Answered step by step

Verified Expert Solution

Question

1 Approved Answer

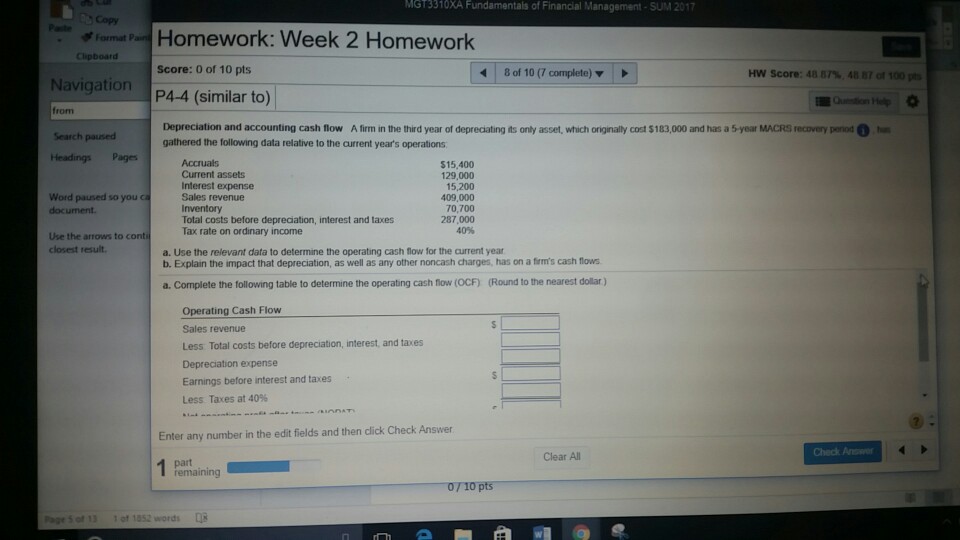

GT3310XA Fundamentals of Financial Management-SUM 2017 Copy Homework: Week 2 Homework Format Pa Clipboard Score: 0 of 10 pts 8of10(7 complete) HW Score: 48 87%

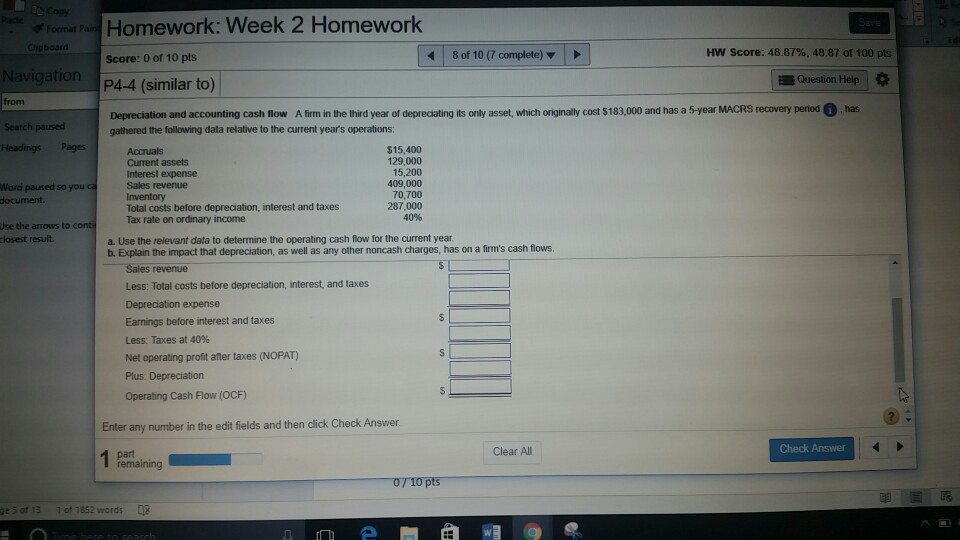

GT3310XA Fundamentals of Financial Management-SUM 2017 Copy Homework: Week 2 Homework Format Pa Clipboard Score: 0 of 10 pts 8of10(7 complete) HW Score: 48 87% , 48 87 of 100 pts Navigation from Depreciation and accounting cash flow A firm in the third year of depreciating its only asset, which originally cost $183,000 and has a 5-year MACRS recovery penad gathered the following data relative to the current year's operations Search paused Headings Pages Accruals Current assets Interest expense $15,400 129,000 15,200 409,000 70,700 287,000 40% Word paused so you caSales revenue document. Inventory Total costs before depreciation, interest and taxes Use the arrows to contiTax rate on ordinary income closest result. a. Use the relevant data to determine the operating cash flow for the current year b. Explain the impact that depreciation, as well as any other noncash charges, has on a firm's cash flows a. Complete the following table to determine the operating cash flow (OCF) (Round to the nearest dollar) Operating Cash Flow Sales revenue Less Total costs before depreciation, interest, and taxes Depreciation expense Earnings before interest and taxes Less Taxes at 40% Enter any number in the edit fields and then click Check Answer Clear All Check An 0T10 pts 1 of 1852 wordsL

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started