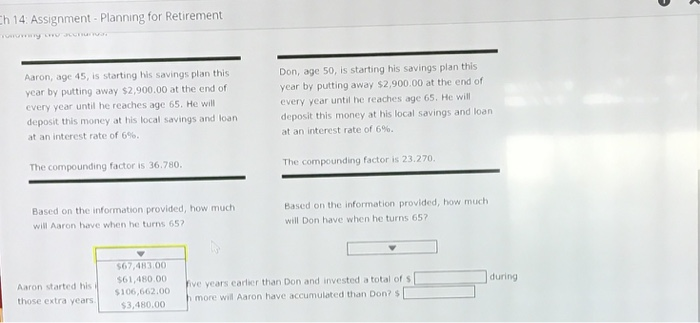

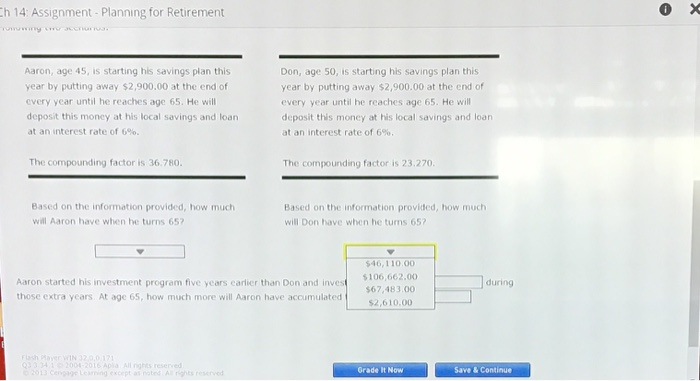

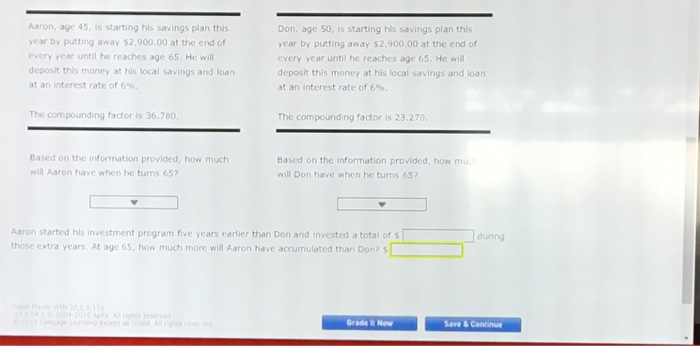

h 14: Assignment Planning for Retirement Aaron, age 45, is starting his savings plan this year by putting away $2,900.00 at the end of every year until he reaches age 65. He will deposit this money at his local savings and loan at an interest rate of 6%. Don, age 50, is starting his savings plan this year by putting away $2,900.00 at the end of every year until he reaches age 65. He will deposit this money at his local savings and loan at an interest rate of 6%. The compounding factor is 36.780 The compounding factor is 23.270 Based on the information provided, how much will Aaron have when he turns 657 Based on the information provided, how much will Don have when he turns 65? Aaron started his those extra years 67,483.00 $61,480.00 $106,662.00 $3,480.00 ve years carlier than Don and invested a total of s more will Aaron have accumulated than Don? s during h 14: Assignment- Planning for Retirement Aaron, age 45, is starting his savings plan this year by putting away $2,900.00 at the end of every year until he reaches age 65. He will deposit this money at his local savings and loan at an interest rate of 6%. Don, age 50, is starting his savings plan this year by putting away $2,900.00 at the end of every year until he reaches age 65. He will deposit this money at his local savings and loan at an interest rate of 6% The compounding factor is 36.780 The compounding factor is 23.270 Based on the information provided, how much will Aaron have when he turns 657 Based on the information provided, how much will Don have when he tuns 657 46, 110.00 106,662.00 $67,483.00 $2,610.00 Aaron started his investment program five years carlier than Don and invest00during those extra years At age 65, how much more will Aaron have accumulated Apla Allrights reserved Grade It Now Save & Continue 13 Ce Lering except as oted A rights served Aaron, age 45, is starting his savings plan this year by putting away $2,900.00 at the end of every year until he reaches age 65. He will deposit this money at his local savings and loan at an interest rate of 6% Don, age 50, is starting his savings plan this year by putting away $2,900,00 at the end of every year until he reaches age 65. He will deposit this money at his local savings and loan at an interest rate of 6% The compounding factor is 36.780 The compounding factor is 23.270 Based on the information provided, how much will Aaron have when he tums 657 Based on the information provided, how mu will Don have when he turns 65? Aaron started his investment program five years carlier than Don and invested a total of s those extra years At age 65, how much more will Aaron have accumulated than Don? s during Grade iIt Now