Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GULINNRZLOMKOST QUESTION 3. (15 MARKS). You have been appointed as a Project Manager for Maya Construction Company. The company is about to select a group

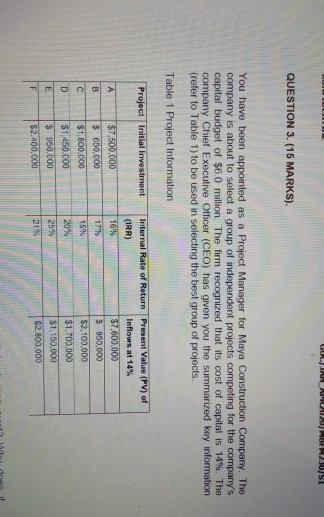

GULINNRZLOMKOST QUESTION 3. (15 MARKS). You have been appointed as a Project Manager for Maya Construction Company. The company is about to select a group of independent projects competing for the company's capital budget of $6.0 million. The firm recognized that its cost of capital is 14%. The company Chief Executive Officer (CEO) has given you the summarized key information (refer to Table 1) to be used in selecting the best group of projects. Table 1 Project Information Project Initial Investment Internal Rate of Return (IRR) $7,500,000 $ 650,000 $1.800.000 $1.450.000 $ 960.000 $2,400.000 Present Value (PM) of Inflows at 14% $7,600.000 $ 950,000 $2,100,000 $1,700.000 $1,150,000 $2,800,000 a) What is capital rationing? In theory, should capital rationing exist? Why does it frequently occur in practice? b) Apply the internal rate of return (IRR) approach to select the best group of projects c) Apply the net present value (NPV) approach to select the best group of projects. d) Which projects should you recommend to be implemented by the company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started