Answered step by step

Verified Expert Solution

Question

1 Approved Answer

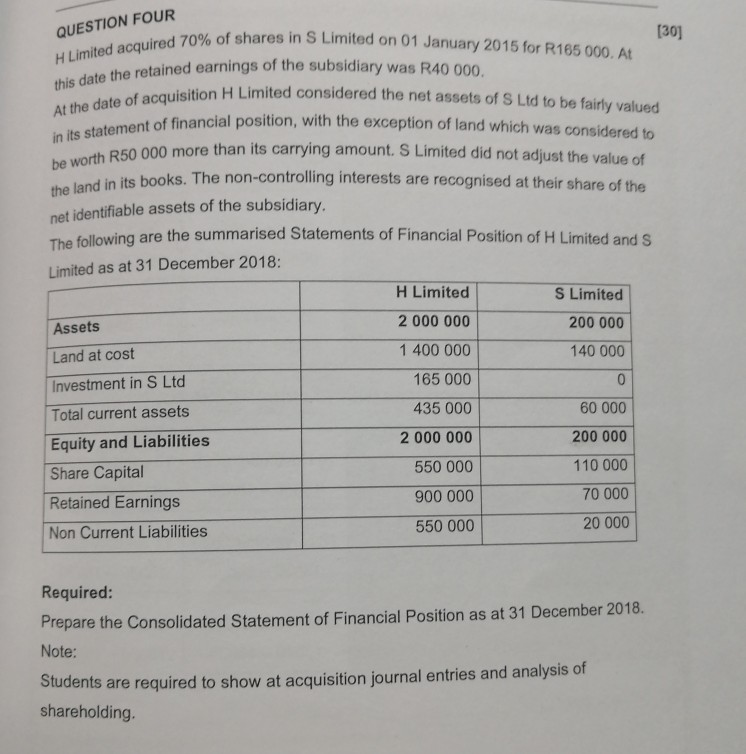

H Limited acquired 70% of shares in S Limited on 01 January 2015 for R165 000. At this date the retained earnings of the subsidiary

H Limited acquired 70% of shares in S Limited on 01 January 2015 for R165 000. At this date the retained earnings of the subsidiary was R40 000. At the date of acquisition H Limited considered the net assets of S Ltd to be fairly valued in its statement of financial position, with the exception of land which was considered to be worth R50 000 more than its carrying amount. S Limited did not adjust the value of QUESTION FOUR [30] the land in its books. The non-controlling interests are recognised at their share of the net identifiable assets of the subsidiary. The following are the summarised Statements of Financial Position of H Limited and s Limited as at 31 December 2018: H Limited S Limited 2 000 000 Assets 200 000 140 000 Land at cost 1 400 000 165 000 0 Investment in S Ltd 435 000 60 000 2 000 000 200 000 Total current assets Equity and Liabilities Share Capital Retained Earnings Non Current Liabilities 550 000 110 000 900 000 70 000 550 000 20 000 Required: Prepare the Consolidated Statement of Financial Position as at 31 December 2018. Note: Students are required to show at acquisition journal entries and analysis of shareholding

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started