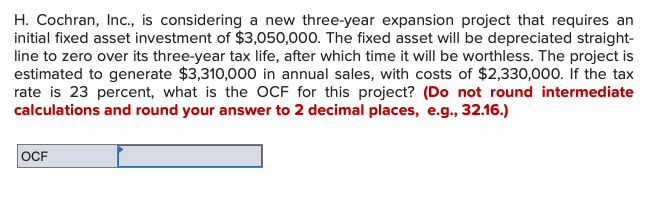

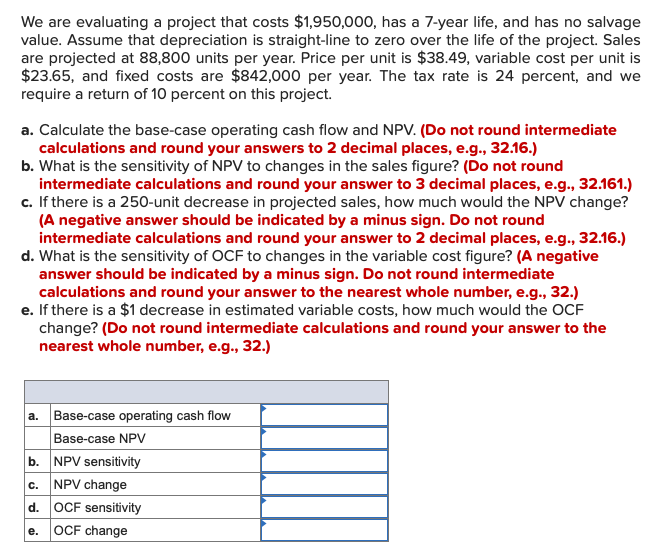

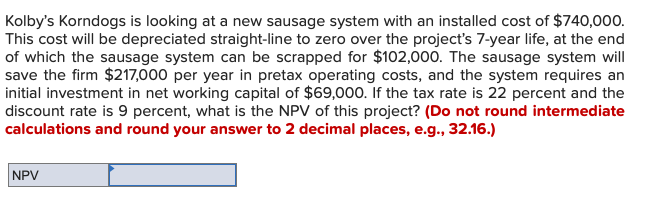

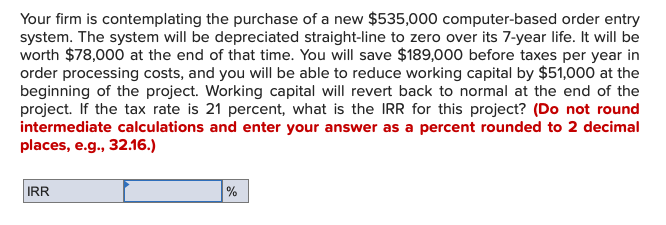

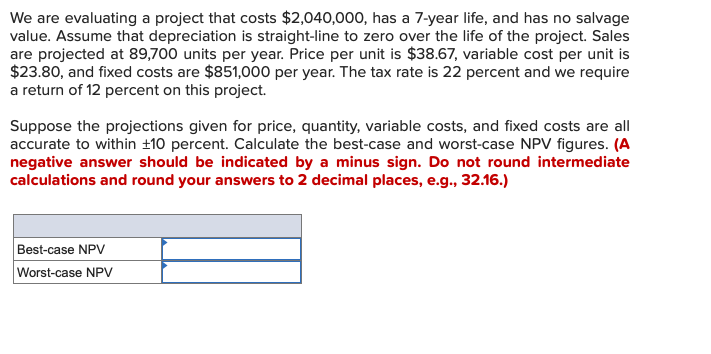

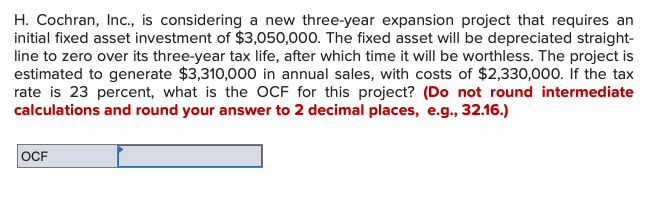

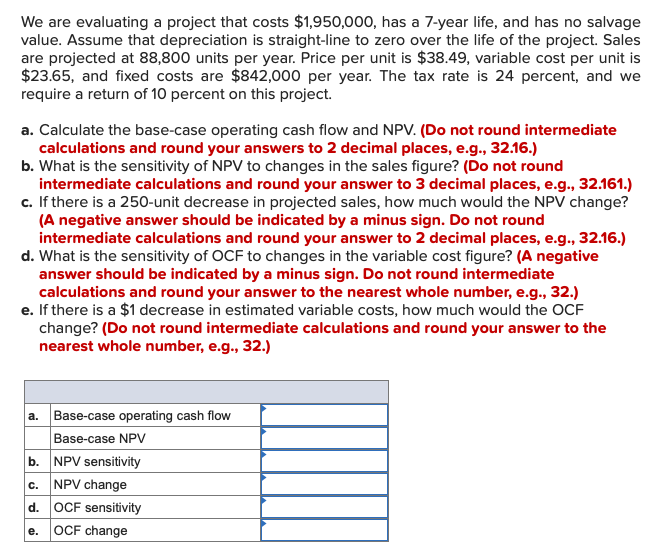

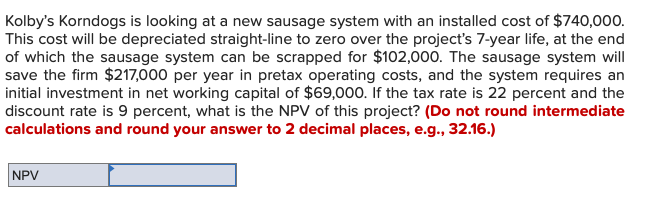

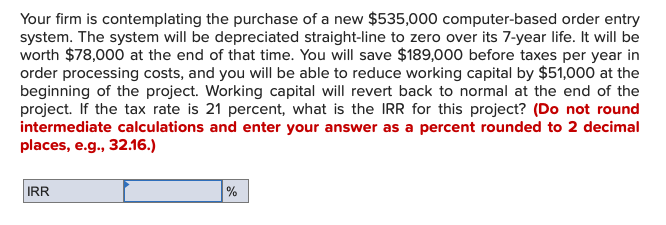

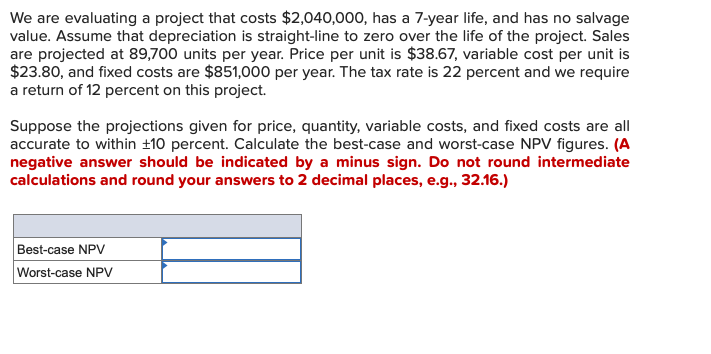

H. Cochran, Inc., is considering a new three-year expansion project that requires an initial fixed asset investment of $3,050,000. The fixed asset will be depreciated straight- line to zero over its three-year tax life, after which time it will be worthless. The project is estimated to generate $3,310,000 in annual sales, with costs of $2,330,000. If the tax rate is 23 percent, what is the OCF for this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) OCH We are evaluating a project that costs $1,950,000, has a 7-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 88,800 units per year. Price per unit is $38.49, variable cost per unit is $23.65, and fixed costs are $842,000 per year. The tax rate is 24 percent, and we require a return of 10 percent on this project. a. Calculate the base-case operating cash flow and NPV. (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) b. What is the sensitivity of NPV to changes in the sales figure? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) c. If there is a 250-unit decrease in projected sales, how much would the NPV change? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) d. What is the sensitivity of OCF to changes in the variable cost figure? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) e. If there is a $1 decrease in estimated variable costs, how much would the OCF change? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) Base-case operating cash flow Base-case NPV NPV sensitivity NPV change d. OCF sensitivity OCF change e. Kolby's Korndogs is looking at a new sausage system with an installed cost of $740,000. This cost will be depreciated straight-line to zero over the project's 7-year life, at the end of which the sausage system can be scrapped for $102,000. The sausage system will save the firm $217,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $69,000. If the tax rate is 22 percent and the discount rate is 9 percent, what is the NPV of this project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV Your firm is contemplating the purchase of a new $535,000 computer-based order entry system. The system will be depreciated straight-line to zero over its 7-year life. It will be worth $78,000 at the end of that time. You will save $189,000 before taxes per year in order processing costs, and you will be able to reduce working capital by $51,000 at the beginning of the project. Working capital will revert back to normal at the end of the project. If the tax rate is 21 percent, what is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR We are evaluating a project that costs $2,040,000, has a 7-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 89,700 units per year. Price per unit is $38.67, variable cost per unit is $23.80, and fixed costs are $851,000 per year. The tax rate is 22 percent and we require a return of 12 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within 10 percent. Calculate the best-case and worst-case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Best-case NPV Worst-case NPV