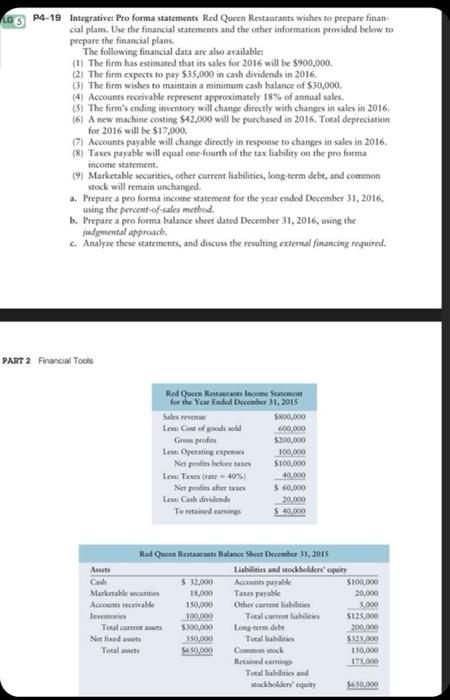

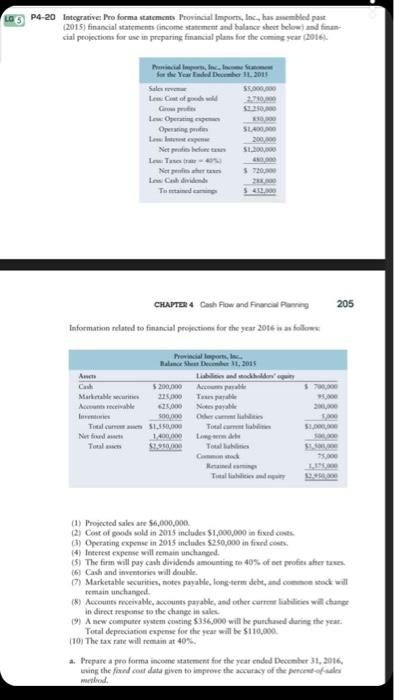

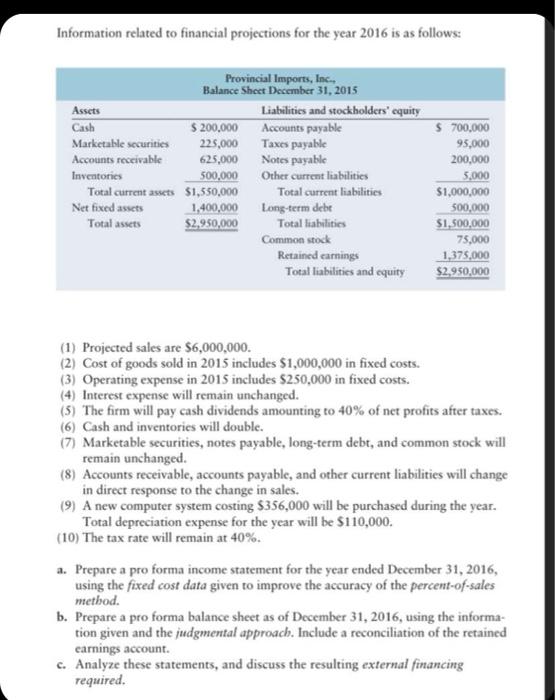

GS P4-19 Integrative Proforma statements Red Queen Restaurants wishes to prepare finan cial plans. Use the financial statements and the other information provided below to prepare the financial plans. The following financial data are also available: (1) The firm has estimated that its sales for 2016 will be $900,000 (2) The firm expects to pay $35,000 in cash dividends in 2016. (3) The firm wishes to maintain a minimum cash balance of $30,000 (4) Accounts receivable represent approximately 18% of annual sales. (5) The firm's ending inventory will change directly with changes in ales in 2016. (6) A new machine costing S42,000 will be purchased in 2016. Total depreciation for 2016 will be $17.000 (7) Accounts payable will change directly in response to changes in sales in 2016, (8) Taxes payable will equal one-fourth of the tax liability on the pro forma income statement. 19 Marketable securities, other current liabilities, long-term debt, and common stock will remain unchanged. 1. Prepare a pro forma income statement for the year ended December 31, 2016, using the percent of sales method. b. Prepare a pro forma balance sheet dated December 31, 2016, using the judgmental approach. 6. Analyze these statements, and discuss the resulting external financing required. PART 2 Financial Tools Red Queen Restaurants Income Statement for the Year Faded December 31, 2015 Sales reven 5800,000 La Cost of good old 600,000 Grow profits 5200,000 La Operating 100,000 Net profits before tamen $100,000 Teses e-40%) 40.000 Net profits after tanes 560,000 Len Cash dividends 20.000 Torted earning $440,000 Red Queen Restaurants Balance Sheet December 31, 2015 Libilities and holders' equity Cal $ 32,000 Accounts payable $100,000 Marketable cui 16.000 Taxes payable 20,000 Accounts recente 150,000 Other current liabilities 5,000 Investors 100.000 Totalcar les $125,000 Tocal current met $300,000 Long-term dat 200.000 Net fedt Totallistes $325,000 Total 5650.000 Commons 150,000 Retained earning 175.000 Total liabilities and wochodnequity S690,000 LOS P4-20 Integrative Proforma satement Provincial Imports, Inc., has embled pot (2015) financial statements (income statement and balance shee below and finan cial projections for me in preparing financial plans for the car (2016) for the Year End December 11, 2015 Sales Lesent of gold $325,00 Lowe | SLADO 200.000 Niet iedere SLO Low Test Nerpart 37200 Les Code To 205 CHAPTER 4 Cash Flow and Farol Pansing Information related to financial projections for the year 2016 12 for Cake Balance 1, 2015 Am Lubin 5200,000 Ae Market 325.000 Te Acable 25.000 Notes 500 OG Tal SISSE.000 Talaiian| Net 1.400 Long Taal TBN Game 51. (1) Projected sales are $6.000.000 (2) Cost of goods sold in 2015 includes $1.000.000 in findet (3) Operating expense in 2015 includes $250,000 in find Interest expense will remain unchanged. 5) The firm will pay cash dividends amounting to 40% of net profits after time Cash and inventore will double (7) Marketable securities, note payable, long-term debt, stuck wat remain unchanged. (Accounts receivable, accounts payable, and other current liabilities will change in direct response to the change in sales A new computer system coming $356,000 will be purchased during the year. Total depreciation expense for the year will be $110,000 (10) The tax rate will remain at 40% a. Prepare a pro forma income statement for the year ended December 31, 2016 using the fixed cour data iven to improve the accuracy of the percent of whid Information related to financial projections for the year 2016 is as follows: Provincial Imports, Inc., Balance Sheet December 31, 2015 Assets Liabilities and stockholders' equity Cash $ 200,000 Accounts payable Marketable securities 225,000 Taxes payable Accounts receivable 625,000 Notes payable Inventories 500,000 Other current liabilities Total current assets $1,550,000 Total current liabilities Net fixed assets 1,400,000 Long-term debe Total assets $2,950,000 Total liabilities Common stock Retained earnings Total liabilities and equity $ 700,000 95,000 200,000 5,000 $1,000,000 500,000 $1,500,000 75,000 1,375,000 $2,950,000 (1) Projected sales are $6,000,000. (2) Cost of goods sold in 2015 includes $1,000,000 in fixed costs. (3) Operating expense in 2015 includes $250,000 in fixed costs. (4) Interest expense will remain unchanged. (3) The firm will pay cash dividends amounting to 40% of net profits after taxes. (6) Cash and inventories will double. (7) Marketable securities, notes payable, long-term debt, and common stock will remain unchanged. (8) Accounts receivable, accounts payable, and other current liabilities will change in direct response to the change in sales. (9) A new computer system costing $356,000 will be purchased during the year. Total depreciation expense for the year will be $110,000. (10) The tax rate will remain at 40%. a. Prepare a pro forma income statement for the year ended December 31, 2016, using the fixed cost data given to improve the accuracy of the percent-of-sales method. b. Prepare a pro forma balance sheet as of December 31, 2016, using the informa- tion given and the judgmental approach. Include a reconciliation of the retained earnings account. c. Analyze these statements, and discuss the resulting external financing required