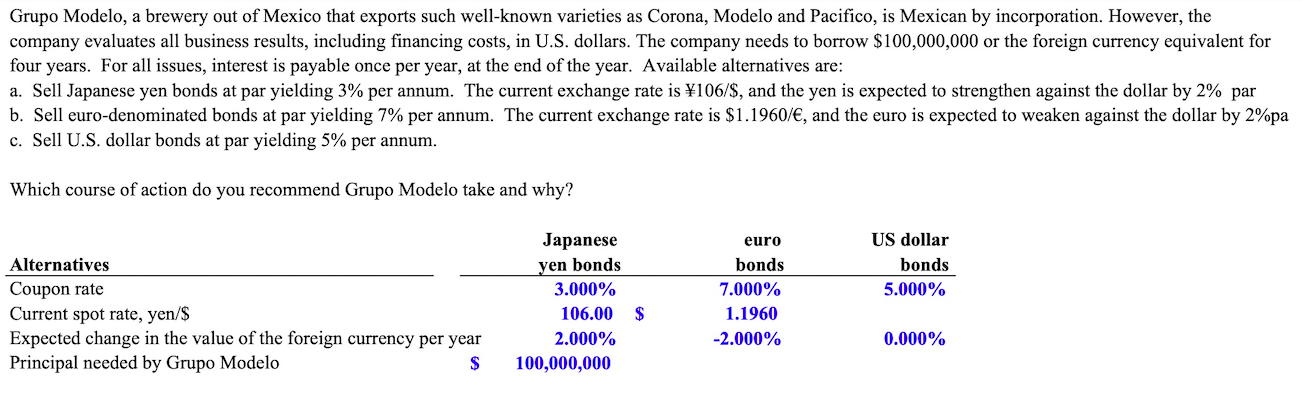

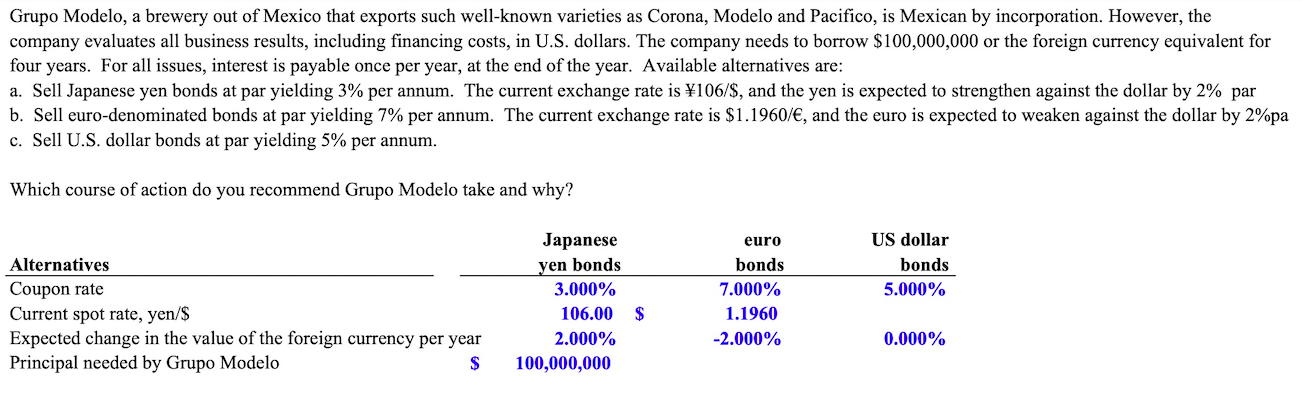

Grupo Modelo, a brewery out of Mexico that exports such well-known varieties as Corona, Modelo and Pacifico, is Mexican by incorporation. However, the company evaluates all business results, including financing costs, in U.S. dollars. The company needs to borrow $100,000,000 or the foreign currency equivalent for four years. For all issues, interest is payable once per year, at the end of the year. Available alternatives are: a. Sell Japanese yen bonds at par yielding 3% per annum. The current exchange rate is 106/$, and the yen is expected to strengthen against the dollar by 2% par b. Sell euro-denominated bonds at par yielding 7% per annum. The current exchange rate is $1.1960/, and the euro is expected to weaken against the dollar by 2% pa c. Sell U.S. dollar bonds at par yielding 5% per annum. Which course of action do you recommend Grupo Modelo take and why? Japanese yen bonds US dollar bonds 5.000% Alternatives Coupon rate Current spot rate, yen/$ Expected change in the value of the foreign currency per year Principal needed by Grupo Modelo $ euro bonds 7.000% 1.1960 -2.000% 3.000% 106.00 2.000% 100,000,000 $ 0.000% Grupo Modelo, a brewery out of Mexico that exports such well-known varieties as Corona, Modelo and Pacifico, is Mexican by incorporation. However, the company evaluates all business results, including financing costs, in U.S. dollars. The company needs to borrow $100,000,000 or the foreign currency equivalent for four years. For all issues, interest is payable once per year, at the end of the year. Available alternatives are: a. Sell Japanese yen bonds at par yielding 3% per annum. The current exchange rate is 106/$, and the yen is expected to strengthen against the dollar by 2% par b. Sell euro-denominated bonds at par yielding 7% per annum. The current exchange rate is $1.1960/, and the euro is expected to weaken against the dollar by 2% pa c. Sell U.S. dollar bonds at par yielding 5% per annum. Which course of action do you recommend Grupo Modelo take and why? Japanese yen bonds US dollar bonds 5.000% Alternatives Coupon rate Current spot rate, yen/$ Expected change in the value of the foreign currency per year Principal needed by Grupo Modelo $ euro bonds 7.000% 1.1960 -2.000% 3.000% 106.00 2.000% 100,000,000 $ 0.000%