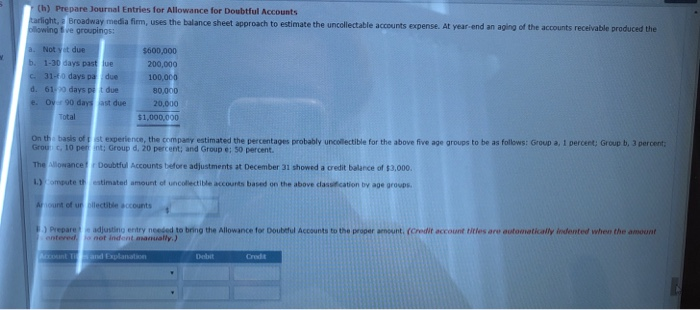

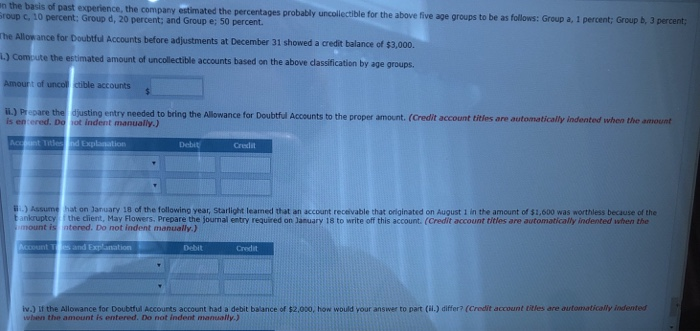

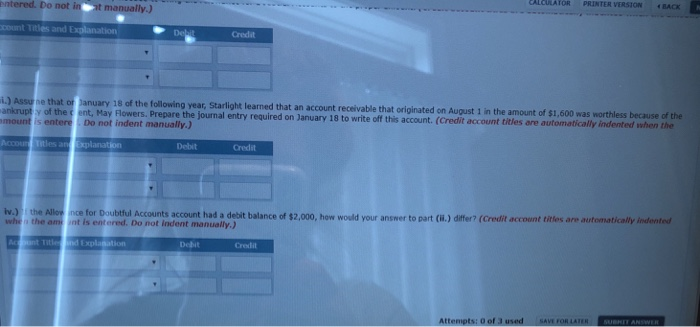

(h) Prepare Journal Entries for Allowance for Doubtful Accounts uses the balance sheet approach to estimate the uncollectable accounts expense. At year-end an aging of the accounts receivable produced the lowing ve groupings: Not yot due b. 1-30 days past lue c. 31-60 days pa due d. 61-0 days pa t due $600,000 200,000 100,000 80,000 90 days ast due Total $1,000,000 On the basis of t st experience, the company estimated the percentages probably uncolectible for the above five age groups to be as follows: Group a, I percent: Group b, 3 percent Grour , 10 pen int; Group d, 20 percent; and Group e: 50 percent. Thllowance, Doubtful Accounts t efore adjustments at December 31 showed a credit balance of 13,000. L) ompute th estimated amount of uncollectible accourts based on the above classification by age groups. prepare e adjustinio entry needed to bring the Allowance for Doubeul Accounts to the proper arnount(Credit account titles are automatkcally indented when the amount enteredo not indent manually.) n the basis of past experience, the company estimated the percentages probably roup c, 10 percent: Group d, 20 percent; and Group e; 50 percent he Allomnance for Doubtful Accounts before adjustments at December 31 showed a credit balance of $ L-) Compute the estimated amount of uncollectible accounts based on the above classification by age groups. the above five age groups to be as follows: Group a, 1 percent; Group b, 3 at December 31 showed a credit balance of $3,000 accountsS i.) Prepare the djusting entry needed to bring the Allowance for Doubtful Accounts to the is encered. Do ot indent manually.) rooer amount (Credi acceunt titlek are auhodd whethe u cont Tites nd Explasation Debit Credit )Assume hat on January 18 of the following year, Starlight learned that an account receivable that orliginated on August 1 in the amount of $1,600 was worthless because of the nkruptcy fthe client, May Flowers, Prepare the journal entry required on January 18 to write off this account. (Credit account titles are automatically indented when the mount is ntered. Do not indent manually.) Debit Credit iv.) If the Allowance for Doubtful Accounts account had a debit balance of $2,000, how would your answer to part (ii.) differ? (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) CULATOR PRINTER VERSION BACK entered. Do not count Titles and Explanation Credit 1 Assu qse that or anuary 18 of the following year, Starlight learmed that an account recaivable that originsted cn Aukst 1n tteamte atiomatical ankrupty of the ent, May F Flowers. Prepare the journal entry required on January 18 to write off this account. (Credit account titles are entere . Do not indent manually.) Debit Credit nce for Doubtful Accounts account had a debit balance of $2,000, how would your answer to part (..) differ? (Credit account titles are automatically indented f th e Mo n the am unt is entered. Do not indent manually.) .) Deit ts: 0 of 3 used