Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Groves currently produces the Slim-Line iPod. Groves has spent $750,000 of R&D to develop a new model, the Soft-Touch iPod. The company has spent

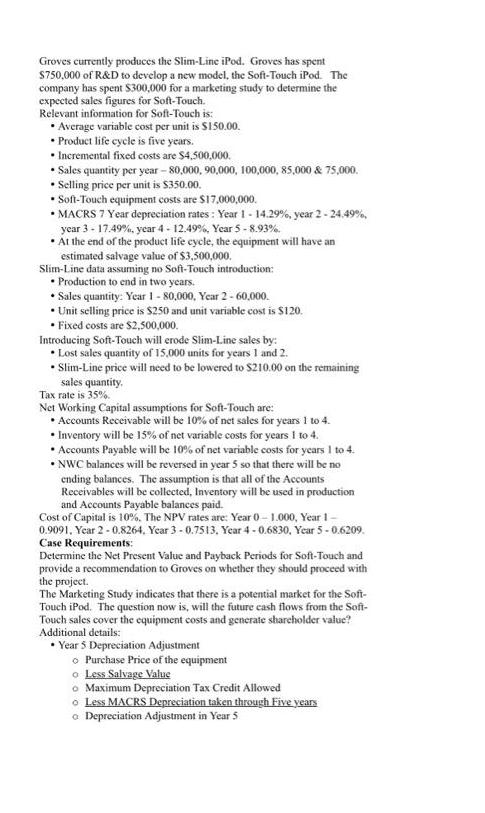

Groves currently produces the Slim-Line iPod. Groves has spent $750,000 of R&D to develop a new model, the Soft-Touch iPod. The company has spent $300,000 for a marketing study to determine the expected sales figures for Soft-Touch. Relevant information for Soft-Touch is: Average variable cost per unit is $150.00 Product life cycle is five years. Incremental fixed costs are $4,500,000. Sales quantity per year -80,000, 90,000, 100,000, 85,000 & 75,000. Selling price per unit is $350.00. Soft-Touch equipment costs are $17,000,000. MACRS 7 Year depreciation rates: Year 1-14.29%, year 2-24.49%, year 3-17.49%, year 4-12.49%, Year 5-8.93% At the end of the product life cycle, the equipment will have an estimated salvage value of $3,500,000. Slim-Line data assuming no Soft-Touch introduction: Production to end in two years. Sales quantity: Year 1-80,000, Year 2- 60,000. Unit selling price is $250 and unit variable cost is $120. Fixed costs are $2,500,000. Introducing Soft-Touch will erode Slim-Line sales by: Lost sales quantity of 15,000 units for years 1 and 2. Slim-Line price will need to be lowered to $210.00 on the remaining sales quantity, Tax rate is 35%. Net Working Capital assumptions for Soft-Touch are: Accounts Receivable will be 10% of net sales for years 1 to 4. Inventory will be 15% of net variable costs for years 1 to 4. Accounts Payable will be 10% of net variable costs for years 1 to 4. NWC balances will be reversed in year 5 so that there will be no ending balances. The assumption is that all of the Accounts Receivables will be collected, Inventory will be used in production and Accounts Payable balances paid. Cost of Capital is 10%. The NPV rates are: Year 0-1.000, Year 1- 0.9091, Year 2-0.8264, Year 3-0.7513, Year 4-0.6830, Year 5-0.6209. Case Requirements: Determine the Net Present Value and Payback Periods for Soft-Touch and provide a recommendation to Groves on whether they should proceed with the project. The Marketing Study indicates that there is a potential market for the Soft- Touch iPod. The question now is, will the future cash flows from the Soft- Touch sales cover the equipment costs and generate shareholder value? Additional details: Year 5 Depreciation Adjustment o Purchase Price of the equipment o Less Salvage Value o Maximum Depreciation Tax Credit Allowed o Less MACRS Depreciation taken through Five years o Depreciation Adjustment in Year 5

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Impact on existing Product Year 1 2 If Project is not Undertaken x Sales of Slim Line in units 80000 60000 yx250120 Contribution 10400000 7800000 If Project of Soft Touch is Undertaken x1x15000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started