Grow More Ltd., is presently operating at 60% level, producing 36000 units per annum. In view of favorable market conditions, it has been decided

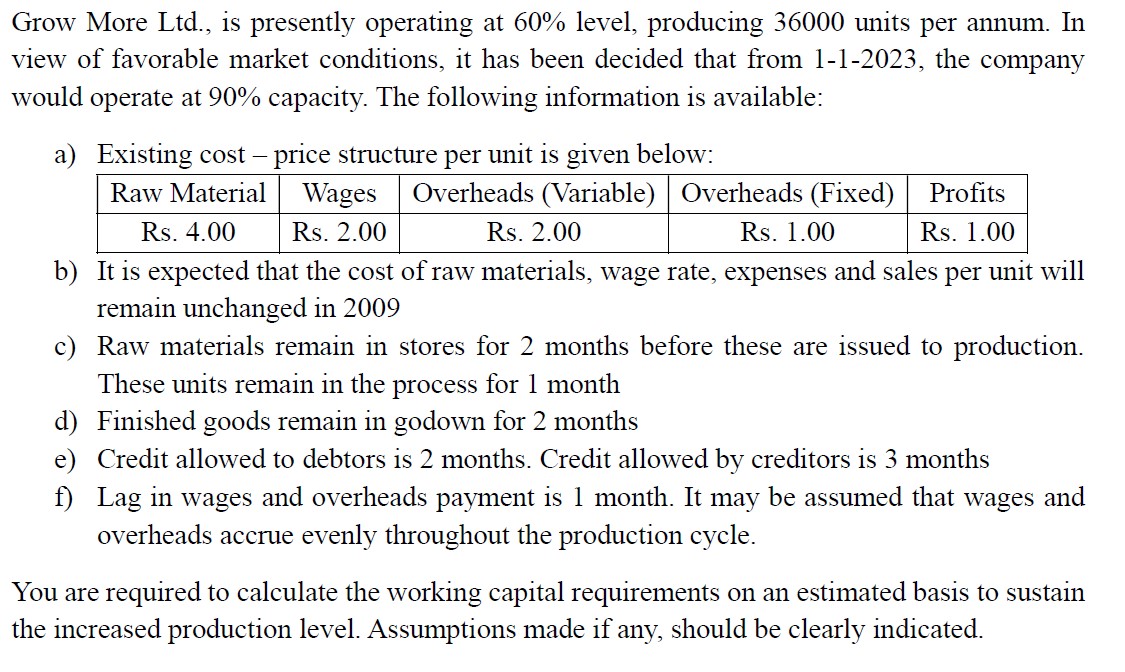

Grow More Ltd., is presently operating at 60% level, producing 36000 units per annum. In view of favorable market conditions, it has been decided that from 1-1-2023, the company would operate at 90% capacity. The following information is available: a) Existing cost - price structure per unit is given below: Profits Raw Material Wages Overheads (Variable)| Overheads (Fixed) Rs. 2.00 Rs. 2.00 Rs. 4.00 Rs. 1.00 Rs. 1.00 b) It is expected that the cost of raw materials, wage rate, expenses and sales per unit will remain unchanged in 2009 c) Raw materials remain in stores for 2 months before these are issued to production. These units remain in the process for 1 month d) Finished goods remain in godown for 2 months e) Credit allowed to debtors is 2 months. Credit allowed by creditors is 3 months f) Lag in wages and overheads payment is 1 month. It may be assumed that wages and overheads accrue evenly throughout the production cycle. You are required to calculate the working capital requirements on an estimated basis to sustain the increased production level. Assumptions made if any, should be clearly indicated.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the working capital requirements for Grow More Ltd to sustain the increased production level of 90 capacity we need to consider various c...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started