Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Guido Properties owes First State Bank $57 million under a 10% note with two years remaining to maturity. Due to financial difficulties of Guido, the

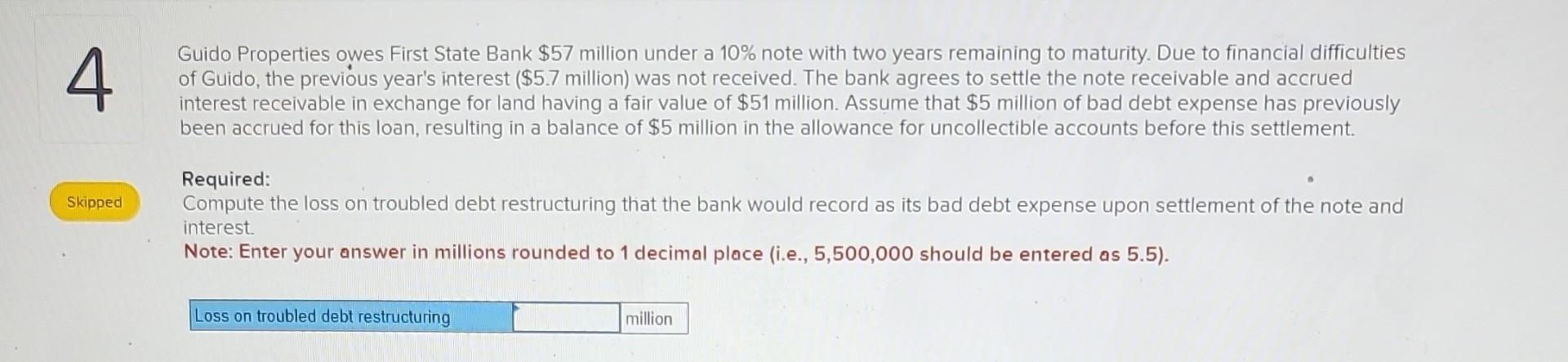

Guido Properties owes First State Bank $57 million under a 10% note with two years remaining to maturity. Due to financial difficulties of Guido, the previous year's interest ( $5.7 million) was not received. The bank agrees to settle the note receivable and accrued interest receivable in exchange for land having a fair value of $51 million. Assume that $5 million of bad debt expense has previously been accrued for this loan, resulting in a balance of $5 million in the allowance for uncollectible accounts before this settlement. Required: Compute the loss on troubled debt restructuring that the bank would record as its bad debt expense upon settlement of the note and interest. Note: Enter your answer in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started