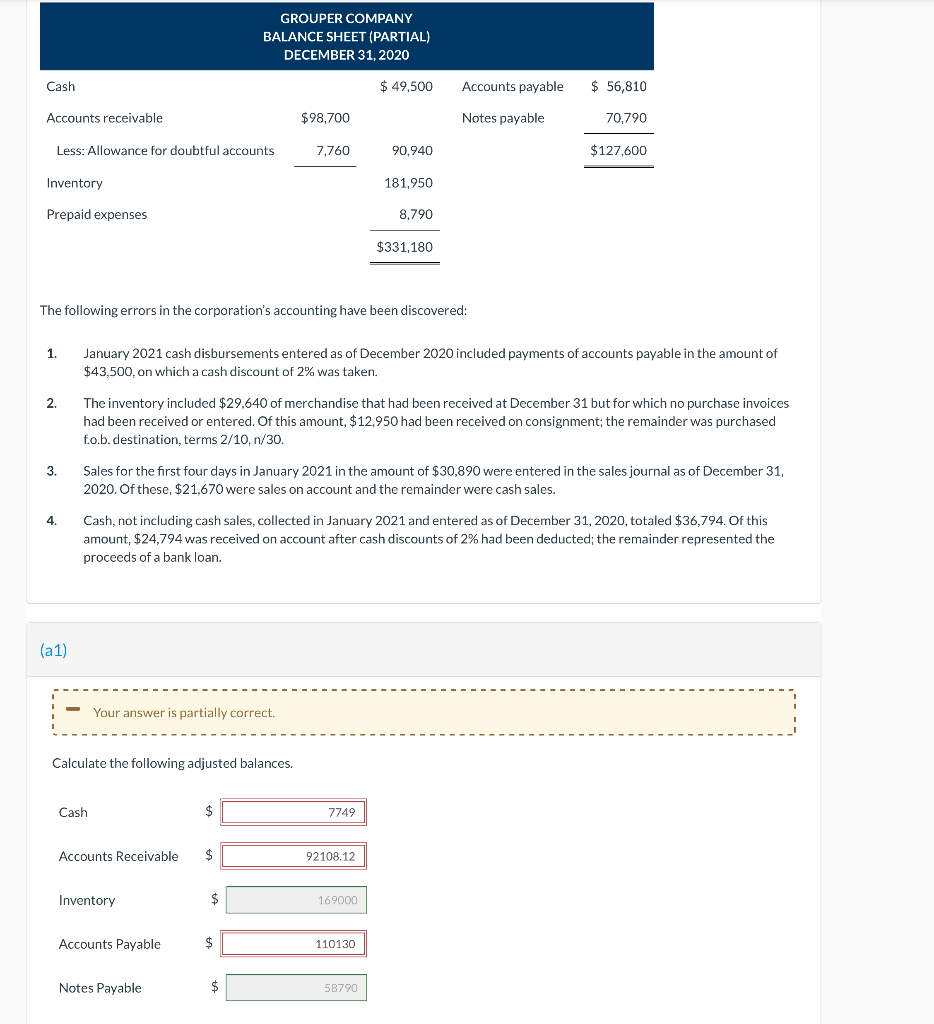

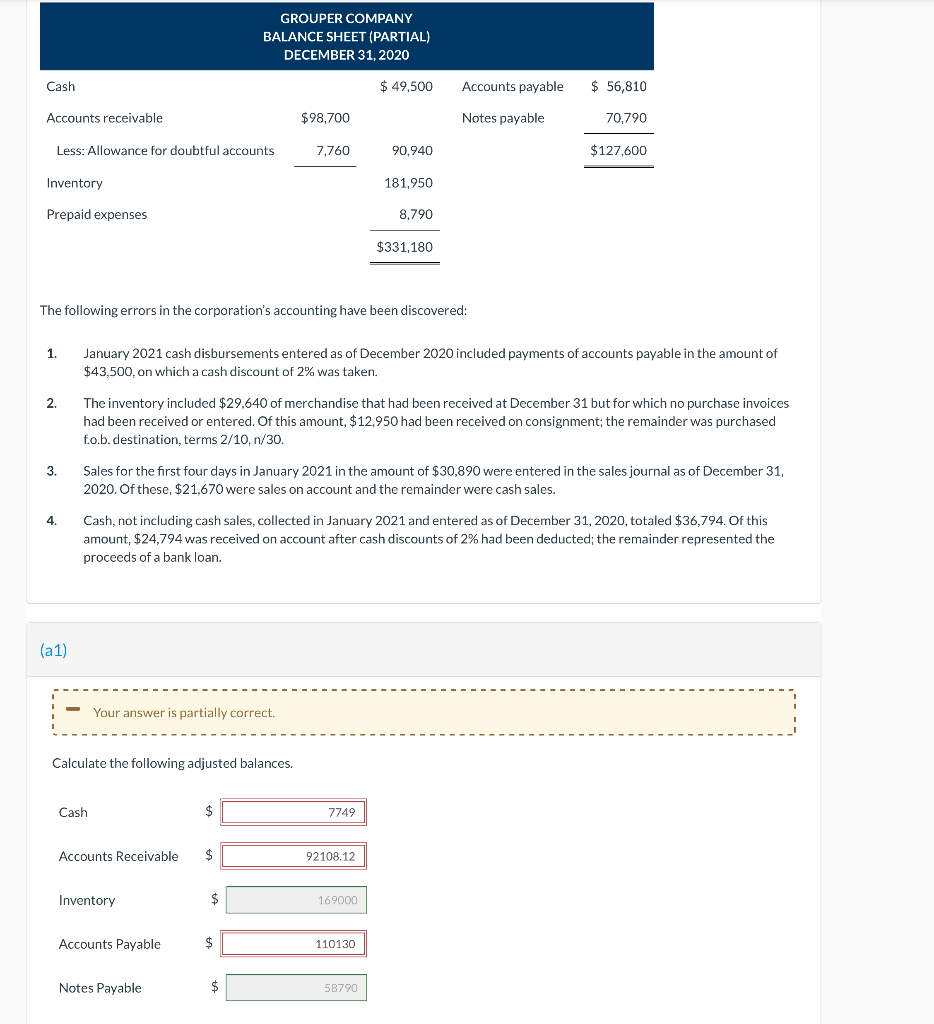

GROUPER COMPANY BALANCE SHEET (PARTIAL) DECEMBER 31, 2020 Cash $ 49,500 Accounts payable $ 56,810 Accounts receivable $98,700 Notes payable 70.790 Less: Allowance for doubtful accounts 7.760 90,940 $127,600 Inventory 181,950 Prepaid expenses 8,790 $331,180 The following errors in the corporation's accounting have been discovered: 1. January 2021 cash disbursements entered as of December 2020 included payments of accounts payable in the amount of $43,500, on which a cash discount of 2% was taken. 2. The inventory included $29,640 of merchandise that had been received at December 31 but for which no purchase invoices had been received or entered. Of this amount, $12,950 had been received on consignment; the remainder was purchased f.o.b.destination, terms 2/10,n/30. 3. Sales for the first four days in January 2021 in the amount of $30,890 were entered in the sales journal as of December 31, 2020. Of these, $21,670 were sales on account and the remainder were cash sales. 4. Cash, not including cash sales, collected in January 2021 and entered as of December 31, 2020, totaled $36,794. Of this amount, $24,794 was received on account after cash discounts of 2% had been deducted; the remainder represented the proceeds of a bank loan. (a 1) Your answer is partially correct. Calculate the following adjusted balances. Cash $ 7749 Accounts Receivable $ 92108.12 Inventory $ 169000 Accounts Payable $ 110130 Notes Payable $ 58790 GROUPER COMPANY BALANCE SHEET (PARTIAL) DECEMBER 31, 2020 Cash $ 49,500 Accounts payable $ 56,810 Accounts receivable $98,700 Notes payable 70.790 Less: Allowance for doubtful accounts 7.760 90,940 $127,600 Inventory 181,950 Prepaid expenses 8,790 $331,180 The following errors in the corporation's accounting have been discovered: 1. January 2021 cash disbursements entered as of December 2020 included payments of accounts payable in the amount of $43,500, on which a cash discount of 2% was taken. 2. The inventory included $29,640 of merchandise that had been received at December 31 but for which no purchase invoices had been received or entered. Of this amount, $12,950 had been received on consignment; the remainder was purchased f.o.b.destination, terms 2/10,n/30. 3. Sales for the first four days in January 2021 in the amount of $30,890 were entered in the sales journal as of December 31, 2020. Of these, $21,670 were sales on account and the remainder were cash sales. 4. Cash, not including cash sales, collected in January 2021 and entered as of December 31, 2020, totaled $36,794. Of this amount, $24,794 was received on account after cash discounts of 2% had been deducted; the remainder represented the proceeds of a bank loan. (a 1) Your answer is partially correct. Calculate the following adjusted balances. Cash $ 7749 Accounts Receivable $ 92108.12 Inventory $ 169000 Accounts Payable $ 110130 Notes Payable $ 58790