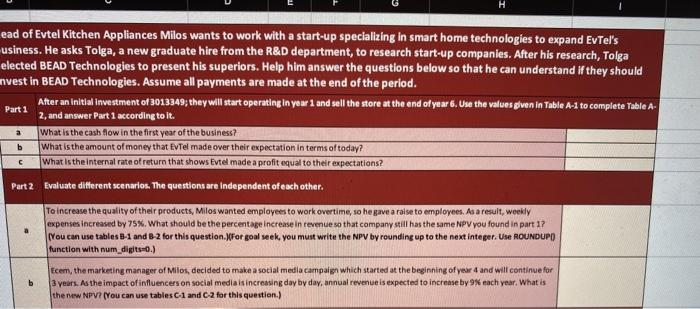

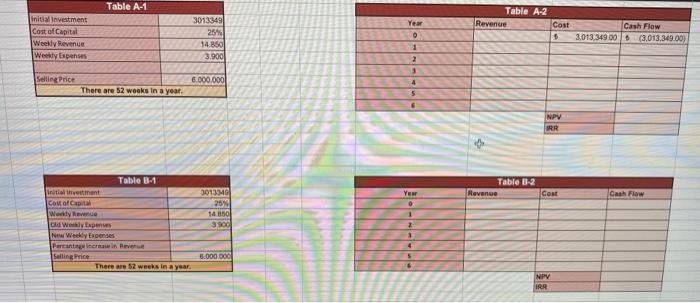

H ead of Evtel Kitchen Appliances Milos wants to work with a start-up specializing in smart home technologies to expand EvTel's usiness. He asks Tolga, a new graduate hire from the R&D department, to research start-up companies. After his research, Tolga elected BEAD Technologies to present his superiors. Help him answer the questions below so that he can understand if they should nvest in BEAD Technologies. Assume all payments are made at the end of the period. After an initial investment of 3013349; they will start operating in year 1 and sell the store at the end of year 6. Use the values given in Table A-1 to complete Table A- 2, and answer Part 1 according to it. What is the cash flow in the first year of the business? What is the amount of money that EvTel made over their expectation in terms of today? What is the internal rate of return that shows Evtel made a profit equal to their expectations? Part 1 a b Part 2 Evaluate different scenarios. The questions are independent of each other. To increase the quality of their products, Milos wanted employees to work overtime, so he gave a raise to employees. As a result, weekly expenses increased by 75%. What should be the percentage increase in revenue so that company still has the same NPV you found in part 17 You can use tables B-1 and B-2 for this question. For goal seek, you must write the NPV by rounding up to the next integer. Use ROUNDUPO function with num_digits.) Ecem, the marketing manager of Milos, decided to make a social media campaign which started at the beginning of year 4 and will continue for 3 years. As the impact of influencers on social media is increasing day by day, annual revenue is expected to increase by 9% each year. What is the new NPV? You can use tables C1 and C2 for this question.) Table A-1 Table A-2 Revenue Cost Initial investment Cost of Capital Weekly Revenue Weekly penses 3013349 25% 14,850 3.900 Year O 1 2 Cash Flow 3,013,349.00$ (3,013,349.00) 1 Selling Price 6.000.000 There are 52 weeks in a year 4 5 NPV BRR Table 0-2 Revenue Cost YEN Cash Flow Table 8-1 Initivement Com o Capital Weekly News Old Welpen New Weekly Expenses Peraturan veut Selling Price There are 52 weeks in a year 301300 25% 14,850 31900 0 1 2 1 4 5.000 DOC 5 NPY IRA H ead of Evtel Kitchen Appliances Milos wants to work with a start-up specializing in smart home technologies to expand EvTel's usiness. He asks Tolga, a new graduate hire from the R&D department, to research start-up companies. After his research, Tolga elected BEAD Technologies to present his superiors. Help him answer the questions below so that he can understand if they should nvest in BEAD Technologies. Assume all payments are made at the end of the period. After an initial investment of 3013349; they will start operating in year 1 and sell the store at the end of year 6. Use the values given in Table A-1 to complete Table A- 2, and answer Part 1 according to it. What is the cash flow in the first year of the business? What is the amount of money that EvTel made over their expectation in terms of today? What is the internal rate of return that shows Evtel made a profit equal to their expectations? Part 1 a b Part 2 Evaluate different scenarios. The questions are independent of each other. To increase the quality of their products, Milos wanted employees to work overtime, so he gave a raise to employees. As a result, weekly expenses increased by 75%. What should be the percentage increase in revenue so that company still has the same NPV you found in part 17 You can use tables B-1 and B-2 for this question. For goal seek, you must write the NPV by rounding up to the next integer. Use ROUNDUPO function with num_digits.) Ecem, the marketing manager of Milos, decided to make a social media campaign which started at the beginning of year 4 and will continue for 3 years. As the impact of influencers on social media is increasing day by day, annual revenue is expected to increase by 9% each year. What is the new NPV? You can use tables C1 and C2 for this question.) Table A-1 Table A-2 Revenue Cost Initial investment Cost of Capital Weekly Revenue Weekly penses 3013349 25% 14,850 3.900 Year O 1 2 Cash Flow 3,013,349.00$ (3,013,349.00) 1 Selling Price 6.000.000 There are 52 weeks in a year 4 5 NPV BRR Table 0-2 Revenue Cost YEN Cash Flow Table 8-1 Initivement Com o Capital Weekly News Old Welpen New Weekly Expenses Peraturan veut Selling Price There are 52 weeks in a year 301300 25% 14,850 31900 0 1 2 1 4 5.000 DOC 5 NPY IRA