Question

GS Pty Ltd has two pieces of equipment and their information extracted as of 30 June 2019 are provided below: Advise Lily who is the

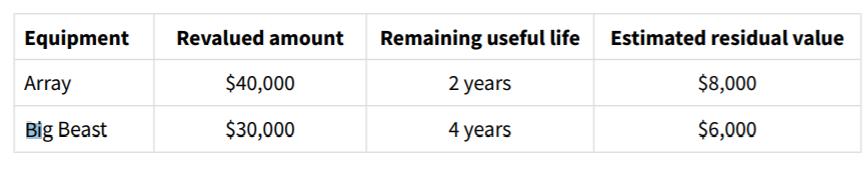

GS Pty Ltd has two pieces of equipment and their information extracted as of 30 June 2019 are provided below:

Advise Lily who is the accountant for GS Pty Ltd, to account for the depreciation and revaluation exercises for the year ending 30 June 2020. Both pieces of equipment were measured using the revaluation model and depreciated on a straight-line basis. Array was revalued a number of times in prior years and it has accumulated revaluation decrements being previously recognized in the profit or loss by 30 June 2019 of $24,000. The directors have estimated the fair value for Array on 30 June 2020 to be $12,800. Big Beast was revalued for the first time on 30 June 2019, from $33,000 to $30,000, where the loss on revaluation has been recorded in the accounts for that year. It has been determined that Big Beast has an estimated fair value of $25,000 on 30 June 2020. Ignore any tax effect.

Required: Lily is required to prepare the necessary journal entries for the year ending 30 June 2020 to record the depreciation and revaluations for the equipment in accordance with AASB 116 Property, Plant and Equipment.

Important tips:

All journal entries in chronological order, with dates stated clearly.

All depreciation charges need to be up to date.

Equipment Array Big Beast Revalued amount $40,000 $30,000 Remaining useful life 2 years 4 years Estimated residual value $8,000 $6,000

Step by Step Solution

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the depreciation for each piece of equipment Array Revalued amount as of 30 June 2019 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started