Answered step by step

Verified Expert Solution

Question

1 Approved Answer

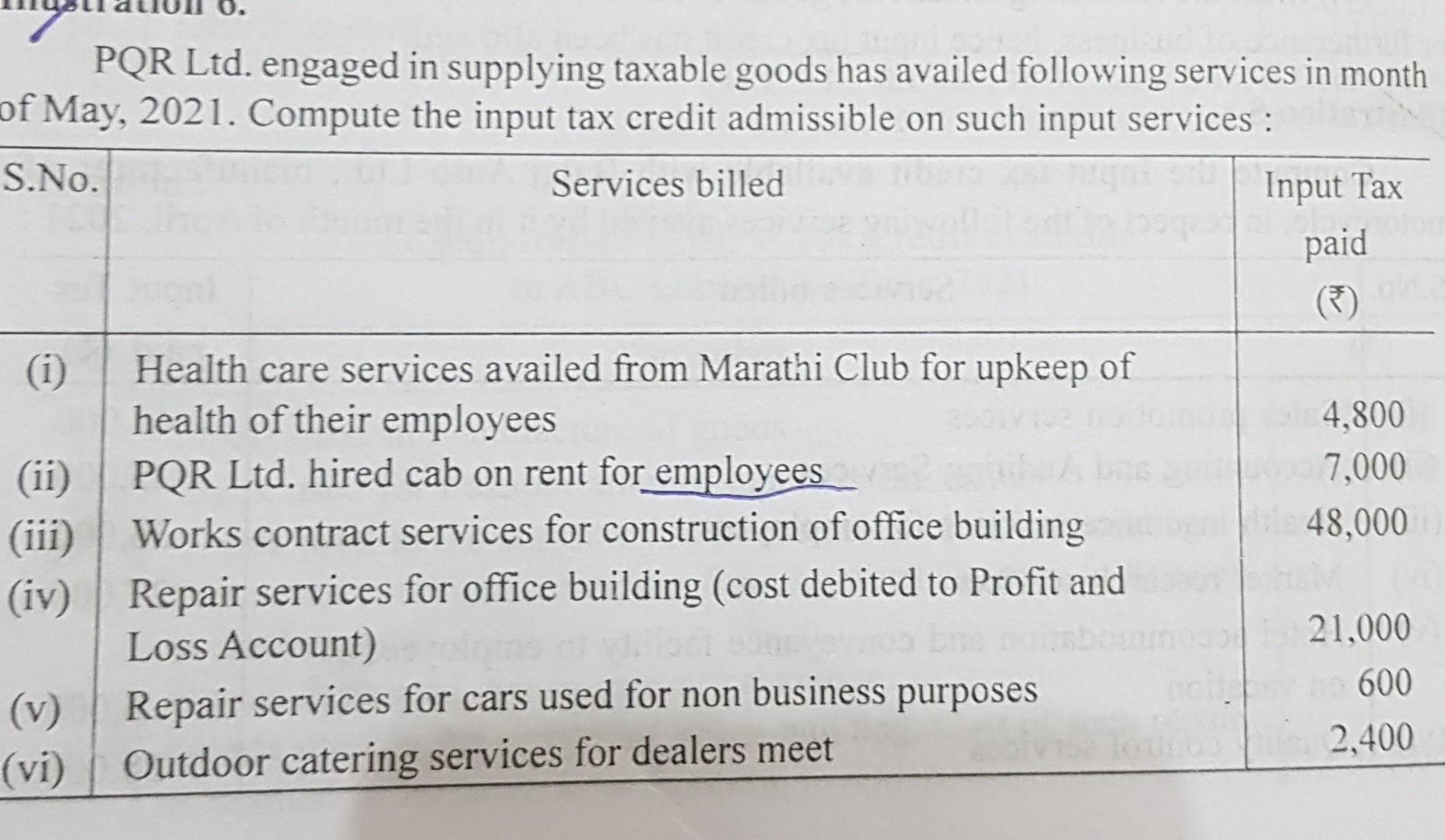

gst act india PQR Ltd. engaged in supplying taxable goods has availed following services in month of May, 2021. Compute the input tax credit admissible

gst act india

PQR Ltd. engaged in supplying taxable goods has availed following services in month of May, 2021. Compute the input tax credit admissible on such input services : S.No. Services billed Input Tax paid (5) (1) Health care services availed from Marathi Club for upkeep of health of their employees 4,800 (ii) PQR Ltd. hired cab on rent for employees 7,000 (iii) Works contract services for construction of office building 48,000 (iv) Repair services for office building (cost debited to Profit and Loss Account) 21,000 (v) Repair services for cars used for non business purposes 600 (vi) Outdoor catering services for dealers meet 2,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started