Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Grouper Corp. began operations on January 1, 2023. Its fiscal year end is December 31. Grouper has decided that prepaid costs are debited to an

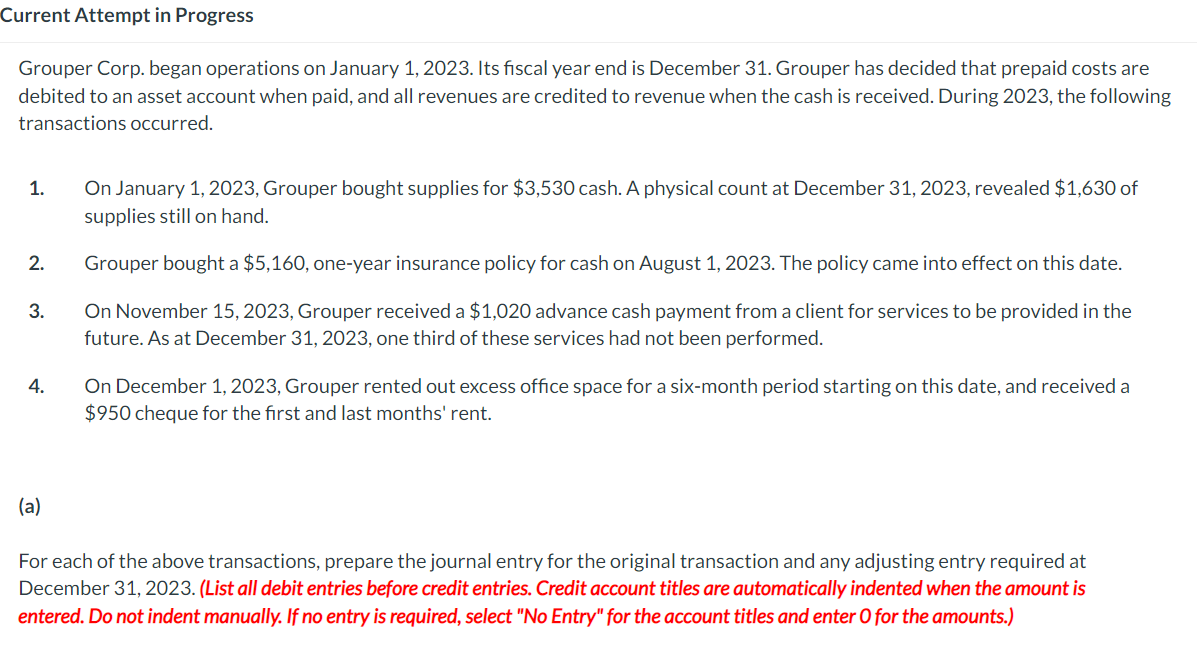

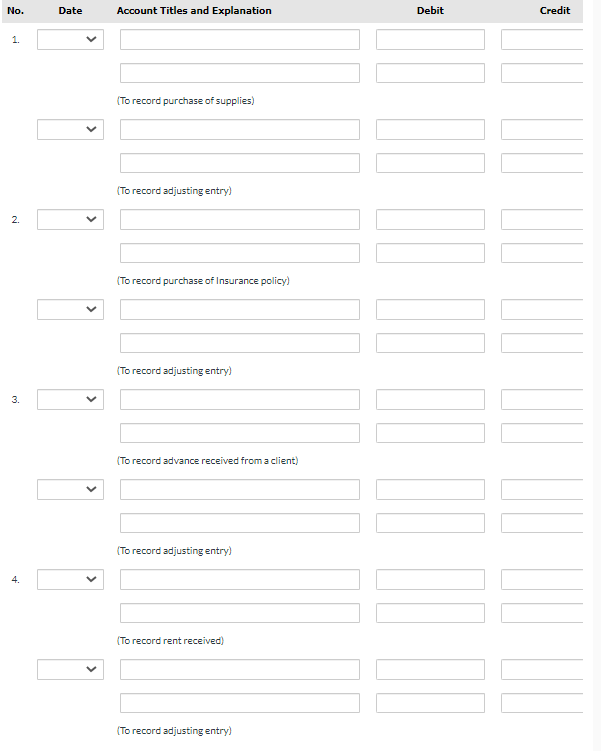

Grouper Corp. began operations on January 1, 2023. Its fiscal year end is December 31. Grouper has decided that prepaid costs are debited to an asset account when paid, and all revenues are credited to revenue when the cash is received. During 2023 , the following transactions occurred. 1. On January 1, 2023, Grouper bought supplies for $3,530 cash. A physical count at December 31,2023 , revealed $1,630 of supplies still on hand. 2. Grouper bought a $5,160, one-year insurance policy for cash on August 1, 2023. The policy came into effect on this date. 3. On November 15, 2023, Grouper received a $1,020 advance cash payment from a client for services to be provided in the future. As at December 31, 2023, one third of these services had not been performed. 4. On December 1, 2023, Grouper rented out excess office space for a six-month period starting on this date, and received a $950 cheque for the first and last months' rent. (a) For each of the above transactions, prepare the journal entry for the original transaction and any adjusting entry required at December 31, 2023. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Date Account Titles and Explanation Debit Credit 1. (To record purchase of supplies) (To record adjusting entry) 2. (To record purchase of Insurance policy) 3. (To record adjusting entry) (To record advance received from a client) (To record adjusting entry) 4. (To record rent received) (To record adjusting entry)

Grouper Corp. began operations on January 1, 2023. Its fiscal year end is December 31. Grouper has decided that prepaid costs are debited to an asset account when paid, and all revenues are credited to revenue when the cash is received. During 2023 , the following transactions occurred. 1. On January 1, 2023, Grouper bought supplies for $3,530 cash. A physical count at December 31,2023 , revealed $1,630 of supplies still on hand. 2. Grouper bought a $5,160, one-year insurance policy for cash on August 1, 2023. The policy came into effect on this date. 3. On November 15, 2023, Grouper received a $1,020 advance cash payment from a client for services to be provided in the future. As at December 31, 2023, one third of these services had not been performed. 4. On December 1, 2023, Grouper rented out excess office space for a six-month period starting on this date, and received a $950 cheque for the first and last months' rent. (a) For each of the above transactions, prepare the journal entry for the original transaction and any adjusting entry required at December 31, 2023. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Date Account Titles and Explanation Debit Credit 1. (To record purchase of supplies) (To record adjusting entry) 2. (To record purchase of Insurance policy) 3. (To record adjusting entry) (To record advance received from a client) (To record adjusting entry) 4. (To record rent received) (To record adjusting entry) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started