Answered step by step

Verified Expert Solution

Question

1 Approved Answer

h stock would have uired rate of return on the market Sisters' stock if the require or (2) 20%? Are these reasonable results Ep cnsonabie

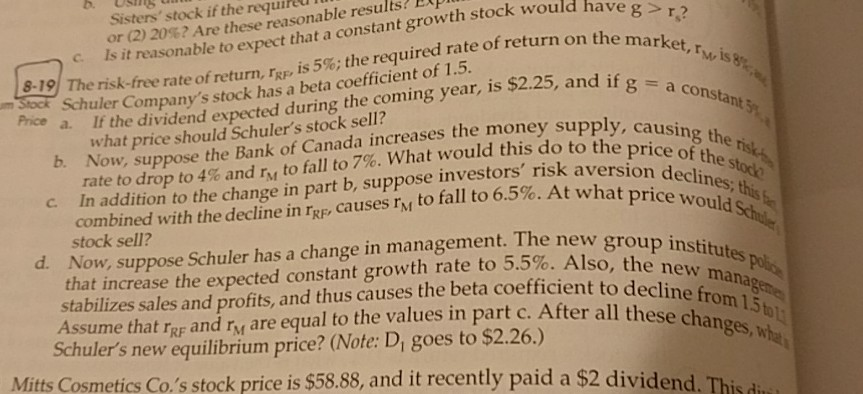

h stock would have uired rate of return on the market Sisters' stock if the require or (2) 20%? Are these reasonable results Ep cnsonabie reset hat aconstant growth stock would have gs market, Tw e risk-free rate of return,TRF, is 5%; the requ Siock Schuler Company's stock has a beta coefficient of 1.5. is 8 Th Price a. ce a If the dividend expected during the coming year, is $2.25, and ifg what price should Schuler's stock sell? b. Now Now, suppose the Bank of Canada increases the money supply rate to drop to 4% and rh, to fall to 7%. What would this do to the,ndusing th In addition to the change in part b, suppose investors' risk ave combined with the decline inrF, causes rM to fall to 6.5%. At what b. aversion declines, this c. stock sell? roup institutes po d. N ow, suppose Schuler has a change in management. The new g that increase the expected constant growth rate to 5.5%. Also, the new stabilizes sales and profits, and thus causes the beta coefficient to dene Assume that Tr and ry are equal to the values in part c. After all these o Schuler's new equilibrium price? (Note: Di goes to $2.26.) age, ha all these changes, wha Mitts Cosmetics Co. 's stock price is $58.88, and it recently paid a $2 dividend. This

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started