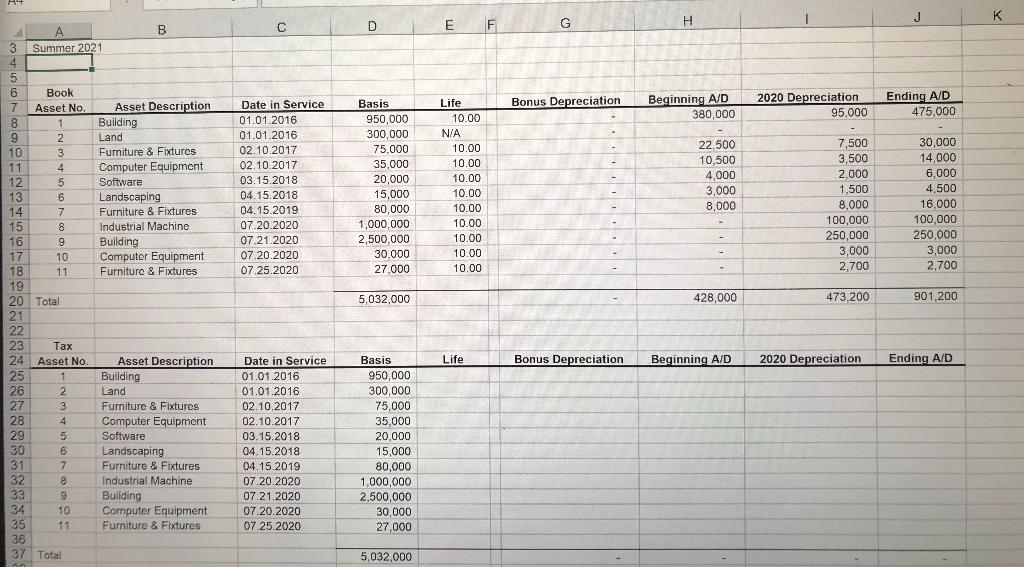

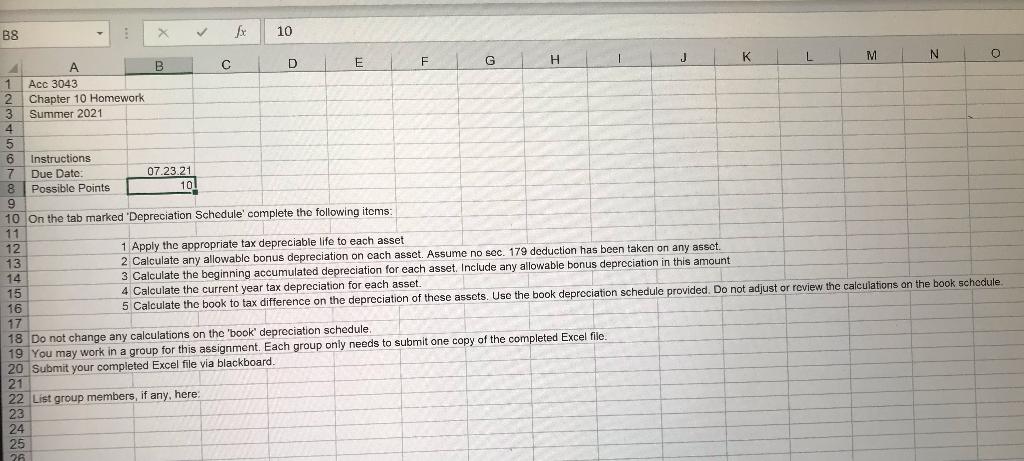

H E K J D G F Bonus Depreciation Beginning A/D 380,000 2020 Depreciation 95,000 Ending A/D 475,000 Date in Service 01.01.2016 01.01.2016 02.10.2017 02.10.2017 03.15.2018 04.15.2018 04.15.2019 07.20.2020 07.21.2020 07.20.2020 07.25.2020 Basis 950,000 300,000 75.000 35,000 20,000 15,000 80,000 1,000,000 2,500,000 30,000 27,000 Life 10.00 N/A 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 22.500 10,500 4.000 3,000 8,000 7,500 3,500 2.000 1,500 8,000 100,000 250,000 3,000 2,700 30,000 14,000 6,000 4,500 16.000 100.000 250.000 3,000 2,700 A B 3 Summer 2021 4 5 6 Book 7 Asset No. Asset Description 8 1 Building 9 2 Land 10 3 Fumiture & Fixtures 11 4 Computer Equipment 12 5 Software 13 6 Landscaping 14 7 Furniture & Fixtures 15 8 Industrial Machine 16 9 Building 17 10 Computer Equipment 18 11 Furniture & Fixtures 19 20 Total 21 22 23 Tax 24 Asset No. Asset Description 25 1 Building 26 2 Land 27 3 Furniture & Fixtures 28 4 Computer Equipment 29 5 Software 30 6 Landscaping 31 7 Furniture & Fixtures 32 8 Industrial Machine 33 9 Building 34 10 Computer Equipment 35 11 Furniture & Fixtures 38 37 Total 5,032,000 428,000 473.200 901,200 Life Bonus Depreciation Beginning A/D 2020 Depreciation Ending A/D Date in Service 01.01.2016 01.01.2016 02.10.2017 02.10.2017 03.15.2018 04.15.2018 04.15.2019 07.20.2020 07.21.2020 07.20.2020 07.25.2020 Basis 950,000 300,000 75,000 35,000 20,000 15,000 80,000 1,000,000 2,500,000 30,000 27,000 5,032,000 B8 X 10 B D E F G . 1 J L M N O 1 Acc 3043 2 Chapter 10 Homework 3 Summer 2021 4 5 6 Instructions 7 Due Date: 07.23.21 8 Possible Points 10! 9 10 On the tab marked 'Depreciation Schedule' complete the following items: 11 12 1 Apply the appropriate tax depreciable life to each asset 13 2 Calculate any allowable bonus depreciation on cach asset. Assume no sec. 179 deduction has been taken on any asset. 14 3 Calculate the beginning accumulated depreciation for each asset. Include any allowable bonus depreciation in this amount 15 4 Calculate the current year tax depreciation for each asset. 16 5 Calculate the book to tax difference on the depreciation of these assets. Use the book depreciation schedule provided. Do not adjust or review the calculations on the book schedule 17 18 Do not change any calculations on the 'book' depreciation schedule 19 You may work in a group for this assignment. Each group only needs to submit one copy of the completed Excel file. 20 Submit your completed Excel file via blackboard. 21 22 List group members, if any, here: 23 24 25 26 H E K J D G F Bonus Depreciation Beginning A/D 380,000 2020 Depreciation 95,000 Ending A/D 475,000 Date in Service 01.01.2016 01.01.2016 02.10.2017 02.10.2017 03.15.2018 04.15.2018 04.15.2019 07.20.2020 07.21.2020 07.20.2020 07.25.2020 Basis 950,000 300,000 75.000 35,000 20,000 15,000 80,000 1,000,000 2,500,000 30,000 27,000 Life 10.00 N/A 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 22.500 10,500 4.000 3,000 8,000 7,500 3,500 2.000 1,500 8,000 100,000 250,000 3,000 2,700 30,000 14,000 6,000 4,500 16.000 100.000 250.000 3,000 2,700 A B 3 Summer 2021 4 5 6 Book 7 Asset No. Asset Description 8 1 Building 9 2 Land 10 3 Fumiture & Fixtures 11 4 Computer Equipment 12 5 Software 13 6 Landscaping 14 7 Furniture & Fixtures 15 8 Industrial Machine 16 9 Building 17 10 Computer Equipment 18 11 Furniture & Fixtures 19 20 Total 21 22 23 Tax 24 Asset No. Asset Description 25 1 Building 26 2 Land 27 3 Furniture & Fixtures 28 4 Computer Equipment 29 5 Software 30 6 Landscaping 31 7 Furniture & Fixtures 32 8 Industrial Machine 33 9 Building 34 10 Computer Equipment 35 11 Furniture & Fixtures 38 37 Total 5,032,000 428,000 473.200 901,200 Life Bonus Depreciation Beginning A/D 2020 Depreciation Ending A/D Date in Service 01.01.2016 01.01.2016 02.10.2017 02.10.2017 03.15.2018 04.15.2018 04.15.2019 07.20.2020 07.21.2020 07.20.2020 07.25.2020 Basis 950,000 300,000 75,000 35,000 20,000 15,000 80,000 1,000,000 2,500,000 30,000 27,000 5,032,000 B8 X 10 B D E F G . 1 J L M N O 1 Acc 3043 2 Chapter 10 Homework 3 Summer 2021 4 5 6 Instructions 7 Due Date: 07.23.21 8 Possible Points 10! 9 10 On the tab marked 'Depreciation Schedule' complete the following items: 11 12 1 Apply the appropriate tax depreciable life to each asset 13 2 Calculate any allowable bonus depreciation on cach asset. Assume no sec. 179 deduction has been taken on any asset. 14 3 Calculate the beginning accumulated depreciation for each asset. Include any allowable bonus depreciation in this amount 15 4 Calculate the current year tax depreciation for each asset. 16 5 Calculate the book to tax difference on the depreciation of these assets. Use the book depreciation schedule provided. Do not adjust or review the calculations on the book schedule 17 18 Do not change any calculations on the 'book' depreciation schedule 19 You may work in a group for this assignment. Each group only needs to submit one copy of the completed Excel file. 20 Submit your completed Excel file via blackboard. 21 22 List group members, if any, here: 23 24 25 26