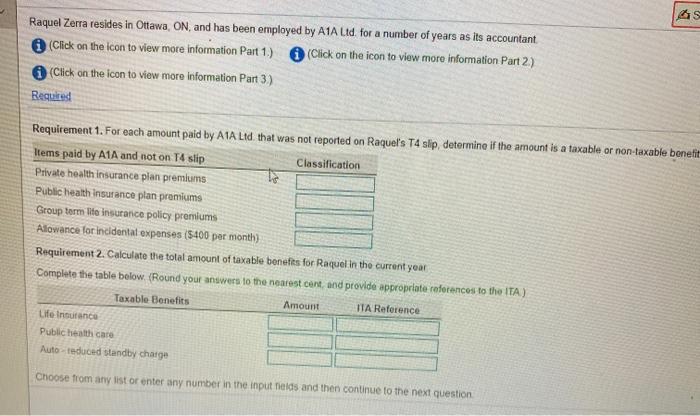

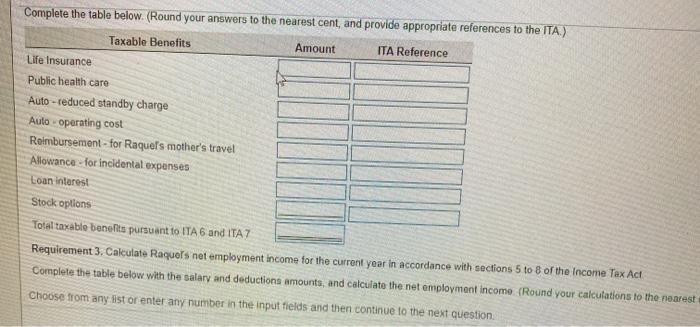

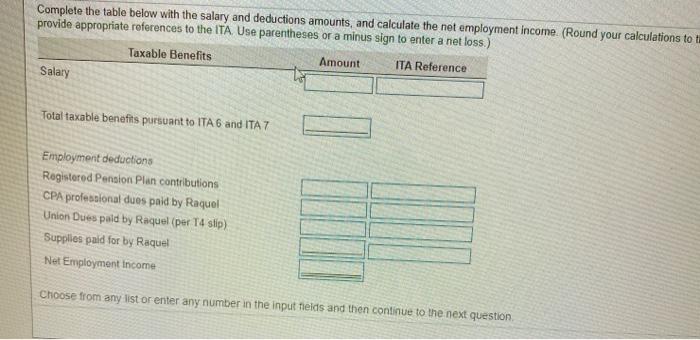

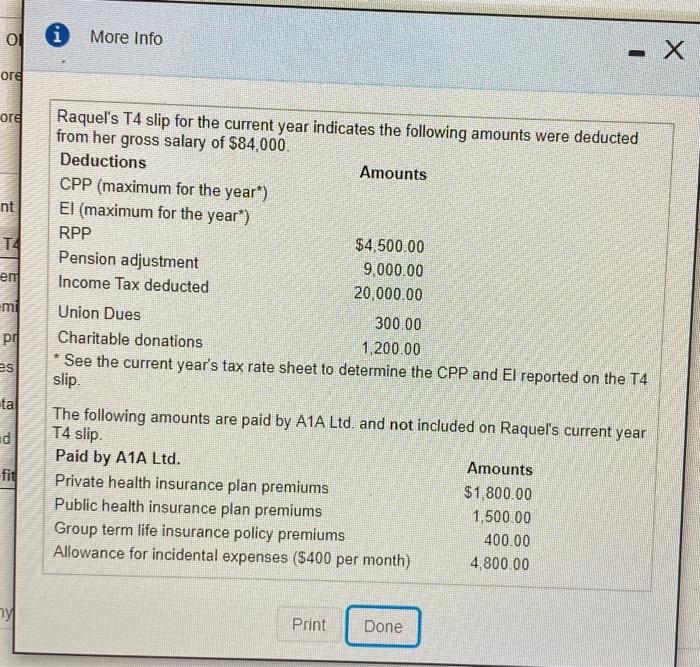

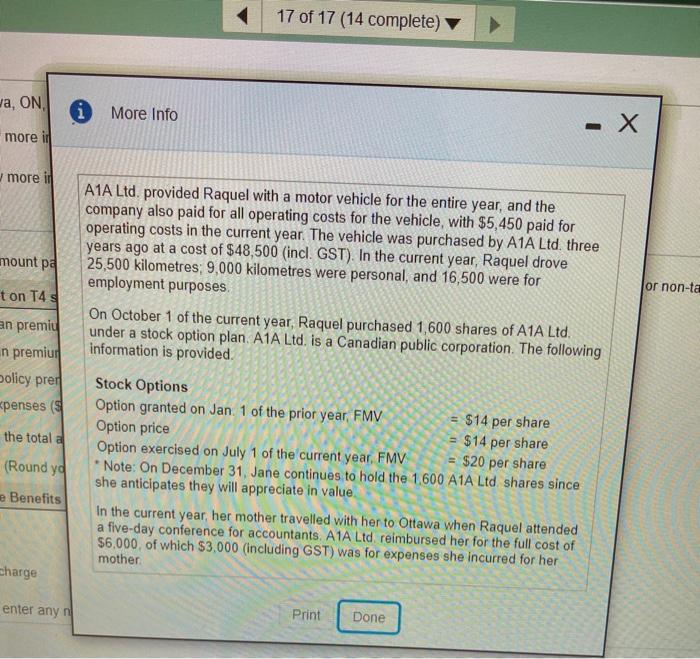

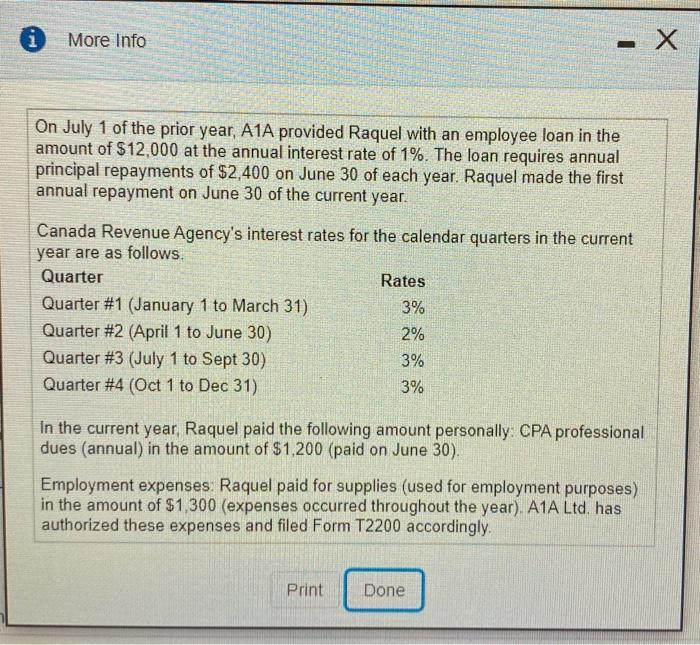

GS Raquel Zerra resides in Ottawa, ON, and has been employed by A1A Ltd. for a number of years as its accountant (Click on the icon to view more information Part 1.) (Click on the icon to view more information Part 2) (Click on the icon to view more information Part 3.) Required Requirement 1. For each amount paid by A1A Ltd, that was not reported on Raquel's T4 slip, determine if the amount is a taxable or non-taxable benefit Items paid by A1A and not on T4 slip Classification Private health insurance plan premiums Public health insurance plan premiums Group term life insurance policy premium Allowance for incidental expenses ($400 per month) Requirement 2. Calculate the total amount of taxable benefits for Raquel in the current year Complete the table below. (Round your answers to the nearest cert, and provide appropriate references to the ITA) Taxable Benefits Amount ITA Reference Life Insurance Public health care Auto reduced standby charge Choose from any list or enter any number in the input nels and then continue to the next question Complete the table below. (Round your answers to the nearest cent, and provide appropriate references to the ITA) Taxable Benefits Amount ITA Reference Life Insurance Public health care Auto-reduced standby charge Auto-operating cost Reimbursement - for Raquel's mother's travel Allowance for incidental expenses Loan interest Stock options Total taxable benefits pursuant to ITA 6 and ITA 7 Requirement 3. Calculate Raquels net employment income for the current year in accordance with sections 5 to 8 of the Income Tax Act Complete the table below with the salary and deductions amounts, and calculate the net employment income (Round your calculations to the nearest Choose from any list or enter any number in the input fields and then continue to the next question Complete the table below with the salary and deductions amounts, and calculate the net employment income. (Round your calculations to tu provide appropriate references to the ITA Use parentheses or a minus sign to enter a net loss.) Taxable Benefits Amount ITA Reference Salary Total taxable benefits pursuant to ITA 6 and ITA 7 Employment deductions Registered Pension Plan contributions CPA professional dues paid by Raquel Union Dues paid by Raquel (per 14 stip) Supplies paid for by Raquel Net Employment Income Choose from any list or enter any number in the input fields and then continue to the next question 0. More Info - X ore ore nt Raquel's T4 slip for the current year indicates the following amounts were deducted from her gross salary of $84,000 Deductions Amounts CPP (maximum for the year*) El (maximum for the year) RPP $4,500.00 Pension adjustment 9,000.00 Income Tax deducted 20,000.00 Union Dues 300.00 Charitable donations 1,200.00 See the current year's tax rate sheet to determine the CPP and El reported on the T4 slip en mi pr es ta d The following amounts are paid by A1A Ltd. and not included on Raquel's current year T4 slip fith Paid by A1A Ltd. Private health insurance plan premiums Public health insurance plan premiums Group term life insurance policy premiums Allowance for incidental expenses ($400 per month) Amounts $1,800.00 1,500.00 400.00 4,800.00 ny Print Done 17 of 17 (14 complete) wa, ON * More Info - X more it or non-ta more id A1A Ltd. provided Raquel with a motor vehicle for the entire year, and the company also paid for all operating costs for the vehicle, with $5,450 paid for operating costs in the current year. The vehicle was purchased by A1A Ltd. three years ago at a cost of $48,500 (incl. GST). In the current year, Raquel drove mount pa 25,500 kilometres; 9,000 kilometres were personal, and 16,500 were for employment purposes. ton T4 On October 1 of the current year, Raquel purchased 1,600 shares of A1A Ltd. an premid under a stock option plan. A1A Ltd. is a Canadian public corporation. The following in premiul information is provided. policy pre Stock Options penses Option granted on Jan 1 of the prior year FMV = $14 per share Option price $14 per share the total Option exercised on July 1 of the current year, FMV = $20 per share (Round ya * Note: On December 31, Jane continues to hold the 1.600 A1A Ltd shares since she anticipates they will appreciate in value e Benefits In the current year, her mother travelled with her to Ottawa when Raquel attended a five-day conference for accountants. A1A Ltd reimbursed her for the full cost of $6,000, of which $3,000 (including GST) was for expenses she incurred for her mother charge enter any Print Done i More Info - On July 1 of the prior year, A1A provided Raquel with an employee loan in the amount of $12,000 at the annual interest rate of 1%. The loan requires annual principal repayments of $2,400 on June 30 of each year. Raquel made the first annual repayment on June 30 of the current year. Canada Revenue Agency's interest rates for the calendar quarters in the current year are as follows. Quarter Rates Quarter #1 (January 1 to March 31) 3% Quarter #2 (April 1 to June 30) Quarter #3 (July 1 to Sept 30) 3% Quarter #4 (Oct 1 to Dec 31) 2% 3% In the current year, Raquel paid the following amount personally: CPA professional dues (annual) in the amount of $1,200 (paid on June 30). Employment expenses: Raquel paid for supplies (used for employment purposes) in the amount of $1.300 (expenses occurred throughout the year). A1A Ltd. has authorized these expenses and filed Form T2200 accordingly. Print Done GS Raquel Zerra resides in Ottawa, ON, and has been employed by A1A Ltd. for a number of years as its accountant (Click on the icon to view more information Part 1.) (Click on the icon to view more information Part 2) (Click on the icon to view more information Part 3.) Required Requirement 1. For each amount paid by A1A Ltd, that was not reported on Raquel's T4 slip, determine if the amount is a taxable or non-taxable benefit Items paid by A1A and not on T4 slip Classification Private health insurance plan premiums Public health insurance plan premiums Group term life insurance policy premium Allowance for incidental expenses ($400 per month) Requirement 2. Calculate the total amount of taxable benefits for Raquel in the current year Complete the table below. (Round your answers to the nearest cert, and provide appropriate references to the ITA) Taxable Benefits Amount ITA Reference Life Insurance Public health care Auto reduced standby charge Choose from any list or enter any number in the input nels and then continue to the next question Complete the table below. (Round your answers to the nearest cent, and provide appropriate references to the ITA) Taxable Benefits Amount ITA Reference Life Insurance Public health care Auto-reduced standby charge Auto-operating cost Reimbursement - for Raquel's mother's travel Allowance for incidental expenses Loan interest Stock options Total taxable benefits pursuant to ITA 6 and ITA 7 Requirement 3. Calculate Raquels net employment income for the current year in accordance with sections 5 to 8 of the Income Tax Act Complete the table below with the salary and deductions amounts, and calculate the net employment income (Round your calculations to the nearest Choose from any list or enter any number in the input fields and then continue to the next question Complete the table below with the salary and deductions amounts, and calculate the net employment income. (Round your calculations to tu provide appropriate references to the ITA Use parentheses or a minus sign to enter a net loss.) Taxable Benefits Amount ITA Reference Salary Total taxable benefits pursuant to ITA 6 and ITA 7 Employment deductions Registered Pension Plan contributions CPA professional dues paid by Raquel Union Dues paid by Raquel (per 14 stip) Supplies paid for by Raquel Net Employment Income Choose from any list or enter any number in the input fields and then continue to the next question 0. More Info - X ore ore nt Raquel's T4 slip for the current year indicates the following amounts were deducted from her gross salary of $84,000 Deductions Amounts CPP (maximum for the year*) El (maximum for the year) RPP $4,500.00 Pension adjustment 9,000.00 Income Tax deducted 20,000.00 Union Dues 300.00 Charitable donations 1,200.00 See the current year's tax rate sheet to determine the CPP and El reported on the T4 slip en mi pr es ta d The following amounts are paid by A1A Ltd. and not included on Raquel's current year T4 slip fith Paid by A1A Ltd. Private health insurance plan premiums Public health insurance plan premiums Group term life insurance policy premiums Allowance for incidental expenses ($400 per month) Amounts $1,800.00 1,500.00 400.00 4,800.00 ny Print Done 17 of 17 (14 complete) wa, ON * More Info - X more it or non-ta more id A1A Ltd. provided Raquel with a motor vehicle for the entire year, and the company also paid for all operating costs for the vehicle, with $5,450 paid for operating costs in the current year. The vehicle was purchased by A1A Ltd. three years ago at a cost of $48,500 (incl. GST). In the current year, Raquel drove mount pa 25,500 kilometres; 9,000 kilometres were personal, and 16,500 were for employment purposes. ton T4 On October 1 of the current year, Raquel purchased 1,600 shares of A1A Ltd. an premid under a stock option plan. A1A Ltd. is a Canadian public corporation. The following in premiul information is provided. policy pre Stock Options penses Option granted on Jan 1 of the prior year FMV = $14 per share Option price $14 per share the total Option exercised on July 1 of the current year, FMV = $20 per share (Round ya * Note: On December 31, Jane continues to hold the 1.600 A1A Ltd shares since she anticipates they will appreciate in value e Benefits In the current year, her mother travelled with her to Ottawa when Raquel attended a five-day conference for accountants. A1A Ltd reimbursed her for the full cost of $6,000, of which $3,000 (including GST) was for expenses she incurred for her mother charge enter any Print Done i More Info - On July 1 of the prior year, A1A provided Raquel with an employee loan in the amount of $12,000 at the annual interest rate of 1%. The loan requires annual principal repayments of $2,400 on June 30 of each year. Raquel made the first annual repayment on June 30 of the current year. Canada Revenue Agency's interest rates for the calendar quarters in the current year are as follows. Quarter Rates Quarter #1 (January 1 to March 31) 3% Quarter #2 (April 1 to June 30) Quarter #3 (July 1 to Sept 30) 3% Quarter #4 (Oct 1 to Dec 31) 2% 3% In the current year, Raquel paid the following amount personally: CPA professional dues (annual) in the amount of $1,200 (paid on June 30). Employment expenses: Raquel paid for supplies (used for employment purposes) in the amount of $1.300 (expenses occurred throughout the year). A1A Ltd. has authorized these expenses and filed Form T2200 accordingly. Print Done