Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pop Corporation purchased 75% of the common stock of Son, Inc. for $1,302,000 on December 31, 20X1. At that date, Son reported retained earnings

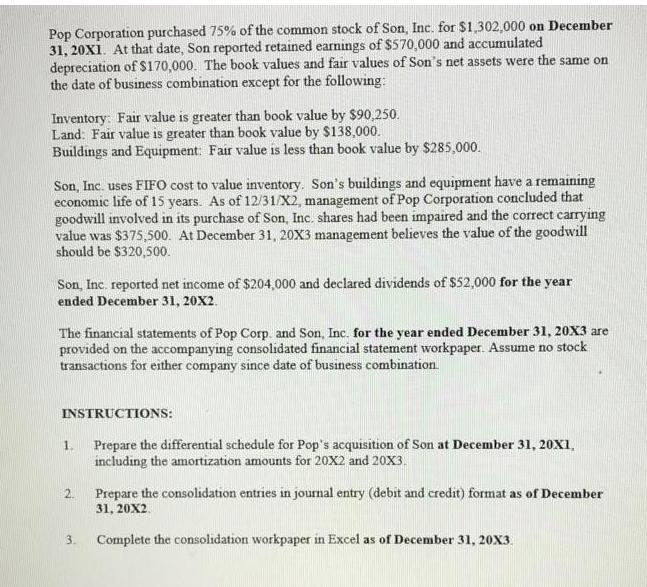

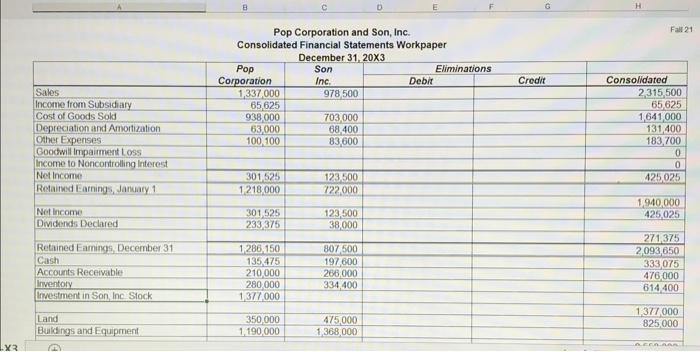

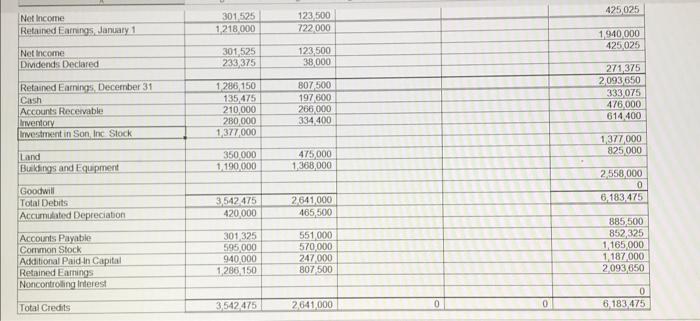

Pop Corporation purchased 75% of the common stock of Son, Inc. for $1,302,000 on December 31, 20X1. At that date, Son reported retained earnings of $570,000 and accumulated depreciation of $170,000. The book values and fair values of Son's net assets were the same on the date of business combination except for the following: Inventory: Fair value is greater than book value by $90,250. Land: Fair value is greater than book value by $138,000. Buildings and Equipment: Fair value is less than book value by $285,000. Son, Inc. uses FIFO cost to value inventory. Son's buildings and equipment have a remaining economic life of 15 years. As of 12/31/X2, management of Pop Corporation concluded that goodwill involved in its purchase of Son, Inc. shares had been impaired and the correct carrying value was $375,500. At December 31, 20X3 management believes the value of the goodwill should be $320,500. Son, Inc. reported net income of $204,000 and declared dividends of $52,000 for the year ended December 31, 20X2. The financial statements of Pop Corp. and Son, Inc. for the year ended December 31, 20X3 are provided on the accompanying consolidated financial statement workpaper. Assume no stock transactions for either company since date of business combination. INSTRUCTIONS: 1. 2. 3. Prepare the differential schedule for Pop's acquisition of Son at December 31, 20X1, including the amortization amounts for 20X2 and 20X3. Prepare the consolidation entries in journal entry (debit and credit) format as of December 31, 20X2 Complete the consolidation workpaper in Excel as of December 31, 20X3 X3 Sales Income from Subsidiary Cost of Goods Sold Depreciation and Amortization Other Expenses Goodwill Impairment Loss Income to Noncontrolling Interest Net Income Retained Earnings, January 1 Net Income Dividends Declared Retained Earnings, December 31 Cash Accounts Receivable Inventory Investment in Son, Inc Stock Land Buildings and Equipment B Pop Corporation and Son, Inc. Consolidated Financial Statements Workpaper Pop Corporation 1,337,000 65,625 938,000 63,000 100,100 301,525 1,218,000 301,525 233,375 1,286,150 135,475 210,000 280,000 1,377,000 350,000 1,190,000 December 31, 20X3 Son Inc. 978,500 703,000 68,400 83,600 123,500 722.000 123,500 38,000 D 807,500 197,600 266,000 334,400 475,000 1,368,000 Debit Eliminations Credit Consolidated Fall 21 2,315,500 65,625 1,641,000 131,400 183,700 0 0 425,025 1,940,000 425,025 271,375 2,093,650 333,075 476,000 614,400 1,377,000 825,000 ACERAAR Net Income Retained Earnings, January 1 Net Income Dividends Declared Retained Earnings, December 31 Cash Accounts Receivable Inventory Investment in Son, Inc Stock Land Buildings and Equipment Goodwill Total Debits Accumulated Depreciation Accounts Payable Common Stock Additional Paid-In Capital Retained Earnings Noncontrolling Interest Total Credits 301,525 1,218,000 301.525 233,375 1,286,150 135,475 210,000 280,000 1,377,000 350,000 1,190,000 3,542 475 420,000 301,325 595,000 940,000 1,286,150 3,542,475 123,500 722,000 123,500 38,000 807,500 197,600 266,000 334,400 475,000 1,368,000 2,641,000 465,500 551,000 570,000 247,000 807,500 2,641,000 0 0 425,025 1,940,000 425,025 271,375 2,093,650 333,075 476,000 614 400 1,377,000 825,000 2,558,000 0 6,183,475 885,500 852,325 1,165,000 1,187,000 2,093,650 0 6,183,475

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

1 Differential schedule for Pops acquisition of Son at December 31 20X1 Differential 1302000 Invento...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started