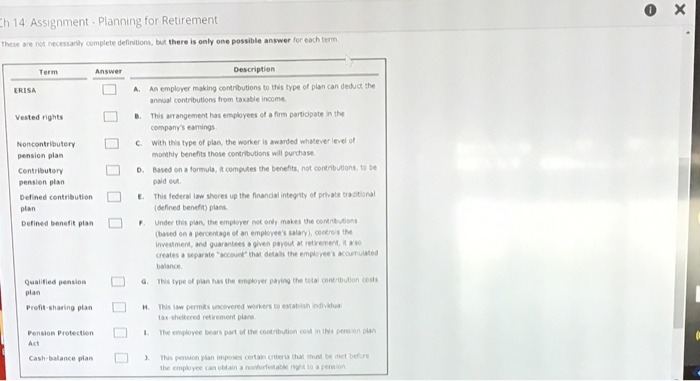

h 14 Assignment Planning for Retirement These are not necessaily complete definitions, but there is only one possible answer for each term Term Answer Description A An employer making contributions to this type of plan can deduct the ERISA annual contributions from taxable income This arrangement has employees of a frm particdpste in the Vested rights company's eamings Noncontributerywith this type of plan, the worker is awarded whatever level of pension plan Centributory pension plan Defined contributionThis federal law shores up the fnancial integrity of private traditional monthly benefits those contributions will purchase ased on a formula, iR computes the benefits, not contnbutions, to b pald out plan (defined benefit) plans Defined benefit planUnder this plan, the employer not only makes the contribution (based on a percentage of an employee's salary),coers th nvestment, and guarantees agiven payout at retirement, tso creates a separate accounk that detals the employee's acoumulated balance Qualified pensionThis type of plan has the empkoyer paying the totai contribution cost plan Profit-sharing plan Pension Protection Cash-balance plan This aw permits uncovered workers to estabish indlivua tax-sheltered retirementplans The employee bears part of the contribution cost in thNs pension pla This pension plan imposes certainenteria that must be met betre the employee can obtain a nooforfeitable rgto a pension 3. h 14 Assignment Planning for Retirement These are not necessaily complete definitions, but there is only one possible answer for each term Term Answer Description A An employer making contributions to this type of plan can deduct the ERISA annual contributions from taxable income This arrangement has employees of a frm particdpste in the Vested rights company's eamings Noncontributerywith this type of plan, the worker is awarded whatever level of pension plan Centributory pension plan Defined contributionThis federal law shores up the fnancial integrity of private traditional monthly benefits those contributions will purchase ased on a formula, iR computes the benefits, not contnbutions, to b pald out plan (defined benefit) plans Defined benefit planUnder this plan, the employer not only makes the contribution (based on a percentage of an employee's salary),coers th nvestment, and guarantees agiven payout at retirement, tso creates a separate accounk that detals the employee's acoumulated balance Qualified pensionThis type of plan has the empkoyer paying the totai contribution cost plan Profit-sharing plan Pension Protection Cash-balance plan This aw permits uncovered workers to estabish indlivua tax-sheltered retirementplans The employee bears part of the contribution cost in thNs pension pla This pension plan imposes certainenteria that must be met betre the employee can obtain a nooforfeitable rgto a pension 3