Answered step by step

Verified Expert Solution

Question

1 Approved Answer

H Limited acquired 35,000 ordinary shares of FBE Limited on 1 July 2019 at a cost of $2 million to obtain control over the

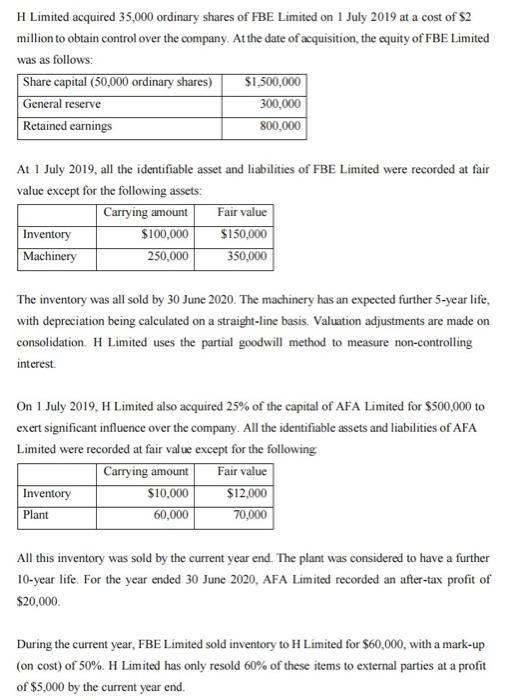

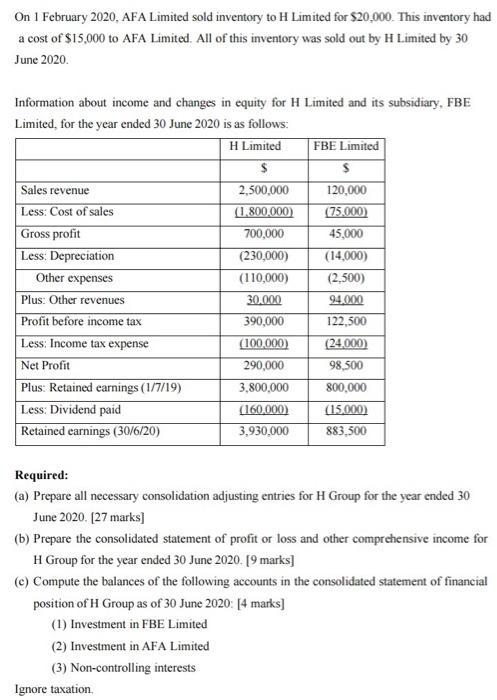

H Limited acquired 35,000 ordinary shares of FBE Limited on 1 July 2019 at a cost of $2 million to obtain control over the company. At the date of acquisition, the equity of FBE Limited was as follows: Share capital (50,000 ordinary shares) General reserve Retained earnings At 1 July 2019, all the identifiable asset and liabilities of FBE Limited were recorded at fair value except for the following assets: Inventory Machinery Carrying amount $100,000 250,000 $1,500,000 300,000 800,000 Inventory Plant The inventory was all sold by 30 June 2020. The machinery has an expected further 5-year life, with depreciation being calculated on a straight-line basis. Valuation adjustments are made on consolidation. H Limited uses the partial goodwill method to measure non-controlling interest. Fair value $150,000 350,000 On 1 July 2019, H Limited also acquired 25% of the capital of AFA Limited for $500,000 to exert significant influence over the company. All the identifiable assets and liabilities of AFA Limited were recorded at fair value except for the following Fair value Carrying amount $10,000 60,000 $12,000 70,000 All this inventory was sold by the current year end. The plant was considered to have a further 10-year life. For the year ended 30 June 2020, AFA Limited recorded an after-tax profit of $20,000. During the current year, FBE Limited sold inventory to H Limited for $60,000, with a mark-up (on cost) of 50%. H Limited has only resold 60% of these items to external parties at a profit of $5,000 by the current year end. On 1 February 2020, AFA Limited sold inventory to H Limited for $20,000. This inventory had a cost of $15,000 to AFA Limited. All of this inventory was sold out by H Limited by 30 June 2020. Information about income and changes in equity for H Limited and its subsidiary, FBE Limited, for the year ended 30 June 2020 is as follows: H Limited $ 2,500,000 (1,800,000) 700,000 Sales revenue Less: Cost of sales Gross profit Less: Depreciation Other expenses Plus: Other revenues Profit before income tax Less: Income tax expense Net Profit Plus: Retained earnings (1/7/19) Less: Dividend paid Retained earnings (30/6/20) (230,000) (110,000) 30.000 390,000 (100,000) 290,000 3,800,000 (160,000) 3,930,000 FBE Limited S 120,000 (75.000) 45,000 (14,000) (2,500) 94.000 122,500 (24,000) 98,500 Ignore taxation. 800,000 (15,000) 883,500 Required: (a) Prepare all necessary consolidation adjusting entries for H Group for the year ended 30 June 2020. [27 marks] (b) Prepare the consolidated statement of profit or loss and other comprehensive income for H Group for the year ended 30 June 2020. [9 marks] (c) Compute the balances of the following accounts in the consolidated statement of financial position of H Group as of 30 June 2020: [4 marks] (1) Investment in FBE Limited (2) Investment in AFA Limited (3) Non-controlling interests

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a 1H Limiteds investment in FBE Limited Dr Investment in FBE Limited 2000000 Equity of FBE Limited Cr Share Capital 1500000 General Reserve 300000 Retained Earnings 800000 2Goodwill Dr Goodwill arisin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started