Answered step by step

Verified Expert Solution

Question

1 Approved Answer

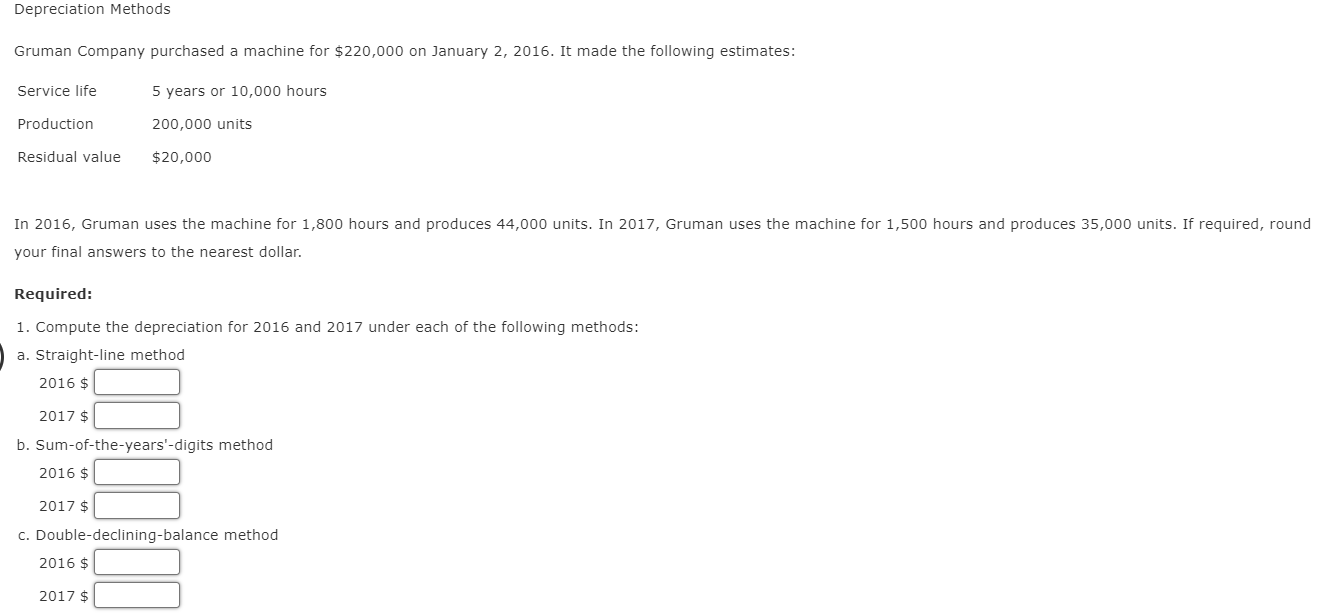

Gruman Company purchased a machine for $220,000 on January 2, 2016 . It made the following estimates: ServicelifeProductionResidualvalue5yearsor10,000hours200,000units$20,000 your final answers to the nearest dollar.

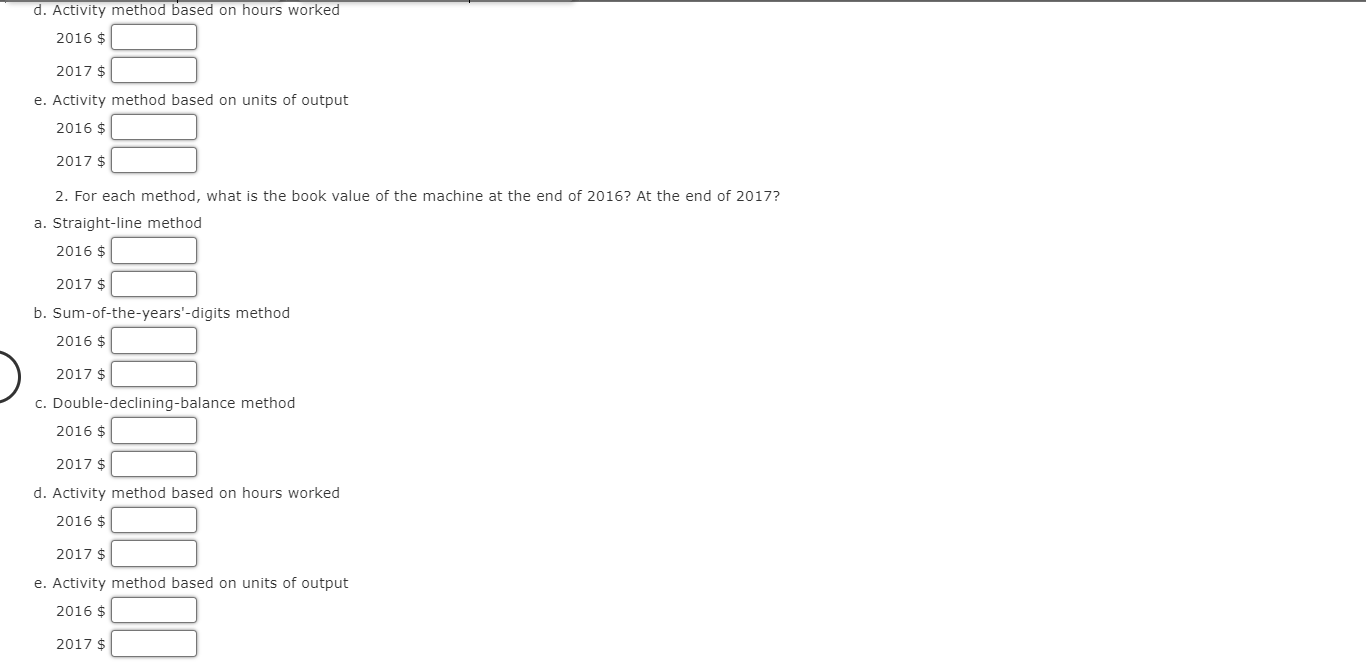

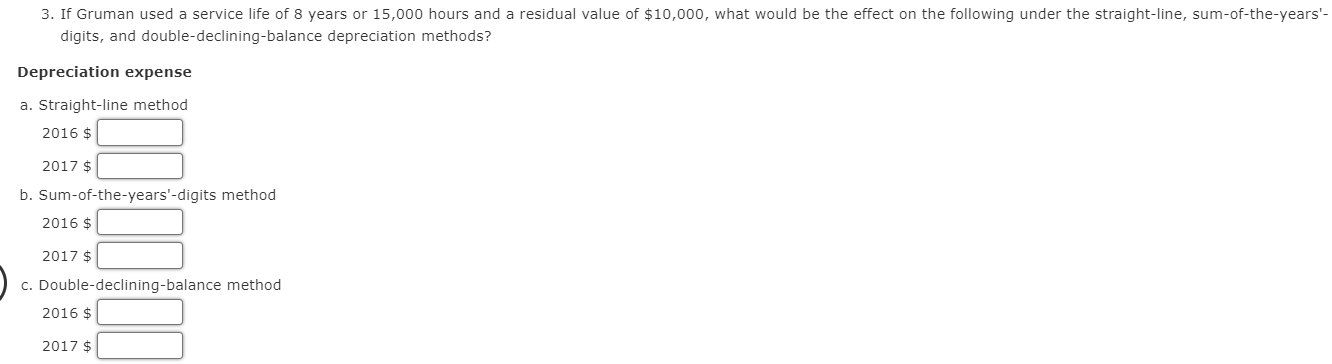

Gruman Company purchased a machine for $220,000 on January 2, 2016 . It made the following estimates: ServicelifeProductionResidualvalue5yearsor10,000hours200,000units$20,000 your final answers to the nearest dollar. Required: 1. Compute the depreciation for 2016 and 2017 under each of the following methods: a. Straight-line method 2016$ b. Sum-of-the-years'-digits method 2016$2017$ c. Double-declining-balance method 2016$ 2017$ d. Activity method based on hours worked 2016$2017$ e. Activity method based on units of output 2016$2017$ 2. For each method, what is the book value a. Straight-line method 2016$2017$ b. Sum-of-the-years'-digits method 2016$2017$ c. Double-declining-balance method 2016$ 2017$ d. Activity method based on hours worked 2016$2017$ e. Activity method based on units of output 2016$ 2017$ 3. If Gruman used a service life of 8 years or 15,000 hours and a residual value of $10,000, what would be the effect on the following under the straight-line, sum-of-the-years'digits, and double-declining-balance depreciation methods? Depreciation expense a. Straight-line method 2016$ 2017$ b. Sum-of-the-years'-digits method 2016$ c. Double-declining-balance method 2016$2017$ Book value a. Straight-line method 2016$2017$ b. Sum-of-the-years'-digits method 2016$2017$ c. Double-declining-balance method 2016$2017$

Gruman Company purchased a machine for $220,000 on January 2, 2016 . It made the following estimates: ServicelifeProductionResidualvalue5yearsor10,000hours200,000units$20,000 your final answers to the nearest dollar. Required: 1. Compute the depreciation for 2016 and 2017 under each of the following methods: a. Straight-line method 2016$ b. Sum-of-the-years'-digits method 2016$2017$ c. Double-declining-balance method 2016$ 2017$ d. Activity method based on hours worked 2016$2017$ e. Activity method based on units of output 2016$2017$ 2. For each method, what is the book value a. Straight-line method 2016$2017$ b. Sum-of-the-years'-digits method 2016$2017$ c. Double-declining-balance method 2016$ 2017$ d. Activity method based on hours worked 2016$2017$ e. Activity method based on units of output 2016$ 2017$ 3. If Gruman used a service life of 8 years or 15,000 hours and a residual value of $10,000, what would be the effect on the following under the straight-line, sum-of-the-years'digits, and double-declining-balance depreciation methods? Depreciation expense a. Straight-line method 2016$ 2017$ b. Sum-of-the-years'-digits method 2016$ c. Double-declining-balance method 2016$2017$ Book value a. Straight-line method 2016$2017$ b. Sum-of-the-years'-digits method 2016$2017$ c. Double-declining-balance method 2016$2017$ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started