Answered step by step

Verified Expert Solution

Question

1 Approved Answer

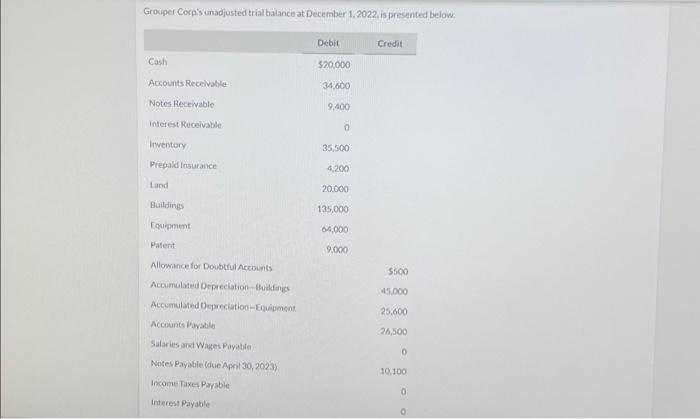

Grouper Corp's unadjusted trial balance at December 1, 2022, is presented below. Cash Accounts Receivable Notes Receivable Interest Receivable Inventory Prepaid Insurance Land Buildings Equipment

Grouper Corp's unadjusted trial balance at December 1, 2022, is presented below. Cash Accounts Receivable Notes Receivable Interest Receivable Inventory Prepaid Insurance Land Buildings Equipment Patent Allowance for Doubtful Accounts Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Notes Payable (due April 30, 2023) Income Taxes Payable Interest Payable Debit $20,000 34,600 9,400 0 35,500 4,200 20,000 135,000 64,000 9,000 Credit $500 45,000 25,600 26,500 0 10,100 0 0 20:2015 Bal

Please fill in the one blank for

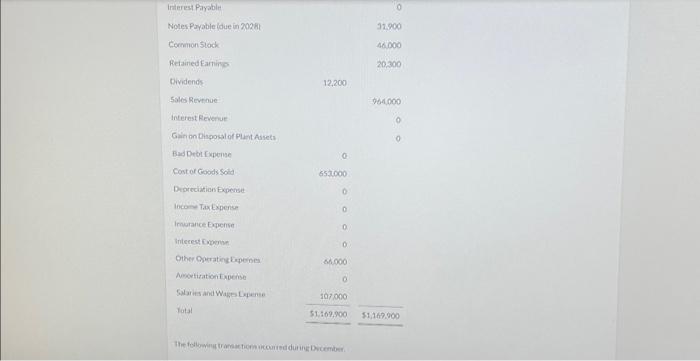

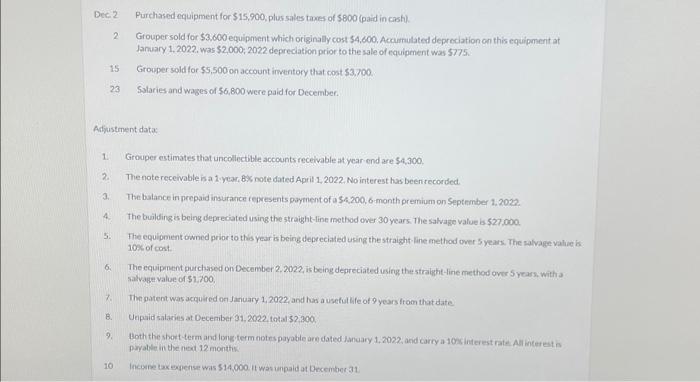

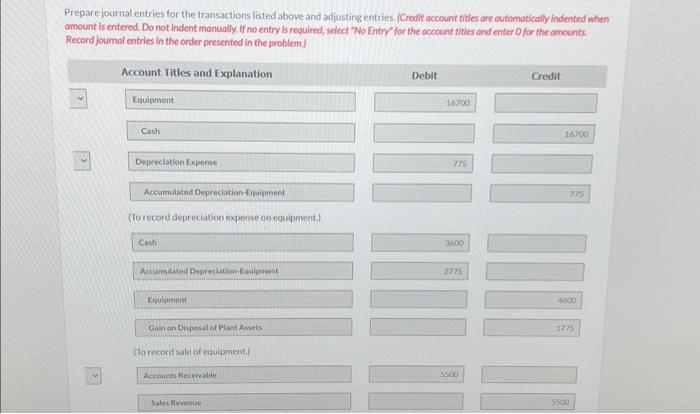

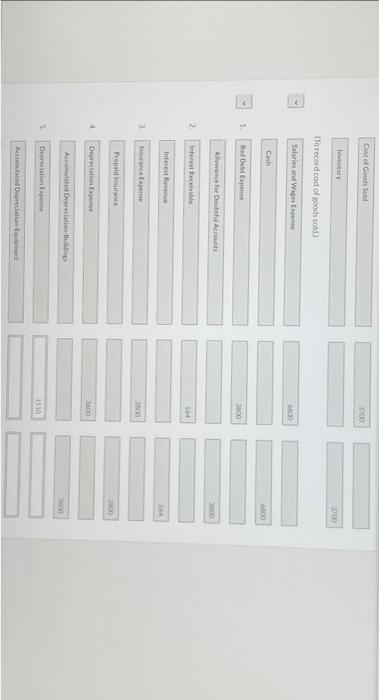

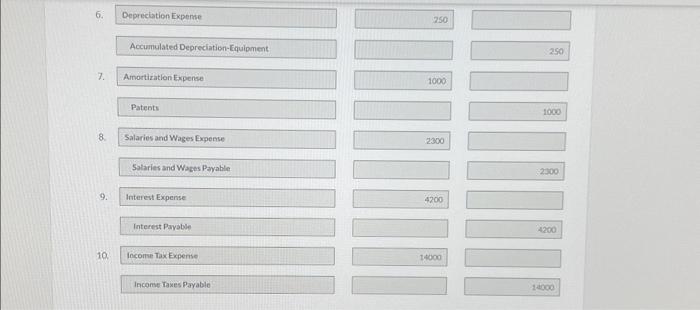

Grouper Corp's unadjusted trial balance at December 1.2022 , is presented below, Inierest Payable Noles Pryable ldue in 2026! 12900 Eorrmonstock 46000 Reianed Eartins 20,300 tividends 12,200 Sales Revioue 284000 interest Reveriue Giniti on Disposal of Pluet Assets 0 Bad Detr Kxperse Cost or Goods Sold 653000 Derceciation Experse (e) Incore Tax Expense 0 Imurance Eyense 0 Interest copente 0 Other OMrratinckepoes sin900 Amsetirationitiverise Salains and Wake Lepene o. fatat tan7000 51,569,90051,167,000 Dec2 2 Purchased equipment for $15,900, plus sales taxes of $800 (paid in cash). 2 Grouper sold for $3,000 equipment which originally cost \$4,600. Accumulated depreciation on this equipment at January 1,2022. was $2,000;2022 depreciation prior to the sale of equipenent was 5775 . 15 Grouper sold for $5,500 on account imentory that cost $3,700. 23 Salaries and wages of $6.800 were paid for December. Adyustrnent data 1. Grouper estimates that uncollectible accounts receivable at year end are 5.4,300. 2. Thenoterecelvable is a 1.year. B\% note dated April 1, 2022. No interest has been recorded 3. The balance in prepaid insurance fepresents payment of a 4.200,6 manth premium on September 1.2022. 4. The building is being depreciated using the straight-line method over 30 years. The salvage value is 527,000. 5. The equipment owned priar to this year is being depreciated using the straight-line method over 5 years. The salvage value i. 10S of cost. 6. The equipment purchased on December 2,2022 , is being depreciated using the straight-line method over 5 years, with salvage value of $1,700, 7. The patent was acruired on January 1, 2022 , and has a useful he of 9 years from that date B. Uepaid sataries at Deceniber 31,2022, total $2,300. 9. Both the shert term and long term notes payable are dated January 1, 2022. and carry a 10si interest rate Ailiterest pryable in the ned 12 monthis: 10 Incorpe tax expense wis $14,000.11 was unpaid at December 31 Prepare journal entries for the transactions listed above and adjusting entries. CCredit account titles are outomoticolly indented when amount is entered. Do not indent monually, If no entry is required, select "No Entry' for the account titles and enter O for the amounts Record joumal entries in the order presented in the problem.) inventairy (To record cost of poods sold) 1. Alluwance fur Deibisha Accounts 2. Intereat Recepulite Interea Reveles 7. Fepaid hisuranic 5. Jnot 300 2000 3600 1310 Acrumated Orurciatius-tentipent 6. Depreciation Expeme Accumulated Depreciation-Equipment 7. Ainortiration Expense 41000 Patents 8. Salaries and Wages Expense 250 Salaries and Wages Payable 9. Interest Payable 10 Income tax Expense 14000 4200 Income Taxes Payablo 5.

depretiation expense

accumulated depreciation-equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started