Answered step by step

Verified Expert Solution

Question

1 Approved Answer

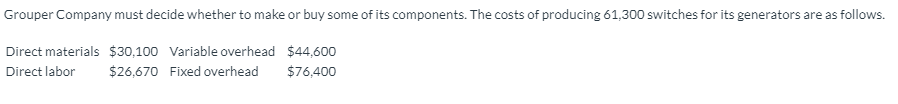

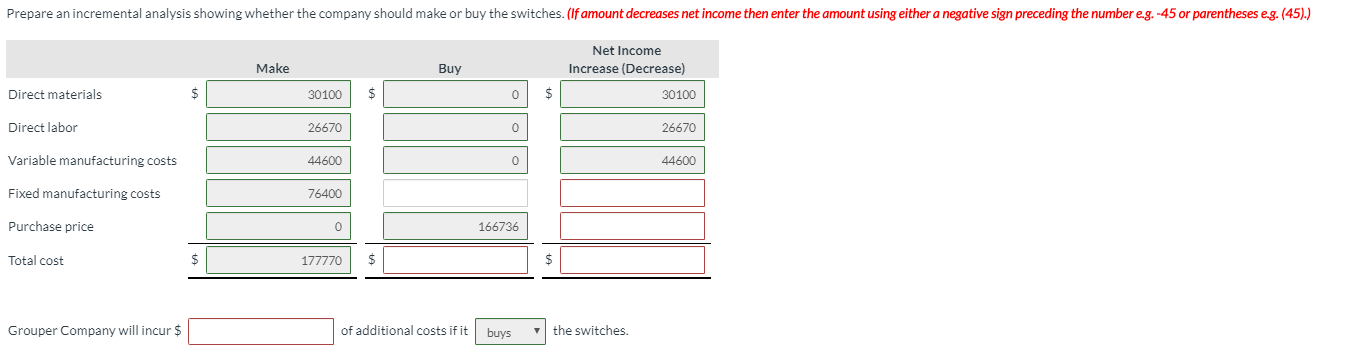

Grouper Company must decide whether to make or buy some of it's components. I can't figure out what I'm missing and how to get it.

Grouper Company must decide whether to make or buy some of it's components.

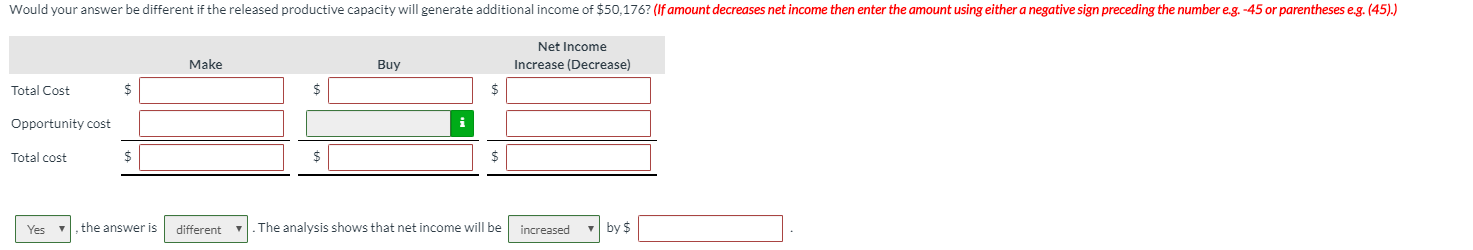

I can't figure out what I'm missing and how to get it. Can you explain?

comment "did not mention if any fixed cost is avoidable when the released capacity is used to generate additional income" the question does not say. I've send the entire screen.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started