Guadalupe purchases an officer building to use in hr business at a cost of $520,000. She properly allocates $20,000 of the cost to the land and $500,000 to the building. Assume that Guadalupe would like to deduct the maximum depreciation on the building. Guadalupe sells the building on October 26, 2020.

Determine her 2020 depreciation if she purchased the building on

June 30, 1992

June 30, 1994

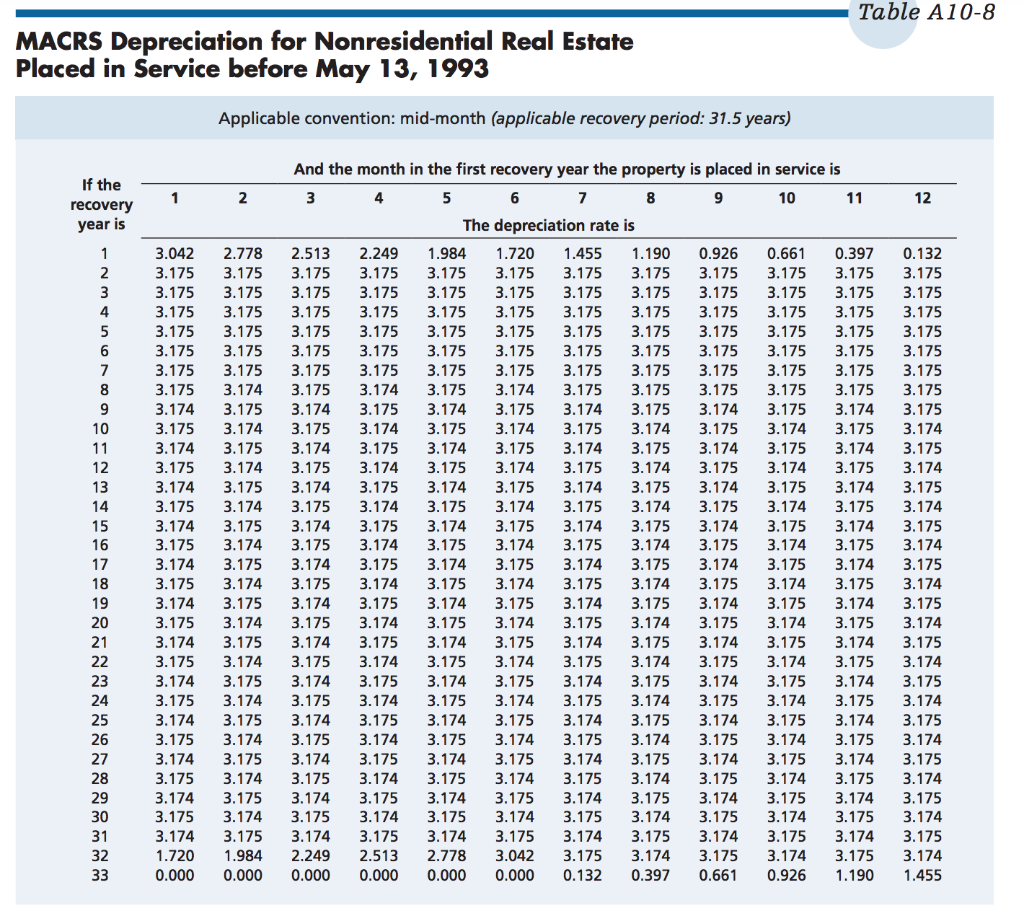

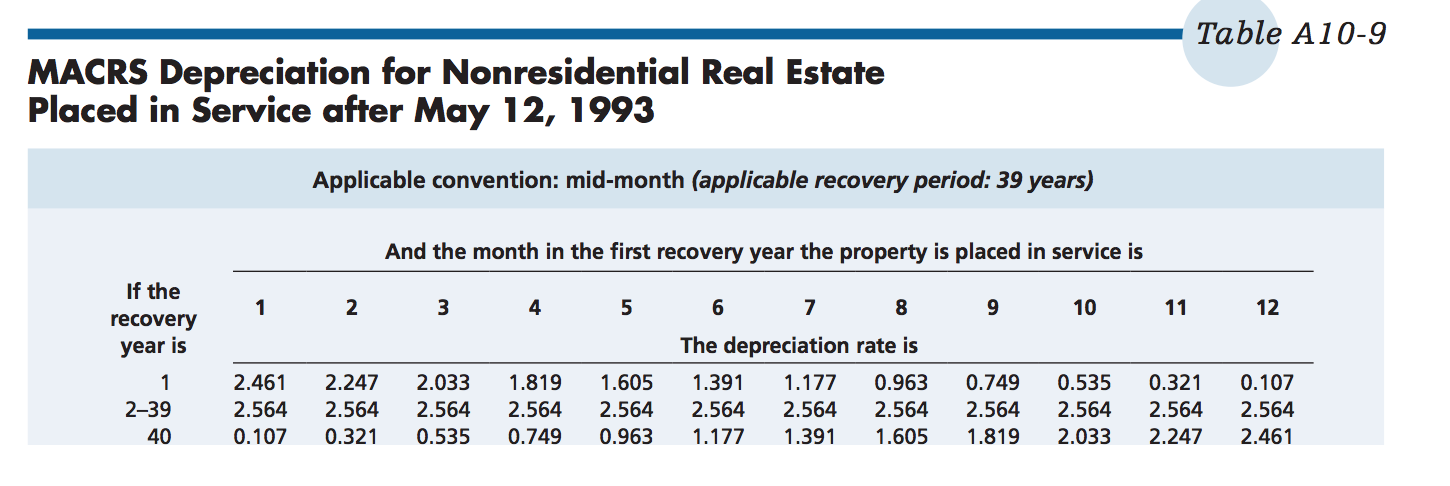

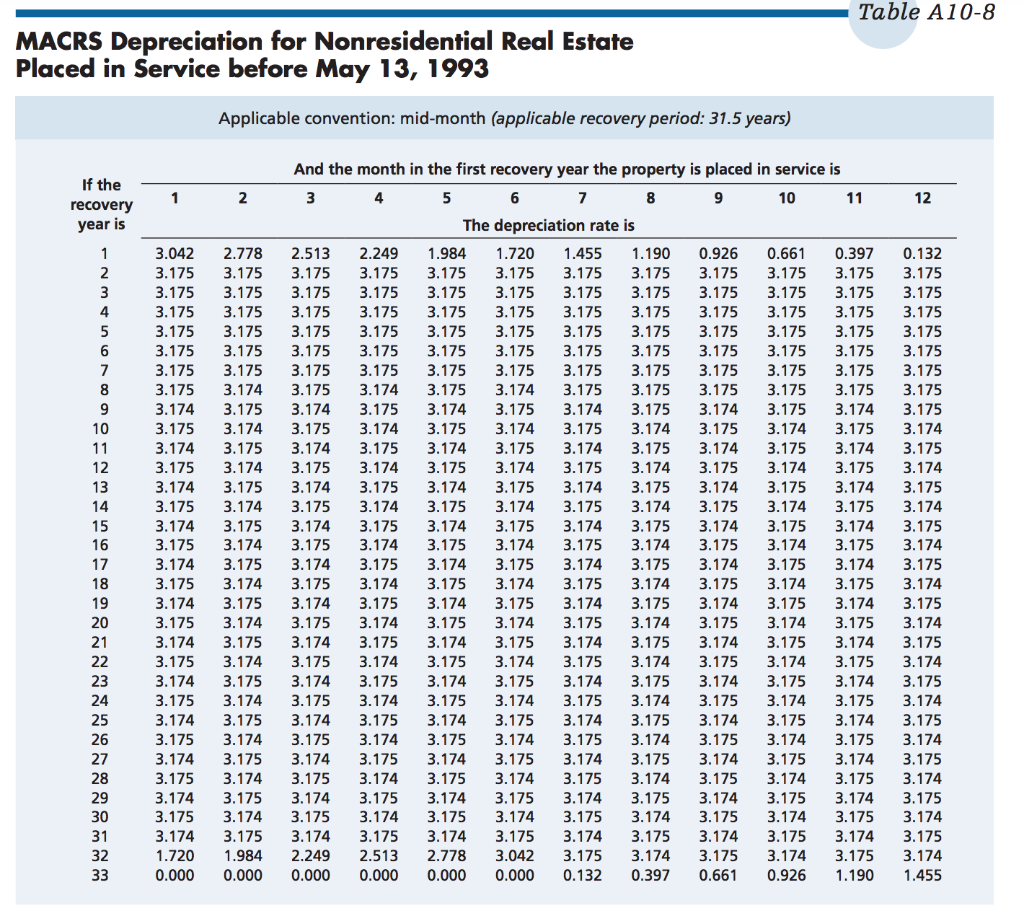

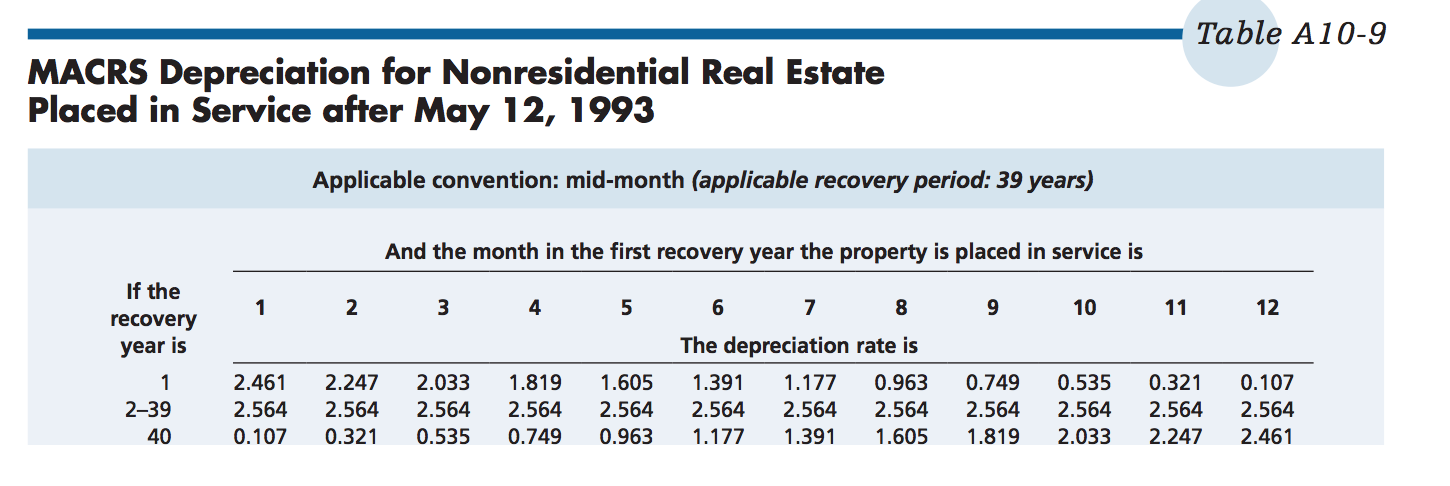

Guadalupe purchases an office building to use in her business at a cost of $520,000. She properly allocates $20,000 of the cost to the land and $500,000 to the building. Assume that Guadalupe would like to deduct the maximum depreciation on the building. Guadalupe sells the building on October 26, 2020. Refer to the MACRS Depreciation Tables to answer the following questions. Note: For intermediate percentage depreciation computations, round to three decimal places. Hint: Don't forget about mid-month convention in the year of acquisition and/or disposal when calculating depreciation. Determine her 2020 depreciation deduction if she purchased the building on a. June 30, 1992. b. June 30, 1994. 6,955 X Table A10-8 MACRS Depreciation for Nonresidential Real Estate Placed in Service before May 13, 1993 Applicable convention: mid-month (applicable recovery period: 31.5 years) 1 2 12 If the recovery year is 3.175 3.175 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 3.042 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 1.720 0.000 2.778 3.175 3.175 3.175 3.175 3.175 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 1.984 0.000 And the month in the first recovery year the property is placed in service is 3 4 5 6 7 8 9 10 11 The depreciation rate is 2.513 2.249 1.984 1.720 1.455 1.190 0.926 0.661 0.397 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.174 3.175 3.174 3.175 3.175 3.175 3.175 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 2.249 2.513 2.778 3.042 3.175 3.174 3.175 3.174 3.175 0.000 0.000 0.000 0.000 0.132 0.397 0.661 0.926 1.190 0.132 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 3.175 3.174 1.455 3.175 Table A10-9 MACRS Depreciation for Nonresidential Real Estate Placed in Service after May 12, 1993 Applicable convention: mid-month (applicable recovery period: 39 years) And the month in the first recovery year the property is placed in service is If the recovery 1 2 3 4 5 6 7 8 9 10 11 12 year is 1 2-39 40 2.461 2.564 0.107 2.247 2.564 0.321 2.033 2.564 0.535 1.819 2.564 0.749 1.605 2.564 0.963 The depreciation rate is 1.391 1.177 0.963 2.564 2.564 2.564 1.177 1.391 1.605 0.749 2.564 1.819 0.535 2.564 2.033 0.321 2.564 2.247 0.107 2.564 2.461