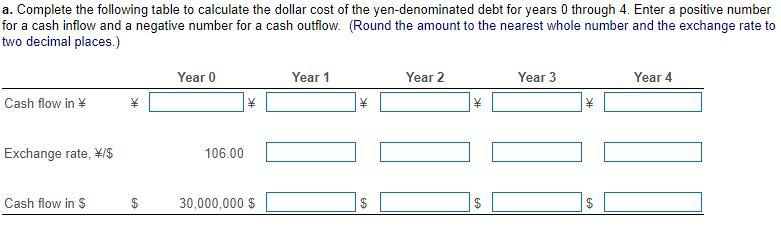

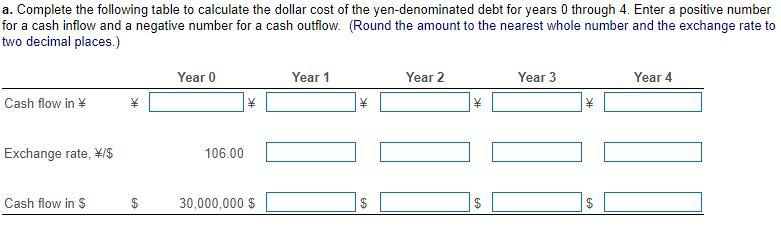

Grupo Modelo S.A.B. de C.V. Grupo Modelo, a brewery out of Mexico that exports such well-known varieties as Corona, Modelo, and Pacifico, is Mexican by incorporation. However, the company evaluates all business results, including financing costs, in U.S. dollars. The company needs to borrow $30,000,000 or the foreign currency equivalent for four years. For all issues, interest is payable once per year, at the end of the year. Available alternatives are as follows: a. Sell Japanese yen bonds at par yielding 3.20% per annum. The current exchange rate is $106.00/S, and the yen is expected to strengthen against the dollar by 2.5% per annum. What is the effective cost of the yen-denominated loan for Grupo Modelo? b. Sell euro-denominated bonds at par yielding 6.60% per annum. The current exchange rate is $1.1930/, and the euro is expected to weaken against the dollar by 2.5% per annum. What is the effective cost of the euro-denominated loan for Grupo Modelo? c. Sell U.S. dollar bonds at par yielding 5.30% per annum. What is the effective cost of the dollar-denominated loan for Grupo Modelo? d. Which course of action do you recommend Grupo Modelo take and why? a. Complete the following table to calculate the dollar cost of the yen-denominated debt for years 0 through 4. Enter a positive number for a cash inflow and a negative number for a cash outflow. (Round the amount to the nearest whole number and the exchange rate to two decimal places.) a. Complete the following table to calculate the dollar cost of the yen-denominated debt for years 0 through 4. Enter a positive number for a cash inflow and a negative number for a cash outflow. (Round the amount to the nearest whole number and the exchange rate to two decimal places.) Year 0 Year 1 Year 2 Year 3 Year 4 Cash flow in * Exchange rate, W/$ 106.00 111 Cash flow in $ $ 30,000,000 $ EA $ Grupo Modelo S.A.B. de C.V. Grupo Modelo, a brewery out of Mexico that exports such well-known varieties as Corona, Modelo, and Pacifico, is Mexican by incorporation. However, the company evaluates all business results, including financing costs, in U.S. dollars. The company needs to borrow $30,000,000 or the foreign currency equivalent for four years. For all issues, interest is payable once per year, at the end of the year. Available alternatives are as follows: a. Sell Japanese yen bonds at par yielding 3.20% per annum. The current exchange rate is $106.00/S, and the yen is expected to strengthen against the dollar by 2.5% per annum. What is the effective cost of the yen-denominated loan for Grupo Modelo? b. Sell euro-denominated bonds at par yielding 6.60% per annum. The current exchange rate is $1.1930/, and the euro is expected to weaken against the dollar by 2.5% per annum. What is the effective cost of the euro-denominated loan for Grupo Modelo? c. Sell U.S. dollar bonds at par yielding 5.30% per annum. What is the effective cost of the dollar-denominated loan for Grupo Modelo? d. Which course of action do you recommend Grupo Modelo take and why? a. Complete the following table to calculate the dollar cost of the yen-denominated debt for years 0 through 4. Enter a positive number for a cash inflow and a negative number for a cash outflow. (Round the amount to the nearest whole number and the exchange rate to two decimal places.) a. Complete the following table to calculate the dollar cost of the yen-denominated debt for years 0 through 4. Enter a positive number for a cash inflow and a negative number for a cash outflow. (Round the amount to the nearest whole number and the exchange rate to two decimal places.) Year 0 Year 1 Year 2 Year 3 Year 4 Cash flow in * Exchange rate, W/$ 106.00 111 Cash flow in $ $ 30,000,000 $ EA $