Question

Gugol.com has a policy of paying 16% of its net income as dividends. Gugols corporate tax rate is 35%, and its cost of debt is

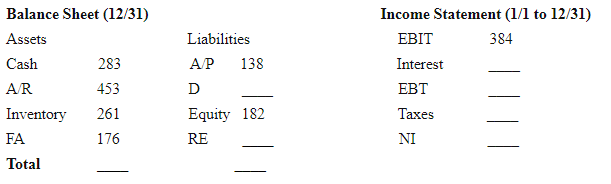

Gugol.com has a policy of paying 16% of its net income as dividends. Gugols corporate tax rate is 35%, and its cost of debt is 6% p.a. Calculate the missing information in this years pro forma balance sheet and partial pro forma income statement (shown below), and then write in the answer box the value for the amount of debt (D) in the balance sheet. Give the answer with a 2-decimal accuracy; that is, it must be accurate to the penny.

---------------------------------------------------------------------------------------------------------

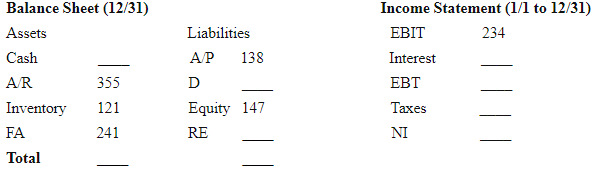

The Koke Company has a policy of not paying dividends, and its bank requires that it always keep a compensating balance of 15% of its debt (D) in cash. Kokes corporate tax rate is 22%, and its cost of debt is 10% p.a. Calculate the missing information in this years pro forma balance sheet and partial pro forma income statement (shown below), and then write in the answer box the value for the amount of debt (D) in the balance sheet. Give the answer with a 2-decimal accuracy; that is, it must be accurate to the penny.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started