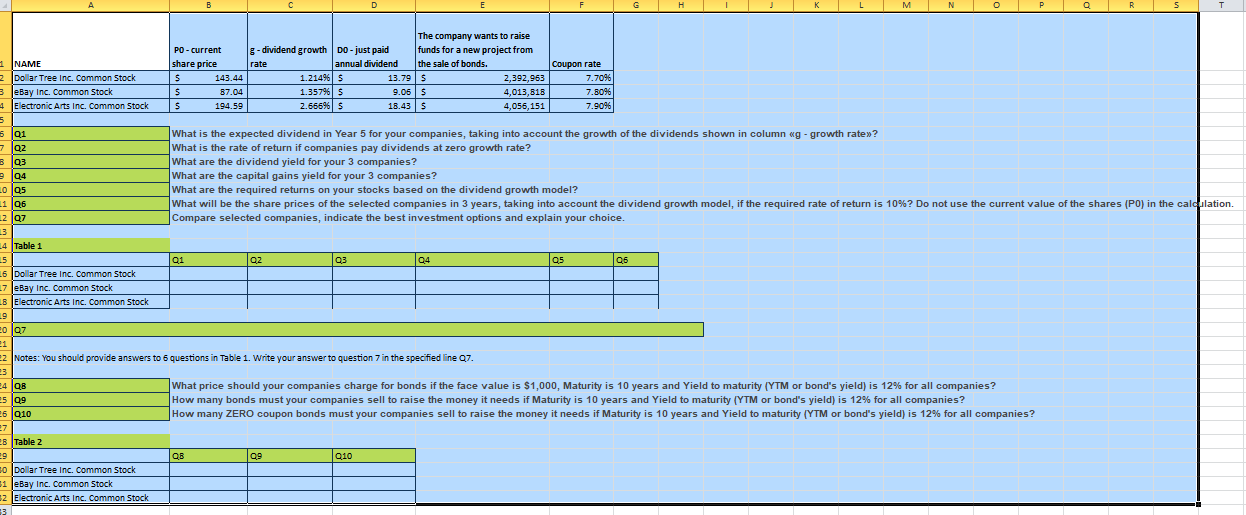

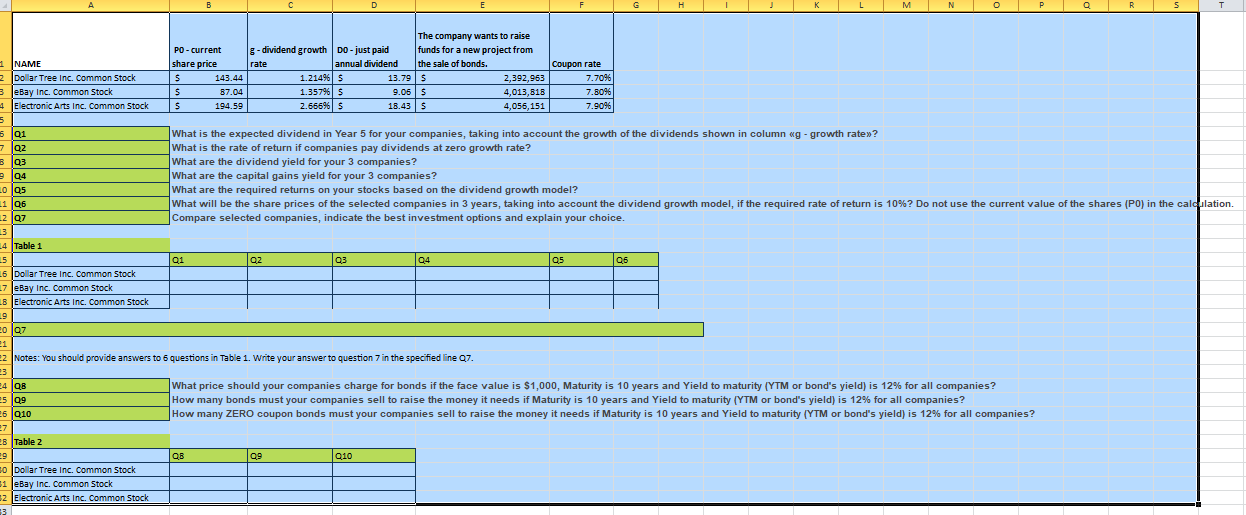

H MN P R 5 T The company wants to raise PO - current 3-dividend growth DO - just paid funds for a new project from share price rate annual dividend the sale of bonds. . Coupon rate s 143.44 1.214965 13.795 2,392,963 7.709 5 87.04 1.357965 9.06S 4,013,818 7.8096 5 194.59 2.6669 $ 18.43 5 4,056,151 7.9096 1 NAME 2 Dollar Tree Inc. Common Stock 3 JeBay Inc. Common Stock 4 Electronic Arts Inc. Common Stock 5 5191 7 192 B 93 e 94 LO 95 11 06 L297 13 24 Table 1 15 16 Dollar Tree Inc. Common Stock 27 eBay Inc. Common Stock B Electronic Arts Inc. Common Stock What is the expected dividend in Year 5 for your companies, taking into account the growth of the dividends shown in column g - growth rate? What is the rate of return if companies pay dividends at zero growth rate? What are the dividend yield for your 3 companies? What are the capital gains yield for your 3 companies? What are the required returns on your stocks based on the dividend growth model? What will be the share prices of the selected companies in 3 years, taking into account the dividend growth model, if the required rate of return is 10%? Do not use the current value of the shares (PO) in the calculation. Compare selected companies, indicate the best investment options and explain your choice. Q1 O2 03 104 05 06 2007 21 2 Notes: You should provide answers to 5 questions in Table 1. Write your answer to question 7 in the specified line 07. 23 24 QB What price should your companies charge for bonds if the face value is $1,000, Maturity is 10 years and Yield to maturity (YTM or bond's yield) is 12% for all companies? 5 99 How many bonds must your companies sell to raise the money it needs if Maturity is 10 years and Yield to maturity (YTM or bond's yield) is 12% for all companies? 26 Q10 How many ZERO coupon bonds must your companies sell to raise the money it needs if Maturity is 10 years and Yield to maturity (YTM or bond's yield) is 12% for all companies? 27 EB Table 2 QB 99 Q10 30 Dollar Tree Inc. Common Stock 51 eBay Inc. Common Stock 2 Electronic Arts Inc. Common Stock 3 H MN P R 5 T The company wants to raise PO - current 3-dividend growth DO - just paid funds for a new project from share price rate annual dividend the sale of bonds. . Coupon rate s 143.44 1.214965 13.795 2,392,963 7.709 5 87.04 1.357965 9.06S 4,013,818 7.8096 5 194.59 2.6669 $ 18.43 5 4,056,151 7.9096 1 NAME 2 Dollar Tree Inc. Common Stock 3 JeBay Inc. Common Stock 4 Electronic Arts Inc. Common Stock 5 5191 7 192 B 93 e 94 LO 95 11 06 L297 13 24 Table 1 15 16 Dollar Tree Inc. Common Stock 27 eBay Inc. Common Stock B Electronic Arts Inc. Common Stock What is the expected dividend in Year 5 for your companies, taking into account the growth of the dividends shown in column g - growth rate? What is the rate of return if companies pay dividends at zero growth rate? What are the dividend yield for your 3 companies? What are the capital gains yield for your 3 companies? What are the required returns on your stocks based on the dividend growth model? What will be the share prices of the selected companies in 3 years, taking into account the dividend growth model, if the required rate of return is 10%? Do not use the current value of the shares (PO) in the calculation. Compare selected companies, indicate the best investment options and explain your choice. Q1 O2 03 104 05 06 2007 21 2 Notes: You should provide answers to 5 questions in Table 1. Write your answer to question 7 in the specified line 07. 23 24 QB What price should your companies charge for bonds if the face value is $1,000, Maturity is 10 years and Yield to maturity (YTM or bond's yield) is 12% for all companies? 5 99 How many bonds must your companies sell to raise the money it needs if Maturity is 10 years and Yield to maturity (YTM or bond's yield) is 12% for all companies? 26 Q10 How many ZERO coupon bonds must your companies sell to raise the money it needs if Maturity is 10 years and Yield to maturity (YTM or bond's yield) is 12% for all companies? 27 EB Table 2 QB 99 Q10 30 Dollar Tree Inc. Common Stock 51 eBay Inc. Common Stock 2 Electronic Arts Inc. Common Stock 3