h) Assume that one of these portfolio's is the Market Portfolio and all portfolios, except Portfolio G, are fairly priced according to the CAPM.

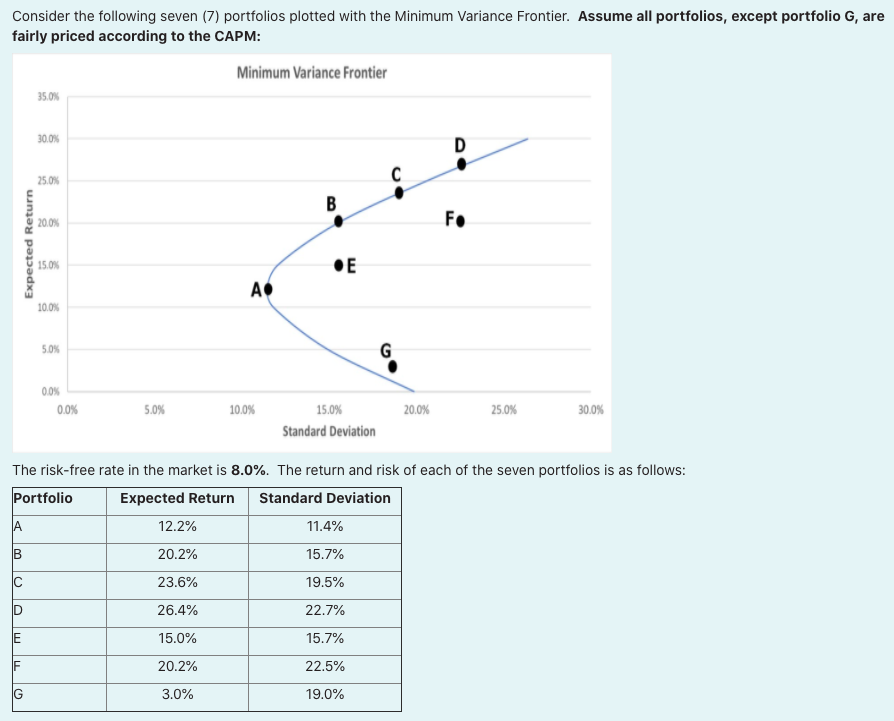

h) Assume that one of these portfolio's is the Market Portfolio and all portfolios, except Portfolio G, are fairly priced according to the CAPM. What is the unsystematic risk (expressed as a variance) of portfolio E? (1.5 marks) Enter your answer to 4 decimal places eg if your answer is 0.45787 enter as 0.4579. Consider the following seven (7) portfolios plotted with the Minimum Variance Frontier. Assume all portfolios, except portfolio G, are fairly priced according to the CAPM: A B C D E IF Expected Return G 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% 0.0% 5.0% Minimum Variance Frontier 12.2% 20.2% 23.6% 26.4% 15.0% 20.2% 3.0% A 10.0% B E 15.0% Standard Deviation C 11.4% 15.7% 19.5% 22.7% 15.7% 22.5% 19.0% G 20.0% D The risk-free rate in the market is 8.0%. The return and risk of each of the seven portfolios is as follows: Portfolio Expected Return Standard Deviation Fo 25.0% 30.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Okay lets solve this stepbystep 1 The market portfolio is ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started