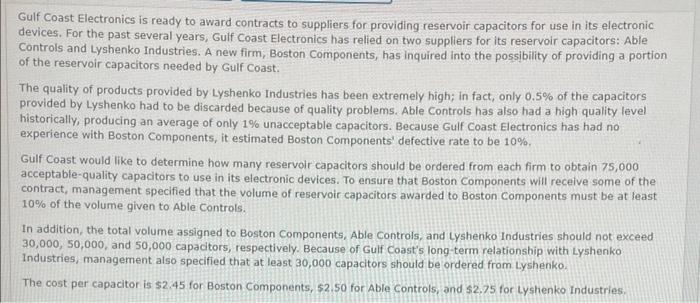

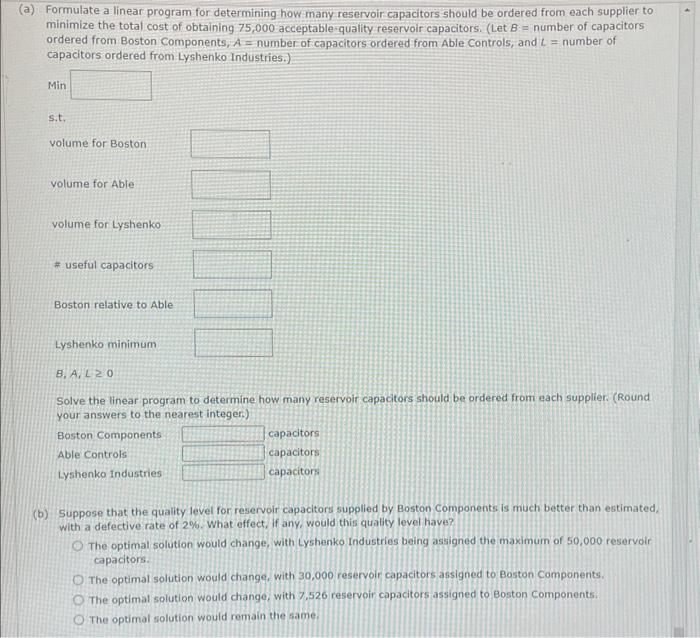

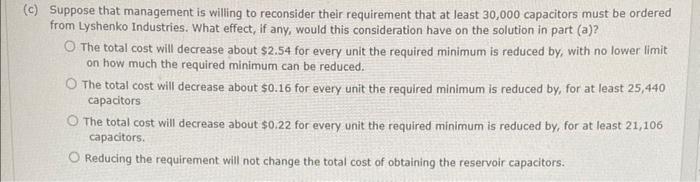

Gulf Coast Electronics is ready to award contracts to suppliers for providing reservoir capacitors for use in its electronic devices. For the past several years, Gulf Coast Electronics has relied on two suppliers for its reservoir capacitors: Able Controls and Lyshenko Industries. A new firm, Boston Components, has inquired into the possibility of providing a portion of the reservoir capacitors needed by Gulf Coast. The quality of products provided by Lyshenko Industries has been extremely high; in fact, only 0.5% of the capacitors provided by Lyshenko had to be discarded because of quality problems. Able Controls has also had a high quality level historically, producing an average of only 1% unacceptable capacitors. Because Gulf Coast Electronics has had no experience with Boston Components, it estimated Boston Components' defective rate to be 10%. Gulf Coast would like to determine how many reservoir capacitors should be ordered from each firm to obtain 75,000 acceptable-quality capacitors to use in its electronic devices. To ensure that Boston components will receive some of the contract, management specified that the volume of reservoir capacitors awarded to Boston components must be at least. 10% of the volume given to Able Controls. In addition, the total volume assigned to Boston Components, Able Controls, and Lyshenko Industries should not exceed 30,000,50,000, and 50,000 capacitors, respectively. Because of Gulf Coast's long-term relationship with Lyshenko Industries, management also specified that at least 30,000 capacitors should be ordered from Lyshenko. The cost per capacitor is $2.45 for Boston Components, 52.50 for Able Controls, and $2.75 for Lystienko Industries. Formulate a linear program for determining how many reservoir capacitors should be ordered from each supplier to minimize the total cost of obtaining 75,000 acceptable quality reservoir capacitors. (Let B= number of capacitors ordered from Boston Components, A= number of capacitors ordered from A Able Controls, and L= number of capacitors ordered from Lyshenko Industries.) s.t. volume for Boston volume for Able volume for Lyshenko * useful capacitors Boston relative to Able Lyshenko minimum B. A,L0 Solve the linear program to determine how many reservoir capacitors should be ordered from each supplier. (Round your answers to the nearest integer) Boston Components Able Controls capacitors Lyshenko industries capacitors capacitors (b) Suppose that the quality level for reservoir capacitors supplied by Boston Components is much better than estimated, with a defective rate of 2%. What effect, if any, would this quatity level have? The optimal solution would change, with Lyshenko Industries being assigned the maximum of 50,000 reservoir capacitors. The optimal solution would change, with 30,000 reservoir capacitors assigned to Boston Components. The optimal solution would change, with 7,526 reservoir capacitors assigned to Boston Components. The optimal solution would remain the same. c) Suppose that management is willing to reconsider their requirement that at least 30,000 capacitors must be ordered from Lyshenko Industries. What effect, if any, would this consideration have on the solution in part (a)? The total cost will decrease about $2.54 for every unit the required minimum is reduced by, with no lower limit on how much the required minimum can be reduced. The total cost will decrease about $0.16 for every unit the required minimum is reduced by, for at least 25,440 capacitors The total cost will decrease about $0.22 for every unit the required minimum is reduced by, for at least 21,106 capacitors. Reducing the requirement will not change the total cost of obtaining the reservoir capacitors. Gulf Coast Electronics is ready to award contracts to suppliers for providing reservoir capacitors for use in its electronic devices. For the past several years, Gulf Coast Electronics has relied on two suppliers for its reservoir capacitors: Able Controls and Lyshenko Industries. A new firm, Boston Components, has inquired into the possibility of providing a portion of the reservoir capacitors needed by Gulf Coast. The quality of products provided by Lyshenko Industries has been extremely high; in fact, only 0.5% of the capacitors provided by Lyshenko had to be discarded because of quality problems. Able Controls has also had a high quality level historically, producing an average of only 1% unacceptable capacitors. Because Gulf Coast Electronics has had no experience with Boston Components, it estimated Boston Components' defective rate to be 10%. Gulf Coast would like to determine how many reservoir capacitors should be ordered from each firm to obtain 75,000 acceptable-quality capacitors to use in its electronic devices. To ensure that Boston components will receive some of the contract, management specified that the volume of reservoir capacitors awarded to Boston components must be at least. 10% of the volume given to Able Controls. In addition, the total volume assigned to Boston Components, Able Controls, and Lyshenko Industries should not exceed 30,000,50,000, and 50,000 capacitors, respectively. Because of Gulf Coast's long-term relationship with Lyshenko Industries, management also specified that at least 30,000 capacitors should be ordered from Lyshenko. The cost per capacitor is $2.45 for Boston Components, 52.50 for Able Controls, and $2.75 for Lystienko Industries. Formulate a linear program for determining how many reservoir capacitors should be ordered from each supplier to minimize the total cost of obtaining 75,000 acceptable quality reservoir capacitors. (Let B= number of capacitors ordered from Boston Components, A= number of capacitors ordered from A Able Controls, and L= number of capacitors ordered from Lyshenko Industries.) s.t. volume for Boston volume for Able volume for Lyshenko * useful capacitors Boston relative to Able Lyshenko minimum B. A,L0 Solve the linear program to determine how many reservoir capacitors should be ordered from each supplier. (Round your answers to the nearest integer) Boston Components Able Controls capacitors Lyshenko industries capacitors capacitors (b) Suppose that the quality level for reservoir capacitors supplied by Boston Components is much better than estimated, with a defective rate of 2%. What effect, if any, would this quatity level have? The optimal solution would change, with Lyshenko Industries being assigned the maximum of 50,000 reservoir capacitors. The optimal solution would change, with 30,000 reservoir capacitors assigned to Boston Components. The optimal solution would change, with 7,526 reservoir capacitors assigned to Boston Components. The optimal solution would remain the same. c) Suppose that management is willing to reconsider their requirement that at least 30,000 capacitors must be ordered from Lyshenko Industries. What effect, if any, would this consideration have on the solution in part (a)? The total cost will decrease about $2.54 for every unit the required minimum is reduced by, with no lower limit on how much the required minimum can be reduced. The total cost will decrease about $0.16 for every unit the required minimum is reduced by, for at least 25,440 capacitors The total cost will decrease about $0.22 for every unit the required minimum is reduced by, for at least 21,106 capacitors. Reducing the requirement will not change the total cost of obtaining the reservoir capacitors