenu F-Cotisation syndicale G-Saare admissible URRO H. Cotisation au ROAP - Salaire admissible au ROAP 1- Rgime priv d'ass maladie K-Voyages (rgion toigne) L-Autres avantages M-Commissions N-Dors de bienfaisance 0 O-Autres revenus P- Rgime d'ass. interentreprises Q-Salaires diffres R- Revenue situ dans une rserve S. Pourboiresnes T- Pourboires attributes U. Retraite progressive - Nourriture et logement W-Vehicule moteur Code (case o Renseignements Nom de famille, prnom et adresse du particulier Nom de famille Numro d'assurance sociale du particulier Numro de reference (facultatif) Prnom Nom et adresse de l'employeur ou du payeur Appartement Numro Rue, case postale Appartement Numro Ville, village ou municipalit Rue, case postale Province Code postal Ville, village ou municipalit Province Code postal REVENU QUBEC 12EA ZZ 49506965 Relev officiel - Revenu Qubec Formulaire prescrit - President-directeur gnral Caroonchot