Answered step by step

Verified Expert Solution

Question

1 Approved Answer

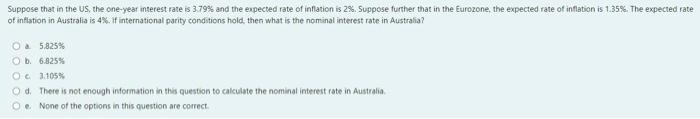

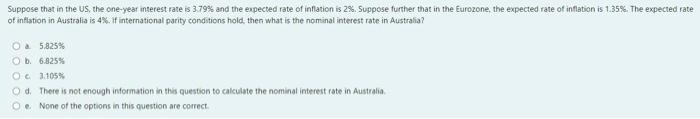

h Suppose that in the US, the one-year interest rate is 3.79% and the expected rate of inflation is 2%. Suppose further that in the

h

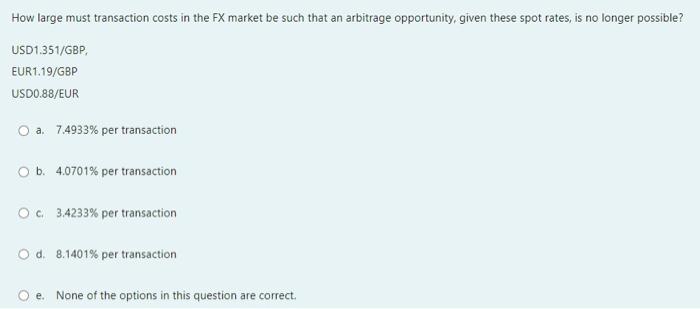

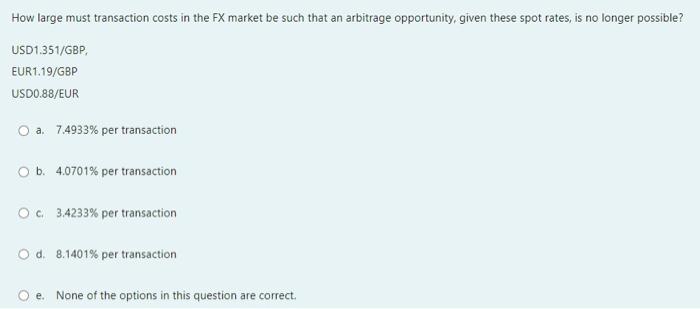

Suppose that in the US, the one-year interest rate is 3.79% and the expected rate of inflation is 2%. Suppose further that in the Eurozone, the expected rate of inflation is 1.35%. The expected rate of inflation in Australia is 4%. If international parity conditions hold then what is the nominal interest rate in Australia? Oa 5.825% Ob. 6.825% Oc3.105% Od. There is not enough information in this question to calculate the nominal interest rate in Australia O None of the options in this question are correct How large must transaction costs in the FX market be such that an arbitrage opportunity, given these spot rates, is no longer possible? USD1.351/GBP EUR1.19/GBP USD0.88/EUR O a. 7.4933% per transaction O b. 4.0701% per transaction OC 3.4233% per transaction Od 8.1401% per transaction e. None of the options in this question are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started