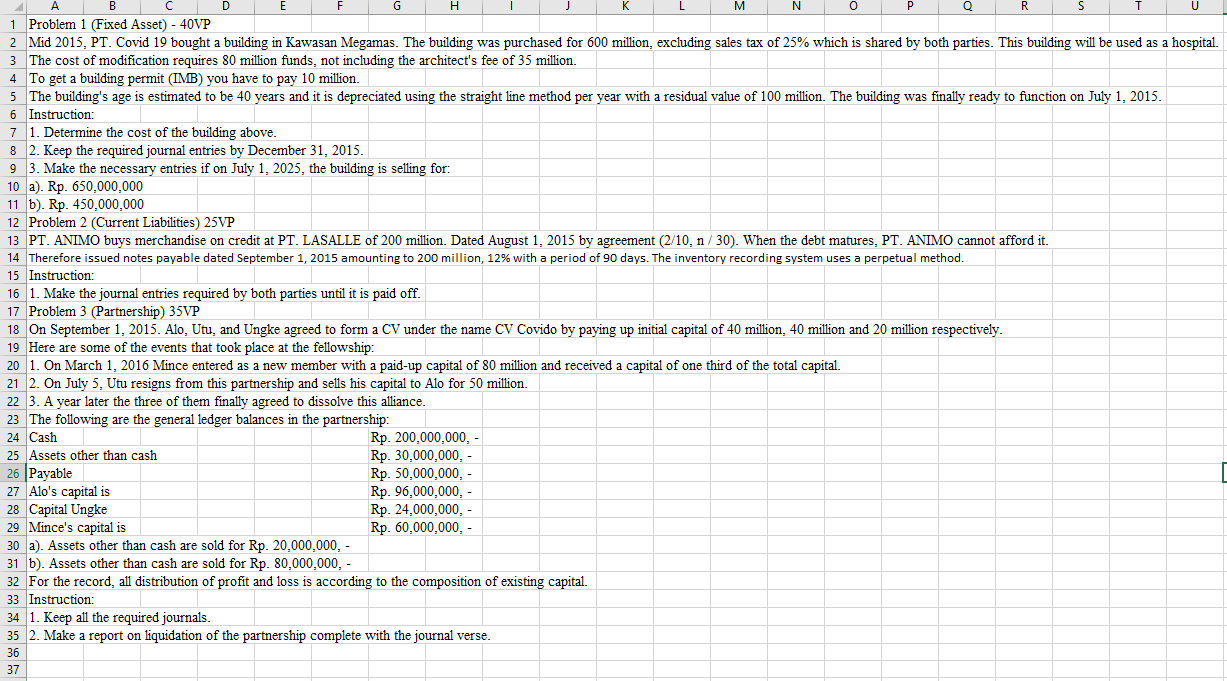

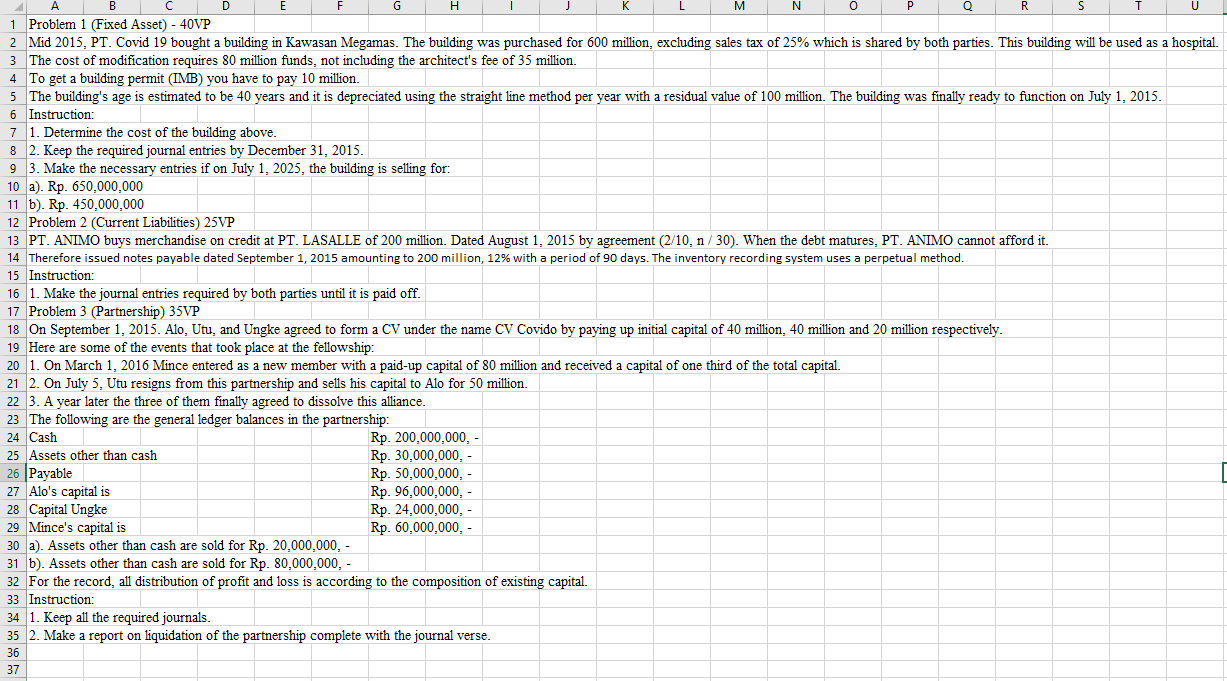

H M U 1 Problem 1 (Fixed Asset) - 40VP 2 Mid 2015, PT. Covid 19 bought a building in Kawasan Megamas. The building was purchased for 600 million, excluding sales tax of 25% which is shared by both parties. This building will be used as a hospital. 3 The cost of modification requires 80 million funds, not including the architect's fee of 35 million. 4 To get a building permit (IMC) you have to pay 10 million. 5 The building's age is estimated to be 40 years and it is depreciated using the straight line method per year with a residual value of 100 million. The building was finally ready to function on July 1, 2015. 6 Instruction: 7 1. Determine the cost of the building above. 8 2. Keep the required journal entries by December 31, 2015. 9 3. Make the necessary entries if on July 1, 2025, the building is selling for: 10 a). Rp. 650,000,000 11 b). Rp. 450,000,000 12 Problem 2 (Current Liabilities) 25VP 13 PT. ANIMO buys merchandise on credit at PT. LASALLE of 200 million. Dated August 1, 2015 by agreement (2/10, n/30). When the debt matures, PT. ANIMO cannot afford it. 14 Therefore issued notes payable dated September 1, 2015 amounting to 200 million, 12% with a period of 90 days. The inventory recording system uses a perpetual method. 15 Instruction: 16 1. Make the journal entries required by both parties until it is paid off. 17 Problem 3 (Partnership) 35VP 18 On September 1, 2015. Alo, Utu, and Ungke agreed to form a CV under the name CV Covido by paying up initial capital of 40 million, 40 million and 20 million respectively. 19 Here are some of the events that took place at the fellowship: 20 1. On March 1, 2016 Mince entered as a new member with a paid-up capital of 80 million and received a capital of one third of the total capital. 21 2. On July 5, Utu resigns from this partnership and sells his capital to Alo for 50 million. 22 3. A year later the three of them finally agreed to dissolve this alliance. 23 The following are the general ledger balances in the partnership: 24 Cash Rp. 200,000,000,- 25 Assets other than cash Rp. 30,000,000,- 26 Payable Rp. 50,000,000,- 27 Alo's capital is Rp. 96,000,000,- 28 Capital Ungke Rp. 24,000,000,- 29 Mince's capital is Rp. 60,000,000,- 30 a). Assets other than cash are sold for Rp. 20.000.000, 32 For the record, all distribution of profit and loss is according to the composition of existing capital. 33 Instruction: 34 1. Keep all the required journals. 35 2. Make a report on liquidation of the partnership complete with the journal verse. 36 37