Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Growing Annuity problem, please provide step by step calculations. Assume that you plan to retire in 40 years and that you estimate you will need

Growing Annuity problem, please provide step by step calculations.

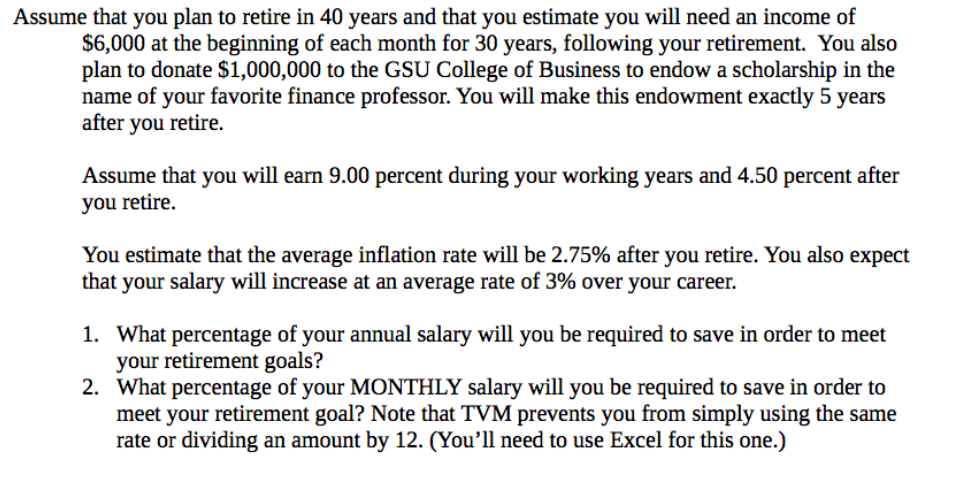

Assume that you plan to retire in 40 years and that you estimate you will need an income of $6,000 at the beginning of each month for 30 years, following your retirement. You also plan to donate $1,000,000 to the GSU College of Business to endow a scholarship in the name of your favorite finance professor. You will make this endowment exactly 5 years after you retire. Assume that you will earn 9.00 percent during your working years and 4.50 percent after you retire. You estimate that the average inflation rate will be 2.75% after you retire. You also expect that your salary will increase at an average rate of 3% over your career. What percentage of your annual salary will you be required to save in order to meet your retirement goals? What percentage of your MONTHLY salary will you be required to save in order to meet your retirement goal? Note that TVM prevents you from simply using the same rate or dividing an amount by 12. (You'll need to use Excel for this one.) 1. 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started