Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Growth Ltd has decided to expand its business after having an existence for 5 years in retailing. Having established their credit worthiness, they decided

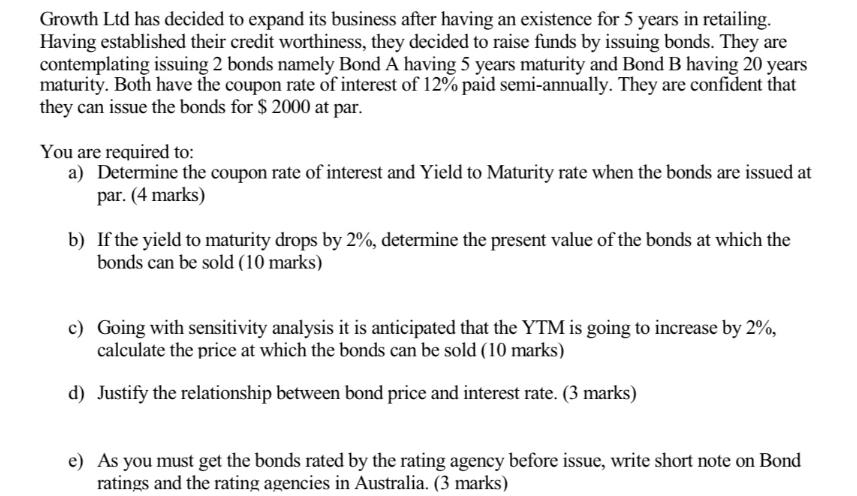

Growth Ltd has decided to expand its business after having an existence for 5 years in retailing. Having established their credit worthiness, they decided to raise funds by issuing bonds. They are contemplating issuing 2 bonds namely Bond A having 5 years maturity and Bond B having 20 years maturity. Both have the coupon rate of interest of 12% paid semi-annually. They are confident that they can issue the bonds for $2000 at par. You are required to: a) Determine the coupon rate of interest and Yield to Maturity rate when the bonds are issued at par. (4 marks) b) If the yield to maturity drops by 2%, determine the present value of the bonds at which the bonds can be sold (10 marks) c) Going with sensitivity analysis it is anticipated that the YTM is going to increase by 2%, calculate the price at which the bonds can be sold (10 marks) d) Justify the relationship between bond price and interest rate. (3 marks) e) As you must get the bonds rated by the rating agency before issue, write short note on Bond ratings and the rating agencies in Australia. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a When the bonds are issued at par 2000 the coupon rate of interest is 12 paid semiannually Since th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started