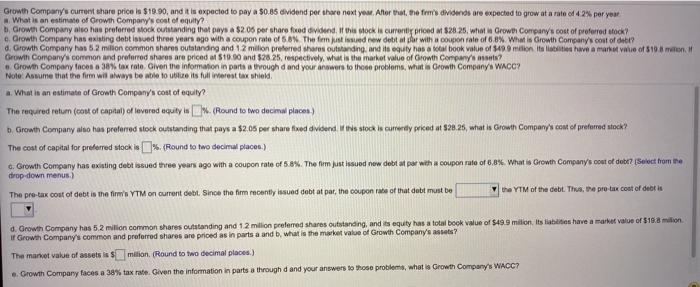

Growth Company's current share price is $10.90, and it is expected to pay a $0.85 dividend per share next you Alor that, the firm's dividends are expected to grow at a rate of 42% per year What is an estimate of Growth Comparwy's cost of equity? Growth Company also has preferred Mock outstanding that pays a $2.06 per share fixed dividend. If this stock is current pred of $28 25, what is Growth Company's cost of proferred stock? Growth Company has existing debt issued three years ago with a coupon rate of the finjusted new dettator with a coupon rate of 6.8% What is Growth Company's cost of att? d. Growth Company has 6.2 million common share outstanding and 12 milion preferred share outstanding and its equity has a book value of $49.9 milion its laities have a market value of 10 Growin Company's common and preferred shares are priced at $19.00 and 528 25, respectively, what is the market value of Growth Company's Growth Company faces a 38% tax rate. Given the information in parte a through d and your answers to those problems, what is Growth Company's WACC? Note Assume that the firm will always be able to lize its fullest tax shield a. What is an estimate of Growth Company's cost of equily? The required retum (cost of capital of levered acuity (Round to two decimal places) b. Growth Company also has preferred stock outstanding that pays a $2.05 per share fixed dividend is stock is currently priced at $28.25, what is Growth Company's como preferred stock The cost of capital for preferred stock is % (Round to two decimal places) 6. Growth Company has existing debt issued three years ago with a coupon rate of 5.8%. The firm just issued new debt od per with a coupon rute of 6,8% What in Growth Company's cost of dubt? (Sowet from the drop-down menus.) The pre-tax cost of debt is the firm's YTM on current debt. Since the firm recently und debt at pat, the coupon rate of that dett must be the YTM of the debt. Thus, the protax cost of the d. Growth Company has 5.2 milion common shares outstanding and 12 million preferred shares outstanding, and its equity has a total book value of $49.9 million its laities have a market value of $19.8 milion if Growth Company's common and preferred shares are priced as in parts a and b. what is the market value of Growth Company's assets The market value of assets is milion (Round to two decimal places) .. Growth Company faces a 38% tax rate. Given the information in parts a through d and your answers to those problems, what is Growth Company's WACC